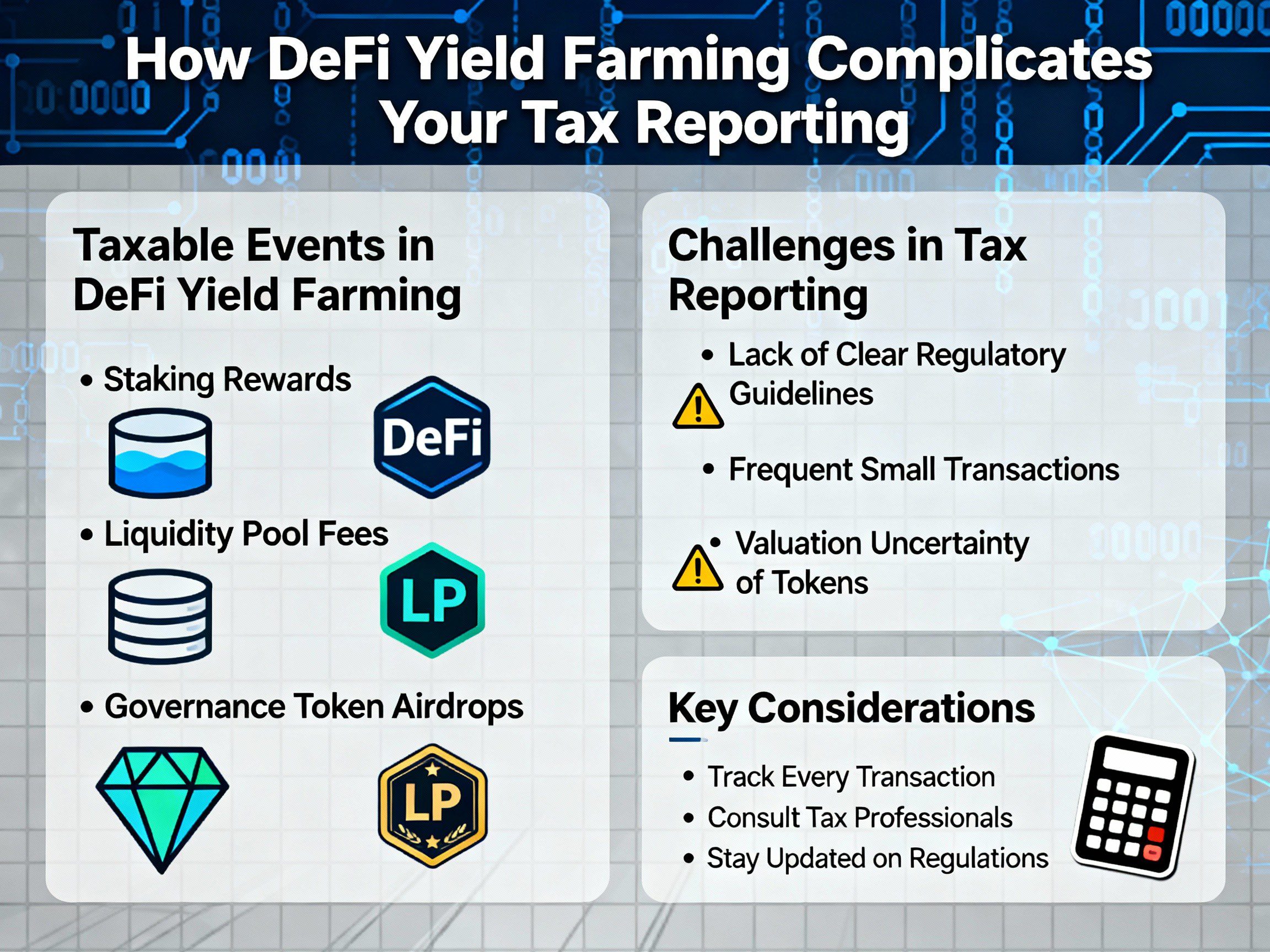

Understanding DeFi yield farming tax implications represents one of the most challenging aspects of cryptocurrency taxation in 2025. When you engage in yield farming activities, you’re not simply investing in a traditional sense—you’re participating in complex financial mechanisms that generate multiple taxable events, each with unique reporting requirements that the IRS hasn’t fully addressed. This complexity transforms what might seem like passive income generation into a labyrinth of tax obligations that can overwhelm even experienced cryptocurrency investors.

- The Foundation: Understanding DeFi Yield Farming Tax Basics

- The Multi-Layer Complexity of DeFi Yield Farming Tax Events

- Understanding Dominion and Control in DeFi Yield Farming Tax

- The Liquidity Pool Puzzle: Navigating DeFi Yield Farming Tax Implications

- Multi-Protocol Strategies and Compound DeFi Yield Farming Tax Issues

- The Record-Keeping Nightmare of DeFi Yield Farming Tax Compliance

- Valuation Challenges in DeFi Yield Farming Tax Calculations

- Cross-Chain Complications in DeFi Yield Farming Tax Reporting

- Advanced DeFi Mechanisms and Their Tax Implications

- The Compliance Burden and Professional Challenges

- Future Regulatory Developments and DeFi Yield Farming Tax

- Practical Strategies for Managing DeFi Yield Farming Tax Compliance

- Conclusion: Navigating the DeFi Yield Farming Tax Maze

The Foundation: Understanding DeFi Yield Farming Tax Basics

Before we can grasp why DeFi yield farming tax reporting becomes so complicated, we need to understand what yield farming actually involves from both a technical and tax perspective. Imagine you’re a farmer who plants seeds (your cryptocurrency) in various fields (DeFi protocols) to harvest crops (yield rewards). However, unlike traditional farming where you simply plant, wait, and harvest, DeFi yield farming involves multiple intermediate steps, each potentially creating distinct tax obligations.

At this time, the IRS hasn’t provided explicit guidance on how DeFi protocols are taxed. As a result, tax professionals rely on existing cryptocurrency tax guidance to determine how DeFi is taxed. This absence of specific guidance means we must interpret traditional tax principles and apply them to novel financial instruments that didn’t exist when those principles were established. The result is a framework filled with uncertainty, where reasonable minds can disagree on the proper tax treatment of identical transactions.

When you participate in yield farming, you’re essentially providing liquidity to decentralized protocols in exchange for rewards. These rewards might come in various forms: interest payments, governance tokens, trading fees, or incentive rewards. Each type of reward potentially triggers different tax treatment, and the mechanism by which you receive these rewards further complicates the tax picture. Consider a simple scenario where you deposit Ethereum and USDC into a liquidity pool on Uniswap. You receive LP (liquidity provider) tokens representing your share of the pool. Later, you stake those LP tokens in a yield farming protocol to earn additional rewards. This seemingly straightforward process involves at least three potentially taxable events, each requiring different calculations and reporting methods.

The fundamental challenge with DeFi yield farming tax reporting stems from the mismatch between how these protocols operate and how traditional tax law conceives of financial transactions. Traditional finance has clear categories: loans generate interest, investments produce capital gains, and services earn income. DeFi protocols blur these distinctions, creating hybrid instruments that don’t fit neatly into existing tax categories.

The Multi-Layer Complexity of DeFi Yield Farming Tax Events

To truly understand the complications in DeFi yield farming tax reporting, we need to examine how a typical yield farming strategy creates multiple layers of taxable events. Think of it like peeling an onion—each layer reveals new tax implications that interact with and compound the complexity of previous layers. This multi-layered nature means that what appears to be a single investment strategy actually consists of numerous discrete transactions, each requiring separate tax analysis and reporting.

The first layer of complexity emerges when you enter a liquidity pool. Many DeFi activities that involve token rewards may be the result of staking, lending, airdrops, or yield farming. Learning how token rewards are taxed is essential for understanding how various other aspects of DeFi taxation work. When you deposit assets into a liquidity pool, you’re exchanging your original tokens for LP tokens. The IRS could potentially view this as a taxable disposal of your original assets, meaning you’d need to calculate capital gains or losses based on the difference between your cost basis and the fair market value at the time of deposit.

Table 1: Layers of Taxable Events in DeFi Yield Farming

| Transaction Layer | Event Type | Tax Treatment | Reporting Challenge |

|---|---|---|---|

| Initial Deposit | Token to LP token swap | Potential capital gains | Determining if disposition occurred |

| Earning Rewards | Receiving farming tokens | Ordinary income | Valuing tokens at receipt time |

| Compound Staking | Staking reward tokens | Additional income or basis | Tracking nested positions |

| Impermanent Loss | Value divergence | Unclear treatment | Calculating unrealized changes |

| Withdrawal | LP token to tokens | Capital gains/loss | Determining basis of returned assets |

| Reward Claiming | Harvesting yields | Income recognition | Timing of constructive receipt |

The second layer involves the rewards you earn while providing liquidity. Every time you receive reward tokens, whether automatically or through manual claiming, you potentially trigger an income tax event. The fair market value of these tokens at the time you gain “dominion and control” over them becomes taxable income. This creates an immediate tax liability even though you haven’t sold anything for fiat currency. The challenge intensifies when you’re earning rewards continuously, as many DeFi protocols distribute rewards per block, meaning you could technically have thousands of taxable events throughout the year.

Understanding Dominion and Control in DeFi Yield Farming Tax

The concept of “dominion and control” becomes crucial when determining when DeFi yield farming tax obligations arise. This legal principle determines the precise moment when you must recognize income for tax purposes, but applying it to DeFi protocols reveals significant ambiguities that complicate tax reporting. Understanding this concept requires thinking about cryptocurrency rewards not just as numbers on a screen, but as property over which you exercise varying degrees of control at different points in time.

The IRS states that staking rewards are income when received and taxed as such. ‘When received’ is important terminology here as this defines the point at which your staking rewards are taxable. In traditional finance, receiving a dividend or interest payment clearly establishes dominion and control—the money appears in your account, and you can immediately use it. DeFi protocols operate differently, often accruing rewards that you can see but cannot access until you take specific actions to claim them.

Consider a yield farming position where rewards accumulate in a smart contract but require you to pay gas fees to claim them. Do you have dominion and control when the rewards are allocated to your address in the smart contract’s internal accounting, or only when you execute a transaction to claim them? The answer significantly impacts both the timing and amount of your tax obligations. If you have dominion and control before claiming, you owe taxes on rewards you haven’t actually received in your wallet. If control only occurs upon claiming, you might be able to strategically time your tax obligations.

This uncertainty extends to more complex scenarios involving locked or vesting rewards. Some DeFi protocols distribute rewards that are initially locked, becoming available only after a vesting period. The tax treatment of these locked rewards remains unclear, with reasonable arguments for recognizing income either at initial distribution, at vesting, or at some point in between. This ambiguity forces taxpayers to make judgment calls that could later be challenged by the IRS.

The Liquidity Pool Puzzle: Navigating DeFi Yield Farming Tax Implications

Liquidity pools present unique challenges for DeFi yield farming tax reporting because they fundamentally alter the nature of your cryptocurrency holdings. When you deposit assets into a liquidity pool, you’re not simply holding them in a different location—you’re transforming them into a fundamentally different type of asset that behaves according to complex mathematical formulas. This transformation creates tax reporting challenges that have no clear precedent in traditional finance.

When transferring units across the blockchain and into or out of a DeFi protocol, you will incur transaction fees, commonly known as gas fees. These gas fees add another layer of complexity, as they must be properly categorized as either additions to cost basis, reductions in proceeds, or potentially deductible expenses, depending on the specific nature of the transaction. The high gas fees often associated with DeFi transactions can significantly impact the economics of yield farming and create additional record-keeping burdens.

Table 2: Liquidity Pool Tax Complications

| Scenario | Traditional Finance Equivalent | DeFi Complexity | Tax Uncertainty |

|---|---|---|---|

| Depositing assets | Opening investment account | Creates new token type | Taxable event unclear |

| Earning trading fees | Dividend income | Continuous accrual | Recognition timing |

| Impermanent loss | Unrealized loss | Algorithmic rebalancing | Deductibility questions |

| Pool token appreciation | Stock appreciation | Composite asset value | Basis tracking difficulty |

| Withdrawing liquidity | Closing account | Receives different ratios | Gain/loss calculation |

Impermanent loss adds yet another dimension to DeFi yield farming tax complexity. This phenomenon occurs when the price ratio of pooled assets changes, resulting in a lower total value compared to simply holding the assets. The tax treatment of impermanent loss remains entirely unclear. Is it a realized loss when you withdraw from the pool? Can it offset other gains? Or is it simply an economic consequence of the investment strategy with no separate tax implications? These questions lack definitive answers, leaving taxpayers to navigate uncertain territory.

Multi-Protocol Strategies and Compound DeFi Yield Farming Tax Issues

Modern DeFi yield farming rarely involves just one protocol. Sophisticated strategies often stack multiple protocols together, creating what the community calls “yield farming strategies” or “DeFi legos.” These multi-protocol approaches multiply the tax complexity exponentially, as each protocol interaction potentially triggers separate taxable events that must be tracked, valued, and reported correctly.

Consider a typical leveraged yield farming strategy. You might start by depositing ETH into Aave as collateral, borrow USDC against it, swap half the USDC for ETH on a DEX, provide ETH-USDC liquidity on Uniswap, stake the resulting LP tokens in a yield aggregator like Convex, and then stake the reward tokens you receive for additional yields. When it comes to reporting crypto taxes, every transaction must be listed on your tax return. That includes buys, sells, swaps, deposits, and transfers. Each step in this strategy creates distinct tax implications that interact in complex ways.

The borrowing component introduces questions about the tax treatment of DeFi loans. When you borrow against your cryptocurrency collateral, you’re not selling it, so there shouldn’t be a taxable event. However, what you do with the borrowed funds might trigger tax obligations. If your position gets liquidated due to price movements, that forced sale definitely creates a taxable event, potentially at the worst possible time from a tax planning perspective.

Table 3: Multi-Protocol DeFi Yield Farming Tax Tracking Requirements

| Protocol Layer | Transaction Type | Data Required | Tracking Challenge |

|---|---|---|---|

| Lending Protocol | Collateral deposit | Value at deposit | No taxable event but basis tracking |

| Borrowing | Loan receipt | Amount borrowed | Debt position tracking |

| DEX Swap | Token exchange | Prices at swap | Capital gains calculation |

| Liquidity Provision | Pool entry | Token ratios | Multiple token basis |

| Yield Aggregator | LP token staking | Additional rewards | Nested reward tracking |

| Reward Staking | Governance tokens | Market values | Continuous income |

The compounding nature of these strategies means that errors or uncertainties at one level propagate through all subsequent levels. If you incorrectly calculate the tax basis of your LP tokens, every subsequent transaction involving those tokens will also be incorrect. This cascade effect makes accurate record-keeping essential from the very beginning of your DeFi journey.

The Record-Keeping Nightmare of DeFi Yield Farming Tax Compliance

Perhaps no aspect of DeFi yield farming tax reporting proves more challenging than maintaining adequate records for tax compliance. Traditional investment platforms provide consolidated 1099 forms that summarize your annual activity, but DeFi protocols offer no such convenience. Since DeFi protocols don’t provide tax forms to users, trying to collect the information you need to fill out your tax return can take weeks of effort. You bear full responsibility for tracking every transaction, calculating every gain or loss, and maintaining documentation that would satisfy an IRS audit.

The decentralized nature of DeFi means your transactions span multiple protocols, chains, and wallets. Each protocol has its own interface, its own way of displaying information, and its own transaction format. Some protocols don’t even maintain user-friendly transaction histories, requiring you to query blockchain data directly to reconstruct your activity. This fragmentation transforms tax reporting from a straightforward process into a complex data archaeology project.

Consider the challenge of tracking cost basis across DeFi protocols. When you deposit tokens into a liquidity pool, the protocol doesn’t know or care what you originally paid for those tokens. When you receive LP tokens, they don’t come with embedded cost basis information. When those LP tokens are staked elsewhere for yield farming, that protocol has even less visibility into your tax situation. You must manually maintain these connections, tracking how basis flows through each transaction.

The temporal aspect of record-keeping presents additional challenges for DeFi yield farming tax reporting. Many yield farming strategies involve continuous reward accrual, meaning you’re technically earning income every block, approximately every 12-15 seconds on Ethereum. Strictly speaking, you should record the fair market value of rewards at each receipt moment. The impracticality of this requirement forces taxpayers to make reasonable approximations, such as using daily average prices, but these approximations introduce uncertainty about IRS acceptance.

Valuation Challenges in DeFi Yield Farming Tax Calculations

Determining fair market value for DeFi yield farming tax purposes becomes extraordinarily complex when dealing with exotic tokens, illiquid markets, and newly launched protocols. Unlike major cryptocurrencies that trade on multiple exchanges with clear price discovery, many DeFi tokens exist in limited liquidity environments where determining a defensible fair market value challenges even experienced practitioners.

Protocols like Beefy Finance and Convex are notable in this space. Currently, specific tax regulations for yield farming remain undefined. Nonetheless, it’s crucial to recognize that rewards received in the form of new cryptocurrencies are taxed as income, based on their value at receipt. But what happens when you’re farming a brand-new token that only trades on a single DEX with minimal liquidity? The price impact of even small trades might be enormous, making the quoted price unrealistic for tax valuation purposes.

Table 4: Valuation Methods for DeFi Yield Farming Tax

| Token Type | Valuation Method | Reliability | IRS Acceptance Risk |

|---|---|---|---|

| Major cryptocurrencies | Exchange spot prices | High | Low risk |

| DEX-only tokens | DEX pool prices | Medium | Moderate risk |

| LP tokens | Underlying asset value | Complex calculation | Uncertainty |

| Governance tokens | Limited liquidity pricing | Low | High risk |

| Locked/vesting tokens | Discounted value | Subjective | Very high risk |

| Synthetic assets | Oracle prices | Depends on oracle | Moderate risk |

The situation becomes even more complex with LP tokens, which represent shares in liquidity pools rather than standalone assets. Valuing LP tokens requires calculating the total value of underlying assets in the pool and determining your proportional share. This calculation must account for trading fees earned, impermanent loss experienced, and any rewards accrued but not yet claimed. The dynamic nature of these values means that the worth of LP tokens constantly changes, making point-in-time valuations necessary for each taxable event.

Governance tokens present another valuation challenge in DeFi yield farming tax calculations. Many protocols distribute governance tokens as rewards, but these tokens might have limited utility beyond voting rights. Some governance tokens trade at prices that seem disconnected from any fundamental value, driven more by speculation than utility. Using these potentially inflated prices for tax reporting could result in paying taxes on paper gains that may never materialize into real value.

Cross-Chain Complications in DeFi Yield Farming Tax Reporting

The multi-chain nature of modern DeFi introduces another layer of complexity to yield farming tax reporting. As protocols expand across Ethereum, Binance Smart Chain, Polygon, Avalanche, and numerous other blockchains, yield farmers must track activities across multiple networks, each with its own tokens, transaction fees, and technical characteristics. This cross-chain complexity multiplies the record-keeping burden and introduces new categories of taxable events.

Bridging—moving assets across chains—might be taxed as a crypto-to-crypto trade in some jurisdictions, considering the change in smart contracts, despite holding equivalent assets. When you bridge assets from one blockchain to another, you’re technically destroying tokens on one chain and minting equivalent tokens on another chain. The IRS hasn’t provided specific guidance on whether this constitutes a taxable event, leaving taxpayers to determine whether they should treat bridging as a non-taxable transfer or a taxable exchange.

Wrapped tokens add further complexity to DeFi yield farming tax reporting. When you wrap Bitcoin to create WBTC for use on Ethereum, or when you wrap ETH to create WETH for certain protocols, you’re creating what might be considered a new asset for tax purposes. The tax treatment of these wrapping and unwrapping transactions remains unclear, with reasonable arguments on both sides of the taxability question.

The gas fee implications of cross-chain yield farming can significantly impact profitability and tax calculations. Operating across multiple chains means paying transaction fees in different native tokens—ETH on Ethereum, BNB on Binance Smart Chain, MATIC on Polygon. Each of these fee payments potentially represents a disposal of cryptocurrency, triggering micro capital gains or losses that must be tracked and reported.

Advanced DeFi Mechanisms and Their Tax Implications

Modern DeFi protocols employ increasingly sophisticated mechanisms that challenge traditional tax frameworks. Concentrated liquidity positions, like those in Uniswap V3, allow liquidity providers to specify price ranges for their capital deployment. These positions behave differently from traditional constant-product pools, creating unique tax reporting challenges that have no precedent in existing tax guidance.

Growing DeFi adoption—ranging from liquid staking and yield farming to lending and borrowing on protocols like Aave and Compound—has caught the IRS’s attention. Liquid staking derivatives (LSDs) represent another innovation complicating DeFi yield farming tax reporting. When you stake ETH through Lido to receive stETH, you’re engaging in what might be a taxable exchange, even though the tokens maintain roughly equivalent value. The automatic rebasing of stETH to reflect staking rewards creates continuous taxable income that must be tracked and reported.

Table 5: Advanced DeFi Mechanisms Tax Treatment

| Mechanism | Description | Tax Complexity | Reporting Challenge |

|---|---|---|---|

| Concentrated Liquidity | Range-bound positions | Dynamic fee earning | Calculating income per range |

| Liquid Staking | Staked token derivatives | Rebasing rewards | Continuous income tracking |

| Flash Loans | Instant borrow-repay | Multiple transactions | Microsecond timing |

| Yield Aggregators | Automated strategies | Nested protocols | Transaction attribution |

| Options Protocols | DeFi derivatives | Premium income/expense | Options tax rules application |

| Synthetic Assets | Price-tracked tokens | Oracle dependencies | Valuation accuracy |

Flash loan transactions present particularly interesting tax questions. These loans are borrowed and repaid within a single blockchain transaction, existing for mere microseconds. If you use a flash loan to arbitrage price differences or manipulate your own positions for yield farming optimization, the tax treatment of profits generated through these instantaneous loans remains entirely unclear.

The Compliance Burden and Professional Challenges

The complexity of DeFi yield farming tax reporting creates a significant compliance burden that extends beyond individual taxpayers to challenge tax professionals and software providers. Even experienced cryptocurrency tax practitioners struggle with DeFi transactions, as they require deep understanding of both blockchain technology and tax law, a combination of expertise that remains rare in the professional community.

It’s practically impossible to report DeFi taxes correctly unless you’re a tax professional with deep knowledge and experience of cryptocurrency. This expertise gap means that many taxpayers cannot find qualified professional help, even when willing to pay premium prices for assistance. The few professionals who do understand DeFi yield farming tax issues often have long waiting lists and charge rates that reflect their scarcity.

Tax software solutions attempt to bridge this gap, but they face their own challenges in handling DeFi transactions. Most cryptocurrency tax software can handle basic trading on centralized exchanges, but DeFi support remains limited and often inaccurate. The software must interpret smart contract interactions, determine the nature of each transaction, and apply appropriate tax treatment—tasks that often require manual intervention and correction.

The cost of compliance for DeFi yield farming tax reporting can be substantial. Between professional fees, software subscriptions, and the time investment required for accurate record-keeping, the compliance cost might exceed the profits from smaller yield farming operations. This creates a barrier to entry for smaller participants and raises questions about the proportionality of tax compliance requirements.

Future Regulatory Developments and DeFi Yield Farming Tax

The regulatory landscape for DeFi yield farming tax continues evolving rapidly, with proposed changes that could fundamentally alter how these activities are reported and taxed. The IRS lowered the reporting threshold to $600 for NFTs and stablecoins. DeFi—decentralized finance—is a hotbed for innovation and crypto taxes. From yield farming to liquidity pools, DeFi activities are taxable, and IRS regulations are tightening. Understanding these potential changes helps prepare for future compliance requirements.

The infrastructure bill’s expansion of “broker” definitions could eventually require DeFi protocols to issue tax forms similar to traditional financial institutions. However, the decentralized nature of many protocols makes implementing such requirements technically challenging or impossible. Smart contracts cannot collect user information or issue 1099 forms in the way traditional brokers do, creating a fundamental mismatch between regulatory requirements and technological reality.

Table 6: Potential Future DeFi Yield Farming Tax Changes

| Proposed Change | Impact on Yield Farmers | Implementation Challenge | Timeline |

|---|---|---|---|

| Broker reporting for DeFi | Automatic tax forms | Technical impossibility | Uncertain |

| Specific DeFi guidance | Clearer rules | Complexity of protocols | 2025-2026 |

| Real-time reporting | Immediate tax calculation | Blockchain integration | Long-term |

| International coordination | Cross-border compliance | Jurisdictional conflicts | Ongoing |

| Automated compliance tools | Reduced burden | Technical development | Near-term |

International coordination efforts could impact DeFi yield farming tax reporting for users operating across multiple jurisdictions. As different countries develop their own approaches to DeFi taxation, yield farmers might face conflicting requirements and potential double taxation. The lack of international consensus on basic issues like the taxability of liquidity provision creates uncertainty for global DeFi participants.

Practical Strategies for Managing DeFi Yield Farming Tax Compliance

Despite the complexity and uncertainty surrounding DeFi yield farming tax, practical strategies can help manage compliance obligations while participating in these innovative financial protocols. The key lies in establishing robust systems from the beginning rather than attempting to reconstruct records after the fact.

Start by choosing a consistent methodology for tracking and reporting your DeFi activities. Whether you decide to treat liquidity pool deposits as taxable events or not, apply your chosen approach consistently across all similar transactions. Document your reasoning for the positions you take, as this documentation could prove valuable if the IRS questions your treatment. Consistency and reasonable basis for your positions matter more than achieving perfect accuracy in an uncertain regulatory environment.

Implement real-time tracking systems that capture transaction data as it occurs. Use portfolio tracking tools that support DeFi protocols, even if they require manual adjustments. CoinTracker, Koinly, and CoinLedger offer varying degrees of DeFi support, though none perfectly handle all scenarios. Supplement automated tools with spreadsheets that track specific details these platforms might miss, such as the exact block numbers of transactions or the precise ratios of tokens in liquidity pools.

Consider the tax implications before entering complex yield farming strategies. High-frequency trading and constant position adjustments might generate impressive returns but create nightmarish tax reporting obligations. Sometimes, simpler strategies with lower yields but clearer tax treatment provide better after-tax returns than complex strategies with uncertain tax implications.

Conclusion: Navigating the DeFi Yield Farming Tax Maze

The intersection of DeFi yield farming and tax reporting represents one of the most challenging areas in cryptocurrency taxation today. The absence of specific IRS guidance, combined with the innovative and complex nature of DeFi protocols, creates an environment where certainty remains elusive and compliance requires significant effort. Understanding these complexities helps you make informed decisions about participating in yield farming while maintaining tax compliance.

As we’ve explored throughout this guide, DeFi yield farming tax complications arise from multiple sources: the multi-layered nature of transactions, uncertainty about when taxable events occur, valuation challenges for exotic tokens, cross-chain complexity, and the sheer volume of transactions that must be tracked. Each of these challenges compounds the others, creating a compliance burden that can overwhelm even dedicated participants.

The key to managing DeFi yield farming tax obligations lies in preparation, documentation, and conservative positioning. By maintaining detailed records, using appropriate tools and professional assistance, and taking defensible positions on uncertain issues, you can participate in DeFi yield farming while minimizing tax risk. Remember that the landscape continues evolving, and staying informed about regulatory developments will help you adapt your strategies as new guidance emerges.

For ongoing updates on DeFi yield farming tax developments, bookmark resources like the IRS Virtual Currency page, follow cryptocurrency tax professionals on social media, and consider joining communities focused on DeFi tax compliance. As DeFi protocols continue innovating and tax authorities develop new frameworks, your understanding of these issues will become increasingly valuable in navigating this complex but rewarding space.