Are you a beginner or intermediate trader intrigued by the power of automation, but wary of the risks lurking beneath crypto trading bots? Risk Management Crypto Bots isn’t just a buzzphrase—it’s your playbook for safe, smart, and confident automated trading.

In this comprehensive guide, we’ll unpack the hidden dangers—from slippage and overleverage to emotional bias and platform failures—and equip you with strategies like diversification, dynamic stop-loss mechanisms, circuit breakers, and AI-driven risk logic to help your bot trade, not fail.

You’ll discover how to size positions prudently, backtest without falling into overfitting traps, and monitor your bot with robust logging. Plus, we’ll explore real-world lessons from major failures like FTX and Mirror Trading International, and highlight tools and platforms built with risk safeguards in mind.

By the end, you’ll not only understand how to protect your capital but also gain unique insights on evolving AI risk controls—perfect for building long-term bot resilience in the volatile crypto world.

- Understanding Risks of Crypto Trading Bots

- Market Volatility & Slippage Risks

- Emotional & Psychological Pitfalls

- Platform, Exchange & Regulatory Risks

- Foundations of Risk Management for Crypto Bots

- Diversification Across Assets & Strategies

- Position Sizing & Bankroll Management

- Stop-Loss & Take-Profit Mechanisms

- Enhancing Bot Logic with Dynamic Controls

- Dynamic Stop-Loss & Adaptive Thresholds

- Circuit Breakers & Emergency Pauses

- Trade Frequency & Overtrading Controls

- Technical Challenges & Backtesting

- Slippage, Latency & API Reliability

- Backtesting, Forward Testing & Overfitting

- Monitoring, Logging & Alert Systems

- AI-Powered Risk Management

- AI-Based Stop-Loss & Predictive Sizing

- Multi-Agent Portfolio Optimization

- Continuous Learning & Adjustment

- Case Studies & Real-World Lessons

- Lessons from FTX, Mt. Gox & Rug Pulls

- Bot Failures & Fraud

- Tools, Platforms & Best Practices

- Selecting Bots with Built-In Risk Features

- Security Practices & Cold Storage

- Regulatory Awareness & Staying Compliant

- Final Thoughts on Sustainable Bot Trading

- Quick Takeaways

- FAQs

- How do I set a safe stop-loss for my trading bot?

- 2. Can I backtest without overfitting?

- 3. What’s the role of circuit breakers in bots?

- 4. How does position sizing protect my capital?

- 5. Are AI-powered risk tools reliable?

- References

Understanding Risks of Crypto Trading Bots

Crypto trading bots aren’t inherently “safe” or “dangerous”—they’re simply tools. The risk lies in how you configure and manage them. Without a structured risk plan, a bot can quickly amplify losses.

Market Volatility & Slippage Risks

Crypto markets are infamous for extreme volatility. Price swings of 10–20% within hours are common. Bots following rigid rules (e.g., fixed stop-losses) may fail under sudden crashes. Worse, slippage—when orders fill at a worse price than expected—erodes profits and magnifies losses.

Mitigation tips:

- Use limit orders instead of market orders.

- Add a slippage tolerance setting.

- Diversify across pairs to reduce single-asset exposure.

Emotional & Psychological Pitfalls

You might think bots remove emotion, but humans supervising bots often fall into FOMO or panic. Adjusting a bot mid-trade can ruin a strategy. True automation means trusting your parameters.

Example: A trader who manually disabled stop-loss after Bitcoin dipped 5% watched it slide 20% further. If they trusted the bot, the small loss would have preserved capital.

Platform, Exchange & Regulatory Risks

Even the best bot fails if the exchange goes down or regulations shift overnight. Exchange hacks, outages, or sudden withdrawal freezes (like during FTX collapse) can wipe accounts.

Mitigation tips:

- Spread funds across multiple exchanges.

- Use platforms with insurance or strong security history.

- Stay informed on regulatory developments in your jurisdiction.

Foundations of Risk Management for Crypto Bots

Diversification Across Assets & Strategies

“Don’t put all your eggs in one basket.” Spread risk by:

- Trading multiple coins.

- Running different bot strategies (e.g., grid + arbitrage + momentum).

- Allocating funds across short-term and long-term bots.

Position Sizing & Bankroll Management

Never risk more than 1–2% of your portfolio per trade. Position sizing rules protect you from black swan events.

Case in point: A trader risking 10% per trade only needs a string of 10 losses to blow up their account. At 1%, survival is possible.

Stop-Loss & Take-Profit Mechanisms

Bots should enforce both stop-loss (to limit losses) and take-profit (to lock gains). Many beginners configure stop-loss but forget take-profit, leaving bots exposed.

Use trailing take-profit that adjusts as price rises. This ensures you secure profits while staying in trends longer.

Enhancing Bot Logic with Dynamic Controls

Dynamic Stop-Loss & Adaptive Thresholds

Static 5% stop-losses don’t work in a market where BTC can move ±8% daily. Adaptive approaches (e.g., ATR-based stops) adjust to volatility, preventing premature exits.

Circuit Breakers & Emergency Pauses

A circuit breaker halts trading when markets behave abnormally—similar to stock exchanges. For bots, triggers might include:

- Daily loss exceeding 5%.

- Exchange downtime alerts.

- Abnormal slippage detected.

Trade Frequency & Overtrading Controls

Bots can fall into overtrading loops, executing too many trades. This inflates fees and risk. Limit trades per day, or impose cooldowns after losses.

Technical Challenges & Backtesting

Slippage, Latency & API Reliability

Even the best algorithms collapse under poor execution. Latency between bot → exchange → order book can cause missed fills or “phantom trades.”

Choose exchanges with stable APIs. Use VPS servers close to exchange servers to reduce latency.

Backtesting, Forward Testing & Overfitting

Backtesting shows potential—but it’s easy to “curve fit” a strategy to past data. The result? A bot that looks perfect historically but fails in real life.

Best practice:

- Use out-of-sample data.

- Forward test on live paper accounts.

- Incorporate slippage + fees in backtests.

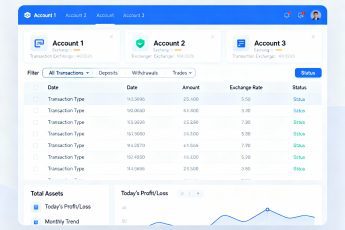

Monitoring, Logging & Alert Systems

A set-and-forget bot is a myth. Logs and alerts are vital:

- Real-time error alerts via email/Telegram.

- Detailed logs for post-mortem analysis.

- Performance dashboards to track drawdowns.

AI-Powered Risk Management

AI-Based Stop-Loss & Predictive Sizing

AI models can adjust stop-loss dynamically based on volatility signals, sentiment data, or news feeds. Predictive sizing algorithms modify trade exposure before risky events.

Multi-Agent Portfolio Optimization

Using Modern Portfolio Theory (MPT), AI bots distribute risk across multiple assets. A “team of bots” manages correlation risk better than one single strategy.

Continuous Learning & Adjustment

Markets evolve—your bot must too. AI systems using reinforcement learning can adapt strategies after losing streaks or new market conditions.

Case Studies & Real-World Lessons

Lessons from FTX, Mt. Gox & Rug Pulls

FTX’s collapse showed that even “trusted” exchanges aren’t safe. Mt. Gox demonstrated custodial risk. Rug pulls highlight that trustless automation needs human oversight.

Bot Failures & Fraud

Mirror Trading International lured traders with bots promising 30% monthly returns. It collapsed as a Ponzi scheme. Lesson: If it sounds too good to be true, it is.

Tools, Platforms & Best Practices

Selecting Bots with Built-In Risk Features

Choose bots offering:

- Stop-loss/take-profit automation.

- Circuit breakers.

- Logging and alerts.

Popular options: 3Commas, Cryptohopper, Pionex.

Security Practices & Cold Storage

Don’t keep all funds on trading exchanges. Use API keys with withdrawal disabled. Store majority funds in cold wallets.

Regulatory Awareness & Staying Compliant

Global regulators now scrutinize automation. Ensure your bot complies with KYC/AML laws. Some countries may restrict algorithmic trading entirely.

Final Thoughts on Sustainable Bot Trading

By now, you’ve seen that Risk Management Crypto Bots isn’t just about automation—it’s about responsible automation. From managing the sheer volatility of crypto markets with smart stop-losses and position sizing, to buffering against execution risks like slippage, latency, and platform failure, the goal is clear: protect first, then trade.

Advanced traders add layers—backtesting with robustness to avoid overfitting, deploying logging systems to monitor real-time performance, and even integrating AI-driven risk logic that adapts stop-loss thresholds or trade sizing dynamically.

Rather than a “set and forget” tool, your bot should be a well-guarded investment vehicle, treated with respect, calibration, and ongoing care. Begin small, observe, adapt—and over time, these risk-aware measures will pay off with consistent, resilient performance.

Quick Takeaways

- Diversify across assets and strategies to spread risk.

- Limit exposure with strict position sizing rules.

- Automate stop-loss and take-profit mechanisms.

- Employ circuit breakers to protect during crashes.

- Backtest wisely, avoid curve-fitting traps.

- Use bots with built-in monitoring and alerts.

- Stay updated on regulations and exchange security.

FAQs

How do I set a safe stop-loss for my trading bot?

2. Can I backtest without overfitting?

3. What’s the role of circuit breakers in bots?

4. How does position sizing protect my capital?

5. Are AI-powered risk tools reliable?

👉 I’d love your thoughts—what’s the biggest risk you’ve faced using crypto bots? Share your story in the comments below and help fellow traders stay safe. If you found this guide useful, please share it with your trading community!

References

- VivoCrypto – Risk Management Strategies When Using Crypto Trading Bots

- Cryptonira – Risk Management in Crypto Trading Bots

- Changelly – Crypto Risk Management Strategies

- CoinBureau – Risk Management Strategies in Crypto

- TechBullion – Crypto Bots with Best Risk Tools