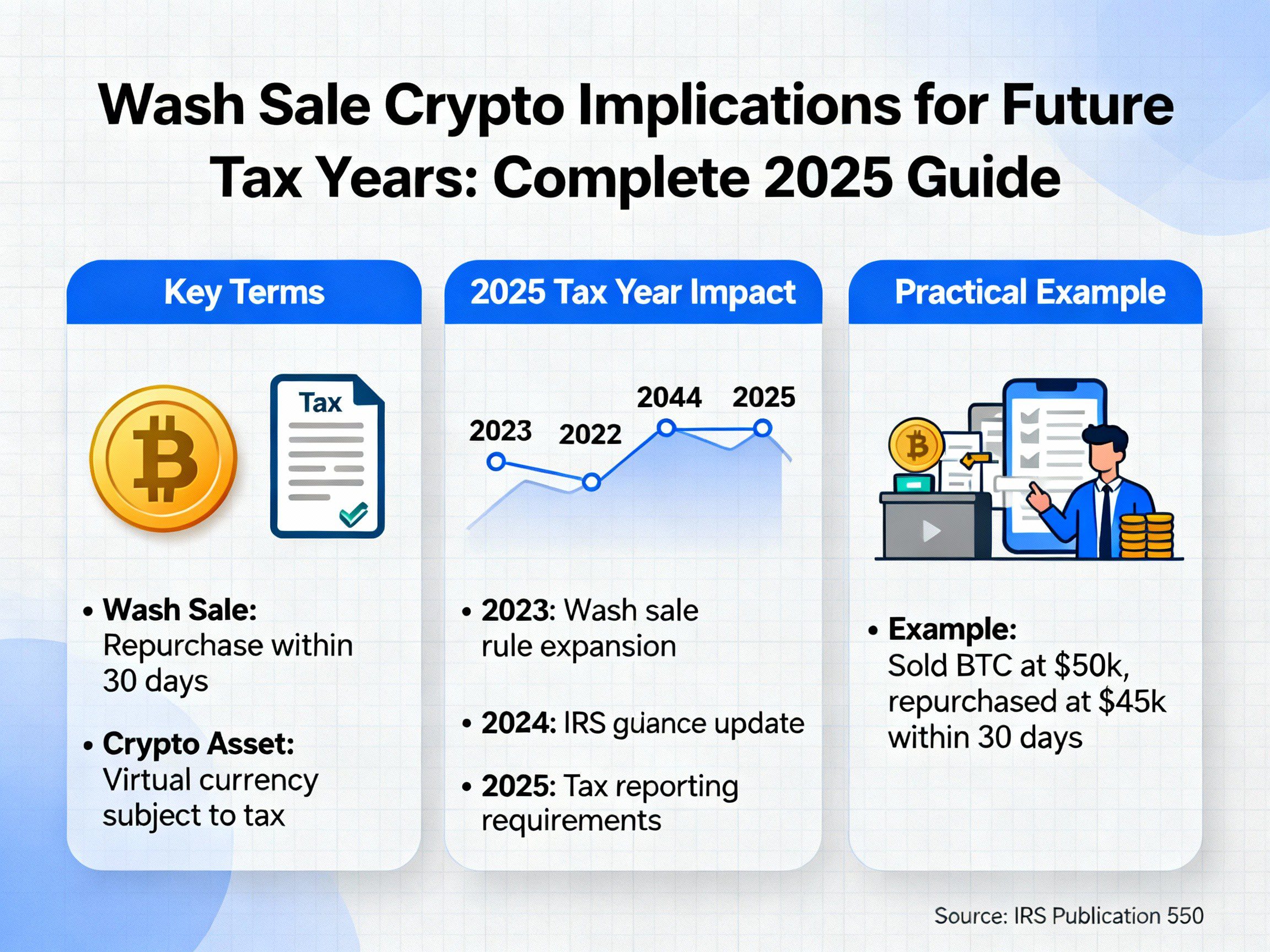

Wash sale crypto regulations represent one of the most significant yet misunderstood aspects of cryptocurrency taxation, creating both opportunities and risks for investors navigating an evolving regulatory landscape. When investors first encounter the concept of wash sale rules in traditional markets, they learn about restrictions preventing them from claiming tax losses on securities sold and quickly repurchased. However, the application of these rules to cryptocurrency exists in a unique space that challenges conventional tax frameworks and creates advantages that won’t last forever.

- Understanding How Wash Sale Crypto Rules Differ from Traditional Securities

- The Current Wash Sale Crypto Exemption and Its Significance

- Legislative Evolution: When Wash Sale Crypto Rules May Change

- Mastering Tax-Loss Harvesting Before Wash Sale Crypto Rules Apply

- Understanding Capital Loss Applications in Wash Sale Crypto Scenarios

- Navigating “Substantially Identical” Securities in Wash Sale Crypto Planning

- Preparing Your Portfolio for Future Wash Sale Crypto Regulations

- International Perspectives on Wash Sale Crypto Regulations

- Technology Infrastructure for Wash Sale Crypto Compliance

- Special Considerations for DeFi in Wash Sale Crypto Planning

- Risk Management Strategies for Wash Sale Crypto Uncertainty

- Building Long-Term Success Beyond Wash Sale Crypto Advantages

- Conclusion: Navigating the Future of Wash Sale Crypto Regulations

Understanding How Wash Sale Crypto Rules Differ from Traditional Securities

To truly grasp why wash sale crypto implications matter so profoundly, we need to build our understanding from foundational concepts. Imagine you own two different types of assets: a painting and a dollar bill. When you trade the painting for another painting, you’ve created a transaction that might generate a taxable gain or loss based on the relative values involved. However, exchanging a dollar bill for four quarters doesn’t create a taxable event because you’re simply changing the form of currency. This distinction illuminates how the IRS approaches cryptocurrency taxation.

For U.S. tax purposes, digital assets are considered property, not currency. A digital asset is stored electronically and can be bought, sold, owned, transferred or traded. This classification fundamentally reshapes every aspect of how we think about cryptocurrency transactions. When the IRS established this framework through Notice 2014-21, they weren’t making an arbitrary choice but rather attempting to fit revolutionary technology into existing tax structures. The property classification means that every time you use cryptocurrency for any purpose, whether buying coffee or trading for another token, you’re essentially selling property from the IRS’s perspective.

The implications ripple through every transaction. Consider Sarah, who purchased one Bitcoin for $30,000 and later used it to purchase a car when Bitcoin reached $45,000. From Sarah’s viewpoint, she simply bought a car with Bitcoin. From the IRS’s perspective, Sarah sold property for $45,000, realizing a $15,000 capital gain that requires reporting on her tax return. This example demonstrates why understanding property classification becomes crucial for anyone involved with cryptocurrency, especially when considering wash sale crypto strategies.

The Current Wash Sale Crypto Exemption and Its Significance

The traditional wash sale rule serves as a referee ensuring fair play in tax reporting. If you sell a security at a loss and buy the same or a substantially identical security within 30 calendar days before or after the sale, you won’t be able to take a loss for that security on your current-year tax return. This rule prevents investors from engaging in what amounts to tax theater: selling stocks on December 30th to claim losses, then repurchasing them on January 2nd, having changed nothing about their actual investment position while reducing their tax liability.

Here’s where cryptocurrency’s story diverges dramatically from traditional securities. The IRS wash sale rule does not currently apply to cryptocurrency because it considers virtual currencies to be property rather than securities. This isn’t a loophole in the traditional sense but rather a structural consequence of how cryptocurrency was initially classified. The current exemption from wash sale crypto rules creates a powerful tax planning opportunity that doesn’t exist in traditional markets.

Table 1: Wash Sale Crypto Rules vs. Traditional Securities

| Aspect | Traditional Securities | Cryptocurrency (Current) | Impact on Tax Strategy |

|---|---|---|---|

| Wash sale rule applies | Yes – strictly enforced | No – complete exemption | Crypto allows immediate repurchase |

| Waiting period required | 61 days total | None required | Flexibility for crypto traders |

| Loss recognition | Deferred to new basis | Immediate recognition | Current tax benefit for crypto |

| Cost basis adjustment | Required adjustment | New basis established | Simpler crypto accounting |

| IRS reporting | Form 1099-B | Form 1099-DA (2026) | Different compliance requirements |

To understand the practical power of this exemption, consider two investors facing similar situations. Jennifer owns Tesla stock that declined from $300 to $200 per share. If she sells to claim the $100 per share loss and immediately repurchases Tesla stock, the wash sale rule disallows her loss deduction. Meanwhile, Michael owns Bitcoin that declined from $60,000 to $40,000. He can sell his Bitcoin, claim the $20,000 loss on his taxes, and immediately repurchase Bitcoin at the same price, maintaining his exact position while reducing his current year tax liability through wash sale crypto harvesting.

Legislative Evolution: When Wash Sale Crypto Rules May Change

Understanding the legislative journey toward applying wash sale crypto rules requires appreciating the complex interplay of political and economic forces. The Biden Administration’s proposed 2025 fiscal budget aims to specifically include cryptocurrencies under the wash sale rule. This move represents the most recent effort by lawmakers to eliminate the so-called wash sale ‘loophole,’ although previous attempts have yet to solidify into law. Each legislative attempt tells a story about evolving attitudes toward cryptocurrency regulation.

The first significant effort emerged in 2021 when the House Ways and Means Committee included language applying wash sale rules to digital assets in a broader tax reform package. This proposal arose during explosive growth in cryptocurrency markets, when Bitcoin reached all-time highs and institutional adoption accelerated rapidly. Lawmakers recognized an opportunity to generate revenue while creating parity between cryptocurrency and traditional securities. However, the proposal became entangled in broader political debates, ultimately stalling when the Build Back Better Act failed to advance through Congress.

The pattern of legislative attempts reveals important insights about wash sale crypto regulation. Each time provisions near passage, they face opposition from stakeholders arguing that premature regulation could stifle innovation or drive cryptocurrency businesses overseas. Yet revenue implications have become increasingly difficult to ignore. Recent estimates suggest that applying wash sale crypto rules could generate $24 billion over ten years, making it an attractive option for deficit reduction efforts. For more information on current tax legislation, visit the House Ways and Means Committee website.

Table 2: Wash Sale Crypto Legislative Timeline

| Year | Legislative Vehicle | Revenue Projection | Current Status | Key Implications |

|---|---|---|---|---|

| 2021 | Build Back Better Act | Not specified | Failed in Senate | First comprehensive crypto attempt |

| 2022 | Inflation Reduction Act | $16 billion/10 years | Provision dropped | Political complexity revealed |

| 2024 | Biden FY2025 Budget | $24 billion projected | Pending review | Most detailed framework |

| 2025 | Multiple proposals | Under assessment | Active debate | International coordination emerging |

Mastering Tax-Loss Harvesting Before Wash Sale Crypto Rules Apply

Tax-loss harvesting with cryptocurrency requires understanding both the mechanical process and strategic considerations that make it effective. When you harvest a tax loss, you’re converting an unrealized loss into a realized loss by selling the asset. The current absence of wash sale crypto restrictions means you can immediately repurchase the same cryptocurrency, maintaining your investment position while claiming the tax deduction.

The beauty of cryptocurrency tax-loss harvesting in today’s regulatory environment lies in its remarkable flexibility. Picture yourself watching your portfolio during a particularly volatile trading day. Bitcoin drops 15% in the morning due to negative news, creating a substantial unrealized loss in your holdings. In traditional stock markets, selling to capture this loss would mean either accepting 61 days of market risk or finding a different investment. With cryptocurrency’s exemption from wash sale crypto rules, you can sell your Bitcoin, immediately repurchase it, and lock in the tax loss while maintaining your exact market position.

Consider this practical example illustrating the power of wash sale crypto harvesting. Alex invested $100,000 in Ethereum when it traded at $4,000 per token, acquiring 25 ETH. The market experiences a downturn, and Ethereum falls to $2,400. Alex sells all 25 ETH for $60,000, realizing a $40,000 capital loss. He immediately repurchases 25 ETH for $60,000, maintaining his position. Come tax time, Alex can use that $40,000 loss to offset capital gains from other investments, potentially saving thousands in taxes. If Ethereum later recovers to $4,000, Alex still participates fully in the recovery, having changed nothing about his long-term investment strategy while securing significant tax benefits.

For detailed guidance on reporting cryptocurrency transactions, consult IRS Publication 544 on sales and dispositions of assets. Additionally, tracking tools like CoinTracker, Koinly, or TokenTax can help manage wash sale crypto calculations.

Understanding Capital Loss Applications in Wash Sale Crypto Scenarios

The systematic application of capital losses follows a specific hierarchy established by tax law. Understanding this structure becomes essential for optimizing your wash sale crypto strategies. First, losses offset gains of the same type: short-term losses reduce short-term gains, and long-term losses reduce long-term gains. This matching principle ensures similar investment activities receive similar tax treatment.

After this initial matching, excess losses can cross over to offset gains of the opposite type. This flexibility proves particularly valuable when your losses in one category exceed your gains. For instance, if you have $30,000 in short-term losses from wash sale crypto harvesting but only $10,000 in short-term gains from stock trading, the remaining $20,000 in losses can offset long-term capital gains from selling real estate or other investments.

Table 3: Capital Loss Application from Wash Sale Crypto Harvesting

| Loss Type | Primary Offset | Secondary Offset | Ordinary Income | Carryforward |

|---|---|---|---|---|

| $50,000 short-term crypto | $30,000 short-term gains | $17,000 long-term gains | $3,000 maximum | Unlimited years |

| $25,000 long-term crypto | $10,000 long-term gains | $12,000 short-term gains | $3,000 maximum | No carryforward needed |

| $75,000 mixed crypto losses | Type-matched first | Cross-application | $3,000 annual limit | $45,000 to future years |

The ability to offset $3,000 of ordinary income annually might seem modest, but it represents valuable tax savings that compound over time. Ordinary income typically faces higher tax rates than long-term capital gains, so reducing it provides outsized value. Moreover, the unlimited carryforward of excess losses from wash sale crypto harvesting creates a tax asset providing benefits for years or even decades into the future.

Navigating “Substantially Identical” Securities in Wash Sale Crypto Planning

One of the most challenging aspects of potential wash sale crypto rules involves determining what constitutes “substantially identical” securities. In determining whether stock or securities are substantially identical, you must consider all the facts and circumstances in your particular case. The IRS intentionally maintains flexibility in this definition, allowing them to address various tax avoidance schemes while creating uncertainty for investors.

Understanding substantial identity requires examining economic substance rather than legal form. Two securities are substantially identical if owning one is economically equivalent to owning the other. The tax regulations say that if two different stocks are linked together in such a way that any change in the price of one will be reflected in the price of another, they’re likely to be treated as substantially identical securities for purposes of the wash sale rule.

This principle becomes particularly complex when considering wash sale crypto applications. If wash sale rules eventually apply to digital assets, would selling Bitcoin and immediately buying Wrapped Bitcoin (WBTC) trigger the rule? What about selling Ethereum and purchasing an Ethereum ETF? These questions lack clear answers currently, but understanding the principles behind substantial identity helps investors prepare for various regulatory scenarios. For more insights on securities regulations, visit the SEC’s investor education resources.

Preparing Your Portfolio for Future Wash Sale Crypto Regulations

Industry experts predict with high confidence that the wash sale rule will eventually apply to cryptocurrencies, marking a significant shift in how crypto investments are managed and taxed. Preparing for this eventuality requires both tactical adjustments to current strategies and strategic thinking about long-term portfolio management.

Consider what compliance will look like when wash sale crypto restrictions take effect. Every transaction will require careful timing analysis. Investors must track not just what they bought and sold, but when they did so relative to other transactions. The 61-day window will become a critical planning consideration. Year-end tax loss harvesting, currently a straightforward exercise of selling and repurchasing losing positions, will require careful choreography to avoid wash sale violations.

Table 4: Adapting Strategies for Future Wash Sale Crypto Rules

| Current Strategy | Required Adaptation | Implementation Tools | Alternative Approach |

|---|---|---|---|

| Daily harvesting | 31-day planning cycles | Automated tracking software | Portfolio diversification |

| Single-asset focus | Multi-asset approach | Correlation analysis tools | Cross-chain strategies |

| Manual tracking | System integration | Cloud-based platforms | Professional tax services |

| Spot trading only | Derivatives inclusion | Options strategies | DeFi protocols |

International Perspectives on Wash Sale Crypto Regulations

Cryptocurrency markets operate globally, and understanding international approaches to wash sale crypto rules provides valuable context for U.S. policy development. Different nations have adopted varying approaches to cryptocurrency taxation, creating a complex patchwork of regulations that sophisticated investors must navigate carefully.

The IRS expects that final regulations will be provided once the United States adheres to the OECD crypto-asset reporting framework (“CARF”). This suggests that U.S. wash sale crypto rules won’t develop in isolation but rather as part of broader international coordination efforts. Understanding these international dimensions helps investors anticipate not just what rules might emerge, but when and how they’ll be implemented.

Consider how different jurisdictions approach wash sale crypto issues. Germany treats cryptocurrency held for more than one year as tax-free, creating incentives for long-term holding. Singapore doesn’t tax capital gains at all, making wash sale rules irrelevant. Japan taxes cryptocurrency gains as miscellaneous income at rates up to 55%, making tax-loss harvesting particularly valuable. These differences create opportunities for international tax planning but also compliance complexity. For international tax treaty information, consult the IRS tax treaty documents.

Technology Infrastructure for Wash Sale Crypto Compliance

The complexity of wash sale crypto compliance has spawned an ecosystem of technology solutions helping investors track, calculate, and optimize their tax positions. Modern tax software must handle unique digital asset challenges: reconciling prices across exchanges, tracking wallet transfers, distinguishing transaction types, and calculating gains across thousands of transactions.

Everyone who files Forms 1040, 1040-SR, 1040-NR, 1041, 1065, 1120 and 1120S must check one box answering either “Yes” or “No” to the digital asset question. This universal reporting requirement underscores the importance of maintaining comprehensive records for wash sale crypto transactions.

Table 5: Essential Features for Wash Sale Crypto Tax Software

| Feature Level | Basic Requirements | Advanced Needs | Enterprise Solutions |

|---|---|---|---|

| Data Import | CSV uploads | API integration | Real-time synchronization |

| Exchange Support | Major platforms | All exchanges + DeFi | Custom protocol integration |

| Wash Sale Detection | Basic flagging | Predictive analysis | Automated optimization |

| Reporting | Form 8949 | Complete packages | Audit support |

| Price Tracking | Daily prices | Minute-level data | Multiple source reconciliation |

Special Considerations for DeFi in Wash Sale Crypto Planning

The decentralized finance ecosystem introduces complexities that traditional wash sale crypto frameworks struggle to address. When providing liquidity to automated market makers, are you selling tokens or lending them? When staking tokens for rewards, does that constitute income or return of capital? These questions lack clear answers yet have significant implications for wash sale analysis.

Consider a typical DeFi yield farming strategy involving wash sale crypto considerations. You deposit Ethereum and USDC into a liquidity pool, receiving LP tokens. You stake these LP tokens earning governance tokens as rewards. Later, you unstake, remove liquidity, and receive back Ethereum and USDC in different proportions. Each step potentially triggers taxable events, and if wash sale rules applied, the timing of each transaction would matter significantly.

For comprehensive DeFi tax guidance, review resources from DeFi Pulse and specialized crypto tax advisors. Understanding these nuances helps investors make informed decisions while regulatory clarity develops around wash sale crypto rules.

Risk Management Strategies for Wash Sale Crypto Uncertainty

Managing tax risk in cryptocurrency requires balancing aggressive optimization with conservative compliance. While current absence of wash sale crypto rules provides opportunities, aggressive strategies could face scrutiny if rules change retroactively or during IRS audits. We recommend that conservative, risk-averse investors avoid crypto wash sales. When in doubt, consult a crypto tax professional.

Creating a risk management framework starts with understanding your tolerance for uncertainty. Some investors prefer maximizing current benefits despite potential future complications. Others prioritize certainty and simplicity, accepting lower tax benefits for reduced audit risk. Neither approach is inherently wrong; the key lies in aligning your wash sale crypto strategy with your overall investment philosophy.

Documentation becomes critical for managing regulatory risk. Maintaining detailed records of not just transactions but business purposes behind trading decisions strengthens your position during potential audits. Document market analysis, investment thesis changes, portfolio rebalancing rationales, and other factors influencing trades. This documentation proves especially valuable as wash sale crypto regulations evolve.

Building Long-Term Success Beyond Wash Sale Crypto Advantages

Success in cryptocurrency investing requires thinking beyond immediate tax benefits from wash sale crypto harvesting. While tax optimization provides value, it shouldn’t drive investment decisions at the expense of sound strategy. Building robust approaches that adapt to changing regulations while maintaining tax efficiency requires careful planning and disciplined execution.

Table 6: Multi-Year Wash Sale Crypto Planning Framework

| Planning Horizon | Current Actions | Transition Preparation | Future Optimization |

|---|---|---|---|

| 2025 | Maximize harvesting opportunities | Document all trades comprehensively | Build tracking infrastructure |

| 2026 | Potential rule implementation | Deploy compliance systems | Adjust strategies accordingly |

| 2027-2030 | New regulatory normal | Optimize within framework | Focus on fundamentals |

| Long-term | Tax-aware investing | Continuous adaptation | Sustainable wealth building |

Consider developing a multi-year approach anticipating various wash sale crypto regulatory scenarios. If rules apply starting in 2026, how would that affect your 2025 year-end planning? Should you accelerate loss harvesting now while permitted? Or would that reduce future opportunities when you might need them more? These strategic questions lack simple answers but thinking through them develops more resilient investment approaches.

Conclusion: Navigating the Future of Wash Sale Crypto Regulations

The intersection of cryptocurrency and tax law continues evolving rapidly, with wash sale crypto rules representing just one aspect of a broader regulatory framework taking shape. Understanding these rules and their implications requires more than memorizing regulations; it demands comprehension of underlying principles and ability to adapt as rules change. The current period, where cryptocurrency enjoys exemption from wash sale rules, provides both opportunity and responsibility.

As you navigate this complex landscape, remember that successful cryptocurrency investing involves more than just wash sale crypto optimization. While understanding these implications remains important, it should integrate into a broader strategy including fundamental analysis, risk management, and long-term planning. Investors who thrive will build robust strategies adapting to regulatory changes while maintaining focus on investment fundamentals.

The journey toward regulatory clarity for wash sale crypto taxation will likely involve multiple iterations and unexpected developments. By building strong foundations now – comprehensive record-keeping systems, relationships with knowledgeable advisors, and flexible investment strategies – investors position themselves for success regardless of regulatory evolution. The key is maintaining perspective: wash sale crypto rules are important, but they’re just one component of successful investing.

For ongoing updates on cryptocurrency tax regulations, bookmark the IRS Digital Assets page and consider subscribing to tax advisory services specializing in cryptocurrency. Focus on building wealth through sound investment decisions, using wash sale crypto strategies to enhance rather than drive those decisions. The future belongs to investors who prepare today for tomorrow’s regulatory landscape.