Ever wondered how some crypto traders catch the right wave at just the right time?

That’s the essence of swing trading crypto—a style that lives between the fast-paced day trading hustle and the patient HODL culture. It’s designed for traders who prefer seizing medium-term opportunities that span from a few days to a few weeks.

In simple terms, swing trading in crypto means buying a coin when it’s undervalued, holding it during its upward “swing,” and selling it when signs suggest the trend is reversing. Unlike day trading, you don’t need to sit in front of a screen all day. And unlike long-term investing, you don’t have to wait months for returns.

It’s a strategy that fits traders who enjoy the thrill of timing the market but value a more manageable pace.

- What is Swing Trading in Cryptocurrency?

- How Swing Trading Differs from Day Trading and HODLing

- Why Swing Trading Crypto is Gaining Popularity

- Real-World Success Stories from Swing Traders

- Core Principles of Swing Trading Crypto

- Risk Management Techniques for Swing Trading

- Best Cryptocurrencies for Swing Trading

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Other Honorable Mentions

- How to Identify Good Coins for Swing Positions

- Essential Tools and Platforms for Swing Trading Crypto

- Charting Tools

- News and Sentiment Platforms

- Crypto Exchanges with Swing-Friendly Features

- Other Essential Tools

- How to Start Swing Trading Crypto

- Step 1: Educate Yourself on the Basics

- Step 2: Choose the Right Exchange

- Step 3: Open a Trading Account

- Step 4: Pick a Swing Trading Strategy

- Step 5: Use Technical Indicators

- Step 6: Plan Every Trade

- Step 7: Start Small and Scale Gradually

- Step 8: Track and Learn from Every Trade

- Creating a Trading Plan for Consistent Results

- Define Your Trading Goals

- Set Rules for Trade Entry

- Determine Stop-Loss and Profit-Taking Strategies

- Choose Your Timeframes

- Define Your Watchlist and Screener Criteria

- Set Routine and Review Schedule

- Popular Swing Trading Strategies

- Support and Resistance Strategy

- Breakout Trading

- Pullback Trading

- Using RSI for Mean Reversion

- MACD Crossover Strategy

- Fibonacci Retracement Swing Strategy

- Risk Factors and Common Mistakes in Swing Trading Crypto

- Risk Factor 1: High Market Volatility

- Risk Factor 2: Liquidity Issues

- Risk Factor 3: Emotional Trading

- Risk Factor 4: Overleveraging

- Mistake 1: No Trading Journal

- Mistake 2: Ignoring Market Sentiment

- Mistake 3: Trading Too Many Coins

- Mistake 4: Chasing Pumps

- Swing Trading Crypto in Bull vs. Bear Markets

- Swing Trading in a Bull Market

- Swing Trading in a Bear Market

- When to Stay Out of the Market

- Tax Implications of Swing Trading Crypto

- How Taxes Work for Crypto Swing Trades

- Short-Term vs. Long-Term Capital Gains

- Tracking and Reporting Trades

- Offsetting Losses with Tax-Loss Harvesting

- What About Crypto-to-Crypto Trades?

- Stay Compliant, Stay Safe

- Swing Trading Crypto Tips from Experts

- “The Market Doesn’t Owe You Anything” – @CryptoKaleo

- “Let the Winners Run, Cut the Losers Fast” – Linda Raschke

- “Don’t Trade Every Day—Trade When the Setup is Right” – Peter Brandt

- “Risk Management is the Game” – Scott Melker (The Wolf of All Streets)

- “Keep a Journal. Review It Weekly.” – Rekt Capital

- “Watch Bitcoin First, Then Trade the Alts” – Benjamin Cowen

- Swing Trading Crypto: Real-Life Examples

- Example 1: Ethereum (ETH) Swing Trade

- Example 2: Solana (SOL) Range Swing

- Example 3: BTC Fakeout Trap Avoided

- Example 4: Losing Trade Managed Well

- FAQs about Swing Trading Crypto

- Swing Trading Crypto

What is Swing Trading in Cryptocurrency?

Swing trading crypto is about capturing short-to-medium term price movements in volatile crypto markets. Traders rely heavily on technical analysis—like chart patterns, indicators, and historical price action—to spot buying or selling points. These trades can last anywhere from 2 days to 2 weeks, depending on the trend and asset.

Unlike scalping or intraday strategies, swing trading doesn’t require you to act on every small price movement. Instead, it focuses on bigger trends and momentum shifts that can generate decent returns with fewer trades.

Swing traders aim to capture “the meat of the move”—the central chunk of a coin’s upward or downward trend.

How Swing Trading Differs from Day Trading and HODLing

Many newcomers to crypto trading struggle with choosing the right strategy. Should you hold long-term and ride the waves? Or should you jump in and out within hours like day traders? Here’s how swing trading crypto strikes the perfect middle ground.

Day trading involves making multiple trades per day, sometimes dozens. It demands constant attention, quick decision-making, and fast execution. Day traders thrive on volatility but often suffer from stress, decision fatigue, and trading fees.

HODLing, on the other hand, is a long-term investment approach. You buy crypto and hold it for months or years, ignoring short-term fluctuations. It’s ideal if you believe in the long-term value of a project, but you may miss chances to profit from market cycles.

Swing trading, by contrast, gives you the best of both worlds. It allows you to stay active in the market without the burnout of day trading. You aim to profit from multi-day to multi-week price moves, and you can spend more time analyzing rather than reacting.

In essence:

| Strategy | Trade Duration | Attention Needed | Goal |

|---|---|---|---|

| Day Trading | Minutes to Hours | High | Small, quick profits |

| Swing Trading | Days to Weeks | Moderate | Capture part of a trend |

| HODLing | Months to Years | Low | Long-term investment gains |

Swing traders often use daily or 4-hour charts, while day traders may look at 15-minute or even 5-minute intervals. This slower pace means you can make more thoughtful, evidence-based decisions without constantly reacting to noise.

Why Swing Trading Crypto is Gaining Popularity

The explosive volatility of the crypto market makes it a fertile ground for swing trading. Here’s why more traders are gravitating towards this strategy in 2025:

1. Volatility Equals Opportunity

Cryptos can easily move 10–20% in a few days. Swing traders love these movements—they look for breakouts, pullbacks, and reversals to get in and out at profitable points.

2. Flexibility and Lifestyle

Unlike day traders, swing traders don’t need to be glued to screens all day. You can analyze the market once or twice a day, set alerts, and let trades run. This strategy is ideal for part-time traders or those with full-time jobs.

3. Higher Profit Margins Per Trade

Instead of trying to make a 1% gain multiple times a day, swing traders often aim for 5%, 10%, or even 30% gains in a single trade. Fewer trades with higher returns can also reduce transaction fees.

4. Psychological Edge

Day trading can trigger stress and emotional decision-making. Holding positions longer allows traders to act with more clarity and less pressure. You’re not forced to make split-second decisions.

5. Technical Tools are Tailored for It

Charting platforms like TradingView, Coinigy, or CryptoQuant offer powerful tools for swing traders. You can easily spot support/resistance zones, RSI divergence, and trend changes with a zoomed-out view.

Real-World Success Stories from Swing Traders

There’s no better way to understand the power of swing trading crypto than by looking at real examples. Traders who’ve mastered the art of timing crypto swings have seen incredible returns without needing to sit in front of charts all day.

Case 1: Lisa – The ETH Swing Queen

Lisa, a part-time trader from Toronto, started swing trading Ethereum during the 2021 bull run. She noticed consistent support at the $1,800 level and sold whenever ETH approached resistance at $2,400. Over the course of five months, she completed four successful swing trades, averaging 20–25% profits each time.

By using RSI and volume indicators, she avoided false breakouts. Instead of hoping for a moonshot, she focused on solid entries and exits. Her strategy was low-stress but highly effective.

Case 2: Ahmed – Profiting from the Dip

In early 2022, Bitcoin dropped from $48,000 to $33,000. Ahmed, an experienced swing trader, identified this as a strong retracement. Using Fibonacci retracement and moving averages, he entered at $34,500 and exited at $42,000.

Though the market was shaky, Ahmed knew how to ride the recovery wave. With a single trade, he made a 21.7% profit in 9 days. It’s this kind of opportunity that swing traders live for.

Case 3: Janine – Mastering Altcoins

Janine specializes in mid-cap altcoins with strong momentum. One of her biggest wins came from $SOL. She bought in at $17 after a significant retracement, held through a breakout, and exited at $29, pocketing a 70% gain in just over two weeks.

She didn’t get lucky—she followed a trading plan, respected her stop-loss, and used indicators like MACD crossover and volume spikes to time her entry.

These stories prove that with the right tools and mindset, swing trading crypto can become a consistent income-generating strategy—even for part-timers.

Core Principles of Swing Trading Crypto

Swing trading isn’t about luck or gut feelings. It’s about applying structured rules and discipline to spot high-probability setups and act on them.

Here are the core principles that every swing trader should follow:

1. Trend Is King

Always trade in the direction of the trend. Whether you’re long or short, aligning with the broader trend increases your chances of success. Use moving averages to identify trend direction.

2. Enter on Pullbacks or Breakouts

Smart swing traders enter either on pullbacks to support or breakouts from resistance zones. Timing is everything—jumping in too early or too late can kill profits.

3. Always Set a Stop-Loss

Crypto markets move fast. A strong risk management rule is to never enter a trade without a pre-determined stop-loss. It protects your capital and allows you to trade another day.

4. Use Technical Indicators Wisely

Don’t overload your charts. A few well-understood indicators like RSI, MACD, Bollinger Bands, and volume can offer better clarity than dozens of confusing tools.

5. Plan the Trade, Then Trade the Plan

Before entering a trade, know your entry price, stop-loss, target level, and time frame. Once the trade is live, avoid moving targets impulsively.

6. Avoid Emotional Trading

If fear or greed drives your decision, it’s a problem. Stick to data and strategy. Losing is part of the game—what matters is how you manage it.

Mastering these principles is the first step toward consistent profitability in swing trading crypto.Timing the Market with Technical Indicators

To succeed in swing trading crypto, you need a way to read the market’s language. Technical indicators are your translator—they help you understand when to buy, sell, or wait.

Here are the most reliable technical indicators swing traders use:

1. Relative Strength Index (RSI)

RSI measures momentum. It tells you if a coin is overbought (above 70) or oversold (below 30). A classic swing strategy is to buy when RSI dips below 30 and crosses back above it. This signals a potential reversal and an entry point.

2. Moving Averages (MA)

Use the 50-day and 200-day moving averages to understand the broader trend. When the price is above the 50-day MA, it often signals strength. A “golden cross” (50-day MA crossing above the 200-day MA) is a strong bullish signal.

Short-term MAs like the 9 or 21 EMA help pinpoint entries during pullbacks.

3. MACD (Moving Average Convergence Divergence)

MACD shows momentum changes and trend direction. A bullish crossover (MACD line crossing above the signal line) is a buy signal. Combine this with volume confirmation to strengthen your setup.

4. Fibonacci Retracement

Fibonacci levels like 0.382, 0.5, and 0.618 act as support and resistance zones. After a strong move up or down, prices often retrace to one of these levels before continuing in the same direction.

5. Bollinger Bands

Bollinger Bands measure volatility. When price touches the lower band during an uptrend, it may be an entry point. When it hits the upper band, consider trimming or exiting.

6. Volume

Volume validates moves. If a breakout happens on high volume, it’s likely to continue. If volume is low, be cautious—it could be a fakeout.

These tools aren’t perfect on their own. The key is confluence—using multiple indicators together to confirm your decision.

Example:

If RSI is below 30 (oversold), price is bouncing off a 50-day MA, and MACD shows a bullish crossover—all signs suggest a good entry.

Swing trading isn’t gambling. It’s about stacking the odds in your favor using tools that work together.

Risk Management Techniques for Swing Trading

In the crypto world, risk management is what separates traders who last from those who burn out. Even the best trade setups can fail—what protects you is your ability to control losses and preserve capital.

Here are the most important risk rules every swing trader should live by:

1. Risk Only 1–2% Per Trade

Never risk more than 1–2% of your total trading capital on a single trade. This keeps losses manageable and gives you room to bounce back.

2. Always Use Stop-Loss Orders

Whether mental or automatic, stop-losses limit damage. Set them based on technical levels, not emotions. For example, just below a recent swing low or support line.

3. Use Position Sizing Wisely

Don’t go all-in on one trade. Calculate how many coins you can buy while staying within your risk threshold. Bigger trades aren’t always better.

4. Know When to Exit

Set both a stop-loss and a profit target. If the price hits your goal, don’t get greedy—take the profit. If it hits your stop-loss, get out fast. Sticking to your exit strategy is key.

5. Avoid Overtrading

Sometimes, the best trade is no trade. Don’t chase moves or force trades because you’re bored. Wait for high-probability setups.

6. Keep a Trade Journal

Log every trade: entry, exit, reason, outcome. Over time, this will reveal your patterns, strengths, and mistakes. It’s your best teacher.

Risk management is the backbone of swing trading crypto. Without it, even the most accurate technical analysis will fail you.

Best Cryptocurrencies for Swing Trading

Not all crypto assets are made for swing trading. Some move too slowly, while others are wildly unpredictable. The sweet spot lies in coins that have sufficient volatility, strong liquidity, and clear chart patterns. Here are some of the best cryptocurrencies that swing traders frequently target:

Bitcoin (BTC)

Even though it’s the largest and most “stable” coin, Bitcoin is still a favorite for swing traders. Why? It responds well to technical indicators and often leads the broader market.

- Pros: Highly liquid, tight spreads, predictable patterns

- Strategy: Trade breakouts from consolidation or trend reversals at key moving averages.

Ethereum (ETH)

ETH is the backbone of DeFi and NFTs, and it’s always buzzing. It tends to follow BTC’s movements, but sometimes with higher volatility.

- Pros: Strong market cap, deep liquidity, solid trend behavior

- Strategy: Look for bounce trades at Fibonacci retracement levels and RSI confirmation.

Solana (SOL)

SOL is loved for its explosive price moves. It’s volatile but often respects support and resistance zones.

- Pros: High price swings, regular trading volume

- Strategy: Swing trade on breakout-pullback setups using Bollinger Bands.

Cardano (ADA)

ADA might not move daily, but when it does, it swings hard. Ideal for patient traders waiting for big setups.

- Pros: Clean chart patterns, reactive to news

- Strategy: Monitor volume surges and breakout candles from long consolidations.

Polygon (MATIC)

This scaling solution for Ethereum has seen regular price fluctuations, making it ideal for swing setups.

- Pros: Mid-cap altcoin with momentum potential

- Strategy: Enter on 20 EMA support with MACD divergence confirmation.

Other Honorable Mentions

- AVAX – Reacts well to sentiment and news.

- LTC – Older coin but still provides clear technical setups.

- ATOM – Often shows predictable swings between $8–$12.

When choosing a coin for swing trading crypto, focus on:

- Liquidity: Easy to enter and exit positions

- Volatility: Enough price movement to make profit

- Technical Respect: The price behaves in a predictable pattern

Avoid ultra-low-cap coins unless you’re highly experienced. Their unpredictability can ruin well-planned trades.

How to Identify Good Coins for Swing Positions

Swing trading success depends on choosing the right coins at the right time. Here’s how to do it:

1. Scan for High Relative Volume

Coins trading above their average volume often indicate upcoming volatility. Use scanners on TradingView or CoinMarketCap to spot these.

2. Look for Clear Trends

A coin with choppy or sideways movement is harder to trade. Focus on those in uptrends or downtrends, not noise-filled ranges.

3. Watch for Technical Patterns

Triangles, flags, and wedges are reliable swing patterns. If a coin is forming a setup near key support or resistance—take notice.

4. Follow Market Sentiment

Monitor crypto news. If a project is releasing updates or partnerships, traders may react strongly. These create opportunities for 1–2 week moves.

5. Use Watchlists

Track 10–15 coins with solid fundamentals and technical behavior. This helps you prepare instead of chasing.

Finding the right asset is half the battle in swing trading. Patience and proper selection often lead to better outcomes than frequent trades.

Essential Tools and Platforms for Swing Trading Crypto

Swing trading crypto requires more than just intuition. To make well-informed trades, you need professional tools and platforms that provide accurate data, analysis capabilities, and seamless trade execution. Here are the must-have tools every swing trader should consider:

Charting Tools

1. TradingView

By far the most popular charting platform for crypto traders. It offers hundreds of indicators, drawing tools, and alerts. The free version is powerful enough for beginners, while the Pro plan gives extra features.

- Features: Multi-timeframe analysis, custom scripts, price alerts

- Why It Matters: Helps you plan trades visually and backtest strategies

2. Coinigy

An all-in-one crypto trading and charting platform. Great for managing multiple exchange accounts from a single dashboard.

- Features: Real-time market data, order execution across exchanges

- Why It Matters: Centralized command center for serious swing traders

3. CryptoQuant

Focused more on on-chain data and sentiment metrics. Useful for longer swings influenced by macro market conditions.

- Features: Exchange inflow/outflow, whale activity, miner behavior

- Why It Matters: Adds a macro perspective beyond price charts

News and Sentiment Platforms

1. Cointelegraph / Decrypt

Staying informed is crucial. These platforms deliver news that often triggers crypto price movements.

- Why It Matters: News drives sentiment, and sentiment drives price swings

2. Santiment / LunarCrush

These tools analyze social media buzz, developer activity, and on-chain metrics to gauge community sentiment.

- Why It Matters: Helps predict short-term movements before they appear on charts

Crypto Exchanges with Swing-Friendly Features

1. Binance

Offers deep liquidity, low fees, and advanced trading tools. It also allows for setting stop-loss and take-profit orders.

2. Bybit / OKX

Great for swing traders who use leverage responsibly. They offer futures and spot trading with clear technical tools.

3. Coinbase Pro (Advanced Trade)

Well-suited for U.S. traders looking for compliance and simplicity, though it’s less feature-rich than Binance.

Other Essential Tools

- CoinMarketCap / CoinGecko: For market overviews, rankings, and price alerts

- CryptoTax Tools (Koinly, CoinTracking): To manage tax obligations from swing trading

- Telegram/Discord Trading Groups: Useful for learning and sharing strategies (be cautious of scams)

In swing trading, your tools become your edge. Without the right data or execution platform, even the best trade setups can go wrong. Investing in proper tools saves time, improves accuracy, and helps you manage trades more effectively.

How to Start Swing Trading Crypto

Ready to get started with swing trading crypto? Great news—it’s easier than you might think, but success comes down to following a structured approach. Here’s a simple, step-by-step guide to launching your swing trading journey the right way.

Step 1: Educate Yourself on the Basics

Before touching your wallet, get comfortable with crypto fundamentals. Understand how blockchain works, what drives coin value, and how to read candlestick charts. Platforms like Investopedia, YouTube, and crypto-focused blogs are excellent starting points.

Tip: Don’t rush. Master the lingo—terms like “bullish engulfing,” “double top,” and “breakout” should be second nature before you start trading.

Step 2: Choose the Right Exchange

Pick a reputable exchange that offers:

- Low trading fees

- Advanced charting tools

- Reliable order execution

- Stop-loss and take-profit functions

For most traders, Binance, Bybit, or OKX provide an ideal mix of functionality and liquidity.

Step 3: Open a Trading Account

Register with your chosen exchange, complete any necessary KYC (Know Your Customer) steps, and fund your account. Use only the amount you’re comfortable risking—never your rent money.

Step 4: Pick a Swing Trading Strategy

Don’t just “wing it.” You need a plan. Start with one of these beginner-friendly swing trading strategies:

- Breakout Trading: Buy after a price breaks above resistance

- Pullback Trading: Enter on a dip during an uptrend

- Range Trading: Buy at support, sell at resistance

Whichever you choose, stick to it. Don’t switch strategies mid-trade.

Step 5: Use Technical Indicators

Equip your charts with tools like:

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Fibonacci retracement levels

- 20-day and 50-day moving averages

These help you make data-driven decisions rather than emotional ones.

Step 6: Plan Every Trade

Before you enter a trade, ask:

- What’s my entry price?

- Where will I set my stop-loss?

- What’s my profit target?

- How much of my capital will I risk?

Write down the answers. That’s your trading plan.

Step 7: Start Small and Scale Gradually

Test your strategy with small amounts. As your confidence and skill grow, slowly increase your position sizes.

Pro Tip: Use a demo account if your platform offers it. Practice trading without risking real funds.

Step 8: Track and Learn from Every Trade

Keep a trading journal. Record:

- Entry and exit prices

- Why you took the trade

- What went right or wrong

- Emotional state during the trade

Over time, this becomes your greatest teacher.

Swing trading crypto isn’t about luck—it’s about preparation, patience, and consistency. Start small, learn every day, and treat it like a business, not a game.

Creating a Trading Plan for Consistent Results

If you want to succeed at swing trading crypto, flying blind isn’t an option. You need a clear, actionable trading plan that guides your decisions and keeps emotions out of the equation. Think of your trading plan as your playbook—it tells you what to do, when to do it, and why.

Here’s how to build a solid plan that gives you consistency and clarity:

Define Your Trading Goals

Ask yourself:

- Are you trading for income, growth, or practice?

- How much capital can you afford to risk?

- What are your weekly/monthly return targets?

Set realistic goals. A 5–10% monthly return is far more sustainable (and achievable) than trying to double your portfolio every week.

Set Rules for Trade Entry

Don’t rely on feelings or FOMO. Create specific conditions that must be met before you enter a trade. Example rules:

- Only enter trades when RSI < 30 and MACD shows bullish crossover

- Only trade coins with 24-hour volume > $500M

- Only take trades in the direction of the 50-day moving average

Having rules removes second-guessing and boosts confidence.

Determine Stop-Loss and Profit-Taking Strategies

Protecting your capital is rule #1. Decide ahead of time:

- Where you’ll place your stop-loss (e.g., just below support)

- When to take profits (e.g., at resistance, or when RSI > 70)

- Whether you’ll use a trailing stop to lock in profits as price rises

Tip: Always know your risk-to-reward ratio. A common target is 1:2 or higher—risking $100 to make $200.

Choose Your Timeframes

Pick a consistent timeframe for analysis. Most swing traders use:

- Daily chart for trend analysis

- 4-hour chart for entry and exit signals

- 1-hour chart for fine-tuning entries

Jumping across timeframes randomly leads to confusion and bad trades.

Define Your Watchlist and Screener Criteria

Don’t trade every coin under the sun. Instead, choose 10–20 assets that fit your strategy. Use screeners to filter for:

- Volume spikes

- Breakouts

- Oversold RSI

- Moving average crossovers

Having a focused watchlist keeps you sharp and ready for opportunities.

Set Routine and Review Schedule

Swing trading doesn’t require all-day chart watching. Plan your workflow:

- Morning: Scan news, check charts, plan trades

- Evening: Review positions, update journal, manage risk

Each week, review your trades. Look for what worked, what didn’t, and how you can improve.

A proper trading plan transforms random trades into calculated moves. It gives you a system to follow, even when emotions rise. Stick to your plan, refine it over time, and let consistency become your secret weapon in swing trading crypto.

Popular Swing Trading Strategies

When it comes to swing trading crypto, having a strategy is everything. Without one, you’re just guessing—and in the fast-moving world of crypto, that’s a recipe for disaster. Here are some of the most effective and widely used swing trading strategies that can help you trade with confidence.

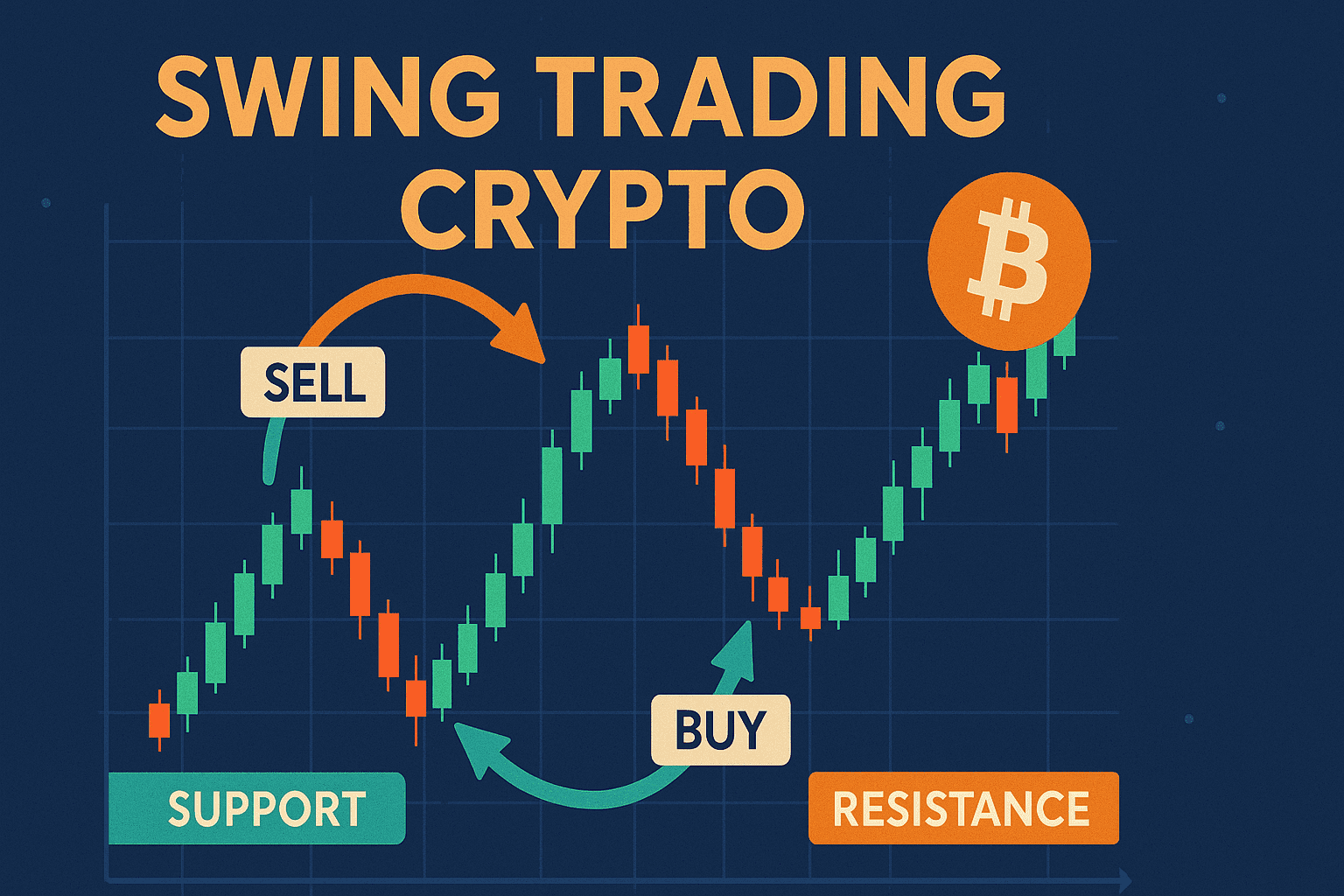

Support and Resistance Strategy

This is one of the most straightforward methods in swing trading. You identify support zones (where price tends to bounce up) and resistance zones (where price tends to reverse downward).

- Buy near support: When price drops to a known support level and shows signs of reversal

- Sell near resistance: When price approaches a resistance level and starts to stall

Pro Tip: Combine this with candlestick patterns (like bullish engulfing or hammer candles) to confirm entries.

Breakout Trading

Breakouts occur when price moves outside of a consolidation range, trendline, or pattern (like a triangle). Swing traders love breakouts because they can signal the start of a strong move.

- Entry: When price breaks out of a clear pattern on high volume

- Stop-loss: Just inside the pattern or below the breakout candle

- Profit target: Based on previous support/resistance or measured move from the pattern

This strategy works best when paired with volume analysis. A breakout on low volume is often a trap.

Pullback Trading

In trending markets, pullbacks (temporary dips or rallies against the trend) provide low-risk entry points.

- Uptrend? Wait for the price to pull back to a key moving average (like the 20 or 50 EMA)

- Downtrend? Look for rallies into resistance to go short (if your exchange allows it)

Combine with RSI for added confirmation—look for a dip into the 40–50 zone in uptrends.

Using RSI for Mean Reversion

RSI (Relative Strength Index) tells you when a coin is overbought or oversold. In swing trading, this can be a powerful signal to anticipate a reversal.

- Buy when RSI drops below 30 and starts rising

- Sell when RSI goes above 70 and begins to fall

Make sure to check price action and support zones—never trade on RSI alone.

MACD Crossover Strategy

MACD shows trend momentum and reversal points. A bullish crossover happens when the MACD line crosses above the signal line—a strong signal of upward momentum.

- Buy on MACD crossover plus volume surge

- Sell when MACD crosses down and momentum fades

You can combine this with moving averages or Fibonacci levels to sharpen your timing.

Fibonacci Retracement Swing Strategy

Fibonacci levels act as key turning points. After a strong move, prices often pull back to a 0.382, 0.5, or 0.618 retracement before continuing in the original direction.

- Enter trades at these levels with confirmation (e.g., bullish candles, RSI bounce)

- Set stop-loss below the swing low (for longs) or above the swing high (for shorts)

This strategy works well when the trend is strong and clearly defined.

These strategies can be used individually or in combination. The goal is to stack probabilities in your favor. With a little practice, you’ll know when to apply each strategy based on market conditions.

Risk Factors and Common Mistakes in Swing Trading Crypto

While swing trading crypto offers high reward potential, it’s not without serious risks. Many traders jump in excited by the profits but overlook the pitfalls. Here’s a breakdown of key risks and common mistakes—and how you can avoid them.

Risk Factor 1: High Market Volatility

Cryptocurrency markets are notoriously volatile. A coin can move 20% in either direction overnight. While this creates swing opportunities, it also increases the risk of sudden losses.

Solution: Always trade with a stop-loss. Never assume “it’ll bounce back.”

Risk Factor 2: Liquidity Issues

Some altcoins have low trading volume, making it difficult to enter or exit a trade without serious slippage. You may also struggle to sell quickly in a sudden market crash.

Solution: Stick with coins that have strong daily trading volume—at least $100 million+ for tighter spreads and easier exits.

Risk Factor 3: Emotional Trading

Fear, greed, and FOMO (fear of missing out) can cloud your judgment and push you to break your plan. One impulsive trade can undo weeks of profits.

Solution: Follow your trading plan like a rulebook. Pre-plan your entries and exits, and never make decisions mid-trade based on emotion.

Risk Factor 4: Overleveraging

Using leverage can amplify gains—but also losses. Many traders overestimate their skills and end up liquidated.

Solution: Avoid leverage as a beginner. If you must use it, start small (1.5x to 2x max) and size your trades conservatively.

Mistake 1: No Trading Journal

If you’re not documenting your trades, you’re not learning from them. Without a log, it’s impossible to see patterns in your wins and losses.

Solution: Record every trade. Note what went right, what went wrong, and what you learned.

Mistake 2: Ignoring Market Sentiment

Technical setups might look great, but a tweet from a major influencer or bad regulatory news can flip the market upside down.

Solution: Stay updated with reliable crypto news sources like CoinDesk or Decrypt. Consider sentiment tools like LunarCrush to gauge social chatter.

Mistake 3: Trading Too Many Coins

Some traders try to swing trade five to ten coins at once. This splits attention and increases the chance of errors.

Solution: Focus on 1–3 coins at a time. Quality over quantity wins in swing trading.

Mistake 4: Chasing Pumps

Buying into a coin that’s already up 50% in the last 24 hours is risky. The move may already be over.

Solution: Let the pump go. Wait for a healthy pullback or consolidation before considering a trade.

Swing trading crypto is like walking a tightrope. With a solid plan and disciplined mindset, you can keep your balance and make consistent gains. But ignore these risks, and the market will teach you the hard way.

Swing Trading Crypto in Bull vs. Bear Markets

One of the most powerful skills a swing trader can develop is the ability to adapt their strategy to different market conditions. What works in a bull market may fail miserably in a bear cycle. Understanding how to shift gears between bullish and bearish trends is key to thriving long-term in swing trading crypto.

Swing Trading in a Bull Market

When markets are trending upward, swing traders have the wind at their backs. Prices are making higher highs and higher lows, and the overall sentiment is optimistic.

Best strategies in bull markets:

- Buy the dip: Look for temporary retracements into support or moving averages (20 EMA, 50 MA) to enter trades

- Breakout trading: Coins breaking above key resistance zones often lead to sharp, continued moves

- Trend following: Enter long positions and hold until the trend shows real signs of reversal

What to watch out for:

- Overbought RSI can still remain high in a bull market, so don’t exit too early

- News-driven FOMO pumps—be cautious of chasing hype

- Sudden corrections—always use stop-losses

Pro Tip: Let winners run. Don’t cut profits too early just because you’re “up.”

Swing Trading in a Bear Market

In a downtrend, swing trading becomes tougher—but not impossible. Bear markets offer fewer long setups, but smart traders can still find opportunities.

Best strategies in bear markets:

- Shorting resistance (if your platform allows it): Identify failed rallies into resistance and ride the drop

- Range trading: Markets often go sideways during bear phases; swing trade within established support and resistance

- High-quality coin bounces: Look for coins that are oversold (RSI < 30) and showing divergence

What to avoid:

- Don’t buy every dip—some dips become deep crashes

- Don’t expect trend continuation unless confirmed by volume and pattern

- Don’t trade low-liquidity assets—they’re more vulnerable in a downtrend

Pro Tip: In bear markets, cash is a position. Don’t be afraid to sit out until the setup is right.

When to Stay Out of the Market

Sometimes, no trade is the best trade—especially when:

- The market is moving sideways with no clear direction

- Major economic news (like Fed meetings or ETF approvals) is pending

- Volatility is too high to manage risk properly

Swing trading requires patience. You’re not paid to take trades—you’re paid to take good trades.

By aligning your strategy with the market’s mood, you’ll increase your chances of success and reduce the stress of working against the trend. Remember, the market doesn’t care what you want—it only responds to those who move with it.

Tax Implications of Swing Trading Crypto

While swing trading crypto can be profitable, many traders forget one critical detail: taxes. Yes, those quick gains from buying low and selling high can come with tax obligations—sometimes more complex than traditional investments.

How Taxes Work for Crypto Swing Trades

In most countries, including the U.S., UK, Canada, and Australia, crypto is treated as property, not currency. That means every time you sell, swap, or use crypto, it creates a taxable event.

For swing traders, that means:

- Every profitable trade = Capital Gains

- Every losing trade = Capital Loss

Short-Term vs. Long-Term Capital Gains

- Short-term capital gains: If you sell a crypto asset within 12 months, the profits are typically taxed at your ordinary income tax rate (which can be 10% to 37% in the U.S.)

- Long-term capital gains: If you hold crypto for more than 12 months, you may qualify for a lower tax rate, often between 0% and 20%

Since swing trades typically last from a few days to a few weeks, they usually fall under short-term gains, meaning higher taxes.

Tracking and Reporting Trades

Keeping track of your crypto trades manually is a nightmare. Thankfully, there are tools that automate everything:

- Koinly

- CoinTracking

- TokenTax

- ZenLedger

These platforms connect to your exchange accounts, import your trading history, and generate tax reports that are ready for filing.

Important: Make sure to log:

- Date and time of purchase and sale

- Amount paid and amount received

- Trading fees

- Fair market value of the coins

You’ll need this info to accurately calculate gains and losses.

Offsetting Losses with Tax-Loss Harvesting

Had a bad trade? You can still benefit. By selling at a loss, you create a capital loss that can offset gains from other trades. This is called tax-loss harvesting, and it can reduce your tax bill significantly.

What About Crypto-to-Crypto Trades?

Even if you swap BTC for ETH without touching fiat money, it’s still a taxable event in many jurisdictions. That’s something swing traders often overlook—and it could come back to bite during tax season.

Stay Compliant, Stay Safe

Don’t assume that crypto is “under the radar.” Regulatory agencies are ramping up enforcement and using AI tools to track wallets and exchange activity.

Tips to stay safe:

- Always report your crypto trades honestly

- Keep a well-organized record of all transactions

- Consider consulting a tax professional familiar with digital assets

Being aware of the tax implications isn’t just about avoiding fines—it’s about protecting your profits. Swing trading crypto is exciting, but smart traders also think about their bottom line after taxes.

Swing Trading Crypto Tips from Experts

If you want to level up your performance in swing trading crypto, there’s no better shortcut than learning from those who’ve done it successfully. Professional swing traders often follow repeatable rules and mental habits that keep them profitable—even when the market gets unpredictable.

Here’s what some of the most experienced crypto swing traders recommend:

“The Market Doesn’t Owe You Anything” – @CryptoKaleo

One of the most common beginner mistakes is revenge trading—trying to earn back losses by jumping into another trade without a plan.

Pro Tip: Stick to your strategy. Losses happen. Focus on probability, not emotions.

“Let the Winners Run, Cut the Losers Fast” – Linda Raschke

This classic rule applies perfectly to crypto. Too many traders do the opposite—they take profits too early but let losing trades drag on, hoping for a recovery.

Pro Tip: Use trailing stops to lock in profits while giving your trade room to grow. And always honor your stop-loss.

“Don’t Trade Every Day—Trade When the Setup is Right” – Peter Brandt

Swing trading is about patience. Not every candle needs a reaction. Professional traders wait for confluence—multiple indicators and price action signals aligning.

Pro Tip: Set alerts instead of watching charts all day. You’re not paid to trade—you’re paid to trade well.

“Risk Management is the Game” – Scott Melker (The Wolf of All Streets)

Even with a 60% win rate, poor risk management can wipe you out. Experienced swing traders focus more on how much they’re risking per trade than how many trades they win.

Pro Tip: Follow the 2% rule—never risk more than 2% of your account on a single trade. It keeps you in the game long enough to win.

“Keep a Journal. Review It Weekly.” – Rekt Capital

You can’t improve what you don’t measure. The best traders obsess over their performance—not just in wins, but in discipline.

Pro Tip: Record why you entered a trade, how you felt, what the outcome was, and what you learned. Over time, you’ll uncover patterns that help or hurt you.

“Watch Bitcoin First, Then Trade the Alts” – Benjamin Cowen

Most altcoins follow Bitcoin’s lead. If BTC is in a downtrend, altcoins are likely to underperform or crash harder.

Pro Tip: Always analyze BTC’s trend before placing a swing trade on any altcoin.

In short, successful swing traders follow rules, routines, and risk discipline. They know when to be aggressive and when to step back. Most importantly, they treat trading like a business—not a gamble.

Follow the pros not just in their trades—but in how they think, prepare, and adapt.

Swing Trading Crypto: Real-Life Examples

To bring all the strategies and tips together, let’s look at some real-life examples of swing trading crypto. These scenarios show how traders use technical tools, risk management, and patience to execute profitable trades in the wild.

Example 1: Ethereum (ETH) Swing Trade

Setup:

- Market was in an uptrend

- ETH was trading at $1,750 after a dip

- 50-day Moving Average acting as support

- RSI dipped to 32

- MACD showed bullish crossover

Trade Plan:

- Entry: $1,750

- Stop-Loss: $1,680 (below support)

- Target: $2,100 (next resistance level)

Outcome:

Price bounced off the 50 MA and hit the $2,100 target in 7 days. The trader captured 20% profit, using only a 4% stop-loss.

Lesson: Buying the dip in a confirmed uptrend using strong confluence can be highly effective.

Example 2: Solana (SOL) Range Swing

Setup:

- SOL stuck between $18 (support) and $22 (resistance)

- High volume at both extremes

- Market was choppy, not trending

Trade Plan:

- Entry: $18.20 (after bullish candle at support)

- Stop-Loss: $17.40

- Target: $21.80

Outcome:

SOL moved sideways for 3 days, then spiked to $21.60. The trade closed at a 18.7% gain, and the stop was never touched.

Lesson: In sideways markets, range trading with well-defined levels can deliver clean, low-risk profits.

Example 3: BTC Fakeout Trap Avoided

Setup:

- BTC appeared to break out above $30,000

- Volume was weak

- RSI was already at 75 (overbought)

- No confirmation candle above resistance

Trade Plan:

- Avoid the trade. Wait for confirmation.

Outcome:

BTC quickly reversed and dropped to $28,200 within two days.

Lesson: Sometimes the best trade is no trade. Waiting for volume and confirmation can save you from getting trapped.

Example 4: Losing Trade Managed Well

Setup:

- Trader expected a breakout in LINK after several bullish signals

- Entry: $7.40

- Stop-loss: $6.95

- Target: $8.80

Outcome:

LINK reversed sharply after a BTC pullback. The trade hit the stop-loss at $6.95. Loss: 6%

Lesson: Even with solid setups, trades can fail. Having a stop-loss and respecting it preserved capital for the next opportunity.

These examples show how different market conditions, strategies, and tools come into play when swing trading crypto. The common thread? Each trade was planned, managed with discipline, and based on technical signals—not emotion.

Even the losing trades are valuable—because success in swing trading comes from managing risk and staying consistent, not from being right every time.

FAQs about Swing Trading Crypto

Swing trading crypto often brings up a lot of questions—especially for beginners. Let’s address some of the most common ones to clear up confusion and help you get started confidently.

What is the best time frame for swing trading crypto?

Most swing traders use the 4-hour and daily charts. The daily chart helps you spot the broader trend, while the 4-hour chart is ideal for timing entries and exits. Some also use the 1-hour chart for confirmation.

Can beginners succeed in swing trading crypto?

Yes, but only if they treat it like a skill to be learned—not a way to get rich overnight. Start with small trades, stick to one or two strategies, and learn from every trade. Use demo accounts to practice without risking real money.

How much capital is needed for swing trading crypto?

You can start with as little as $100–$500, depending on your exchange. The key is proper risk management. Even small accounts can grow if you’re consistent and disciplined. Don’t trade with money you can’t afford to lose.

Are bots helpful for swing trading crypto?

Bots can be useful for automating entries and exits, especially if you can code or use a platform like 3Commas or TradeSanta. However, bots are only as good as the strategy behind them. Beginners are better off learning manually first.

Is swing trading crypto legal?

Yes, swing trading is legal in most countries, as long as you use compliant exchanges and report your taxes. Be sure to follow the laws in your region regarding crypto trading and capital gains.

What are the tax obligations for swing traders?

Every time you sell crypto at a profit, it’s a taxable event. You may owe short-term capital gains tax, which is usually higher than long-term gains. Use tools like Koinly or CoinTracking to keep accurate records, and consult a tax advisor if needed.

If you’re unsure about anything, remember: it’s better to ask questions now than to learn the hard way later. Swing trading crypto is a journey, and getting informed is the first step to long-term success.

Swing Trading Crypto

Swing trading crypto isn’t just a strategy—it’s a mindset. It combines the art of technical analysis with the discipline of risk management and the patience to wait for high-probability setups. Whether you’re a part-time trader, a crypto enthusiast, or someone looking to generate consistent income from the markets, swing trading offers a balanced approach to trading in one of the world’s most volatile asset classes.

Here’s what you should take away:

- You don’t need to be glued to your screen. Swing trading allows you to enter, hold, and exit trades over days or weeks. It’s the perfect strategy for people who want structure but can’t monitor the charts 24/7.

- Technical analysis is your best friend. Learning to read patterns, indicators, and chart levels will give you an edge that emotion or guessing never will.

- Risk management is non-negotiable. Losing trades will happen. What matters is that your winners outweigh your losers—and your losses are always controlled.

- Adapting to market conditions is key. Don’t fight the trend. Learn to profit in both bull and bear environments by adjusting your strategy.

- Start small and grow with experience. The most successful swing traders didn’t get there overnight. They studied, practiced, lost a little, learned a lot, and stayed consistent.

Swing trading crypto offers the kind of flexibility, opportunity, and growth potential that few other strategies can. But like anything worth mastering, it takes time, effort, and discipline.

If you’re willing to treat it like a skill, develop a solid plan, and stick to it, swing trading could be your path to steady and rewarding success in the crypto markets.