You’ve probably heard whispers of “grid trading bots” gliding effortlessly through the crypto markets—buying low, selling high, never blinking. If you want to join the fun without staring at charts all night or succumbing to FOMO, a grid trading bot is your ticket.

This guide rolls out a beginner-friendly roadmap into the world of grid trading bots. We’ll start by demystifying the core mechanics—how that neat grid of buy and sell orders actually works. Then, we’ll walk through picking platforms, dialing in optimal settings (and common mistakes to dodge), and even exploring advanced tactics like dynamic, adaptive grids. You’ll discover the bots that make beginners look good, plus proactive ways to protect capital when markets go rogue.

By the time you finish reading, you’ll not only understand how these bots work—you’ll also appreciate why they’re more than autopilot tools: they’re quiet companions for disciplined, emotionally detached crypto strategies. Let’s plot that grid and get moving.

- What Is a Grid Trading Bot?

- How It Works – The “buy low, sell high” grid mechanic

- Why It Appeals to Beginner and Intermediate Traders

- Spot vs. Forex Grid Bots

- Why Use a Grid Trading Bot in Crypto?

- Harvesting Volatility in Sideways Markets

- Emotion-Free, 24/7 Trading

- Comparing Grid Bots vs. Manual Strategy

- Types of Grid Strategies (and When to Use Them)

- Arithmetic, Geometric, Neutral, and Reverse Grid Types

- Dynamic / Adaptive Grids (Next-Gen Approach)

- When to Use Each Strategy

- How to Set Up a Grid Trading Bot

- Choose Your Platform

- Defining Grid Range (Upper & Lower Boundaries)

- Selecting Number of Grids & Grid Spacing

- Position Size, Allocation & Reinvestment

- Adding Stop-Loss, Trailing, Safety Orders

- Final Setup

- Optimal Settings for Different Market Conditions

- Sideways / Range-Bound Markets

- Trending / Uptrend Adjustments

- Downtrend / Bear Market Adjustments

- Common Mistakes and How to Avoid Them

- Popular Platforms and Tools for Grid Bots

- Binance Spot Grid & Copy-Trading Marketplace

- Pionex: AI and Built-In Bots

- Bitsgap, 3Commas, KuCoin, Quadency, BitUniverse

- Platform Comparisons: Fees, Features, Ease-of-Use

- Risks and Challenges

- Grid Exit Scenarios & Stuck Orders

- Fee Drag, Poor Range Choice, Strong Trends

- “Set and Forget” Pitfalls – Need for Monitoring

- Security & Trust Issues with Third-Party Bots

- The Reality Check

- Advanced Concepts and Unique Insights

- Dynamic Grid Trading (DGT) Overview

- When Grid Bots Underperform – and Why

- Hybrid Strategies: Combining Grid with DCA or Indicators

- Unique Insight: Think Like a Liquidity Provider

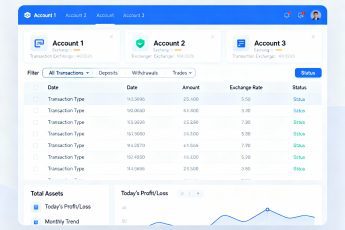

- Tracking Performance and Iterating

- Metrics to Watch: PnL, ROI, Win Rate

- Platform Tools & Backtesting Features

- When to Pause or Adjust Your Grid

- Iterative Learning

- Quick Takeaways

- Frequently Asked Questions (FAQs)

- What is a crypto grid trading bot?

- When should I use a grid trading strategy?

- How do I pick the right grid spacing?

- What happens if price breaks out of my grid range?

- Which platforms offer the best grid trading bots?

- Can grid bots perform badly in strong trends?

- Is dynamic grid trading better than static?

- Conclusion

- Join the Conversation

- References

What Is a Grid Trading Bot?

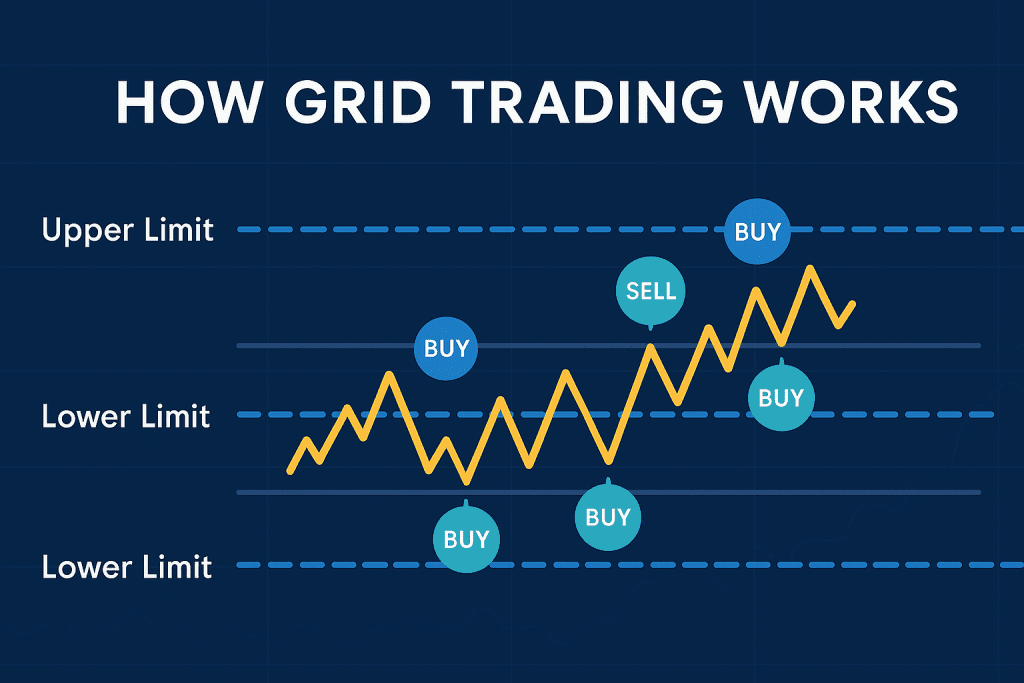

How It Works – The “buy low, sell high” grid mechanic

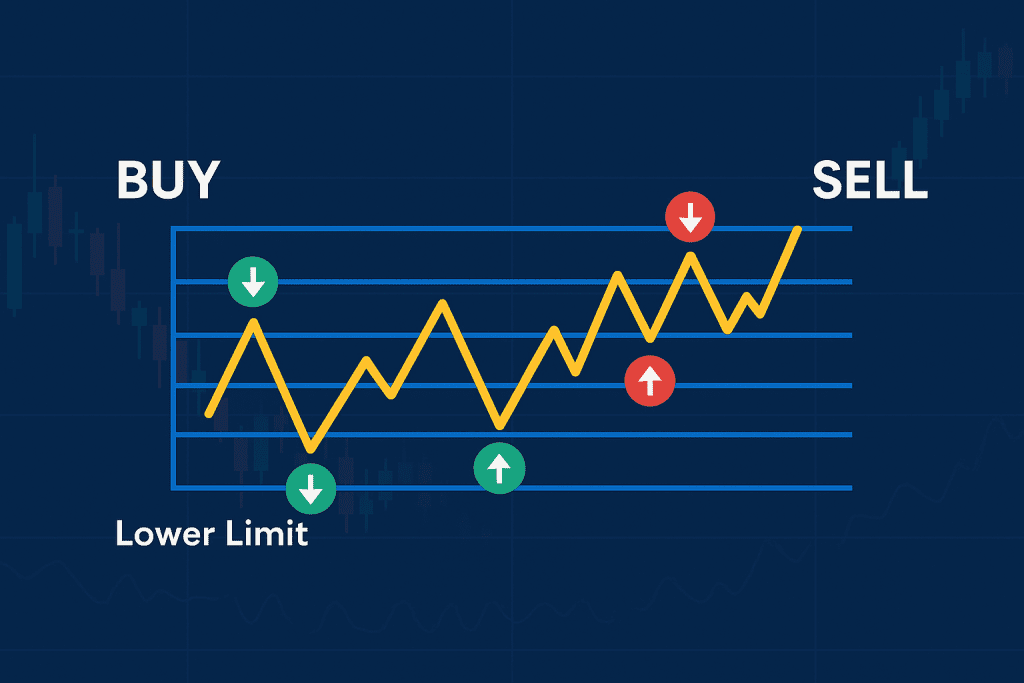

A grid trading bot is a simple but powerful automation tool. It places a series of buy and sell orders at predetermined intervals above and below a set price range. Each “grid line” represents a small trade, so when the price moves down, the bot buys; when it moves up, it sells. This cycle repeats automatically, generating small, consistent profits from price oscillations.

Instead of trying to predict trends, the bot monetizes volatility. Traders often describe it as “scalping the wiggles.” Unlike manual trading, where emotions creep in and decisions lag, the bot executes orders instantly and without hesitation.

Why It Appeals to Beginner and Intermediate Traders

Beginners love grid bots because they don’t require constant monitoring or chart expertise. You simply define a range, number of grids, and allocation, then let the bot run. Intermediate traders appreciate the structure—it enforces discipline and avoids the temptation to chase pumps or panic sell during dips.

For instance, in a range-bound market (say Bitcoin oscillating between $28,000 and $32,000), a grid bot can capture dozens of micro-profits while a manual trader might just wait in frustration.

Spot vs. Forex Grid Bots

- Spot crypto grid bots: Most common; trade assets you own on exchanges like Binance or Pionex.

- Futures/forex grid bots: Use leverage and contracts. They can be more profitable but carry higher risks, including liquidation if ranges break.

The key takeaway: grid bots are not trend-prediction tools. They are volatility harvesters, ideal for sideways or choppy markets. They don’t guarantee profit but create a structured framework to take advantage of conditions that many traders otherwise find unprofitable.

Why Use a Grid Trading Bot in Crypto?

Harvesting Volatility in Sideways Markets

Crypto markets are notorious for whipsaws: sharp moves up, followed by equally sharp pullbacks. For many traders, this volatility feels like chaos. A grid trading bot turns that chaos into opportunity.

Instead of betting on long-term direction, the bot thrives when an asset oscillates in a range. For example, if Ethereum moves between $1,600 and $1,800 for weeks, a grid bot can place dozens of small buy/sell orders within that band, capturing profits every time the price zigzags. Manual traders might just watch in frustration, but bots quietly rack up micro-gains.

This makes grid bots especially appealing during range-bound markets, where breakouts are rare but volatility is constant.

Emotion-Free, 24/7 Trading

Emotions are the silent killers of trading accounts. Fear of missing out (FOMO), panic selling, and overconfidence lead to poor decisions. A bot doesn’t suffer from nerves or fatigue. It sticks to the plan, executing dozens of trades while you sleep.

Beginner traders, in particular, find relief in knowing their strategy runs without emotional interference. Intermediate traders appreciate that bots free them from chart-watching at 2 a.m., letting automation handle the grind.

Comparing Grid Bots vs. Manual Strategy

- Manual trading: Requires constant monitoring, quick reactions, and mental resilience. Profits depend heavily on human discipline.

- Grid trading bot: Systematic, disciplined, and immune to emotional swings. It automates repetitive “buy low, sell high” behavior, ensuring no opportunity is missed.

In essence, a grid trading bot is like a shopkeeper who always buys cheap goods when stock is plentiful and sells them at a markup when demand rises—without ever closing the shop.

Types of Grid Strategies (and When to Use Them)

Arithmetic, Geometric, Neutral, and Reverse Grid Types

Grid bots may all follow the same “buy low, sell high” rhythm, but the way they space their orders changes the outcome.

- Arithmetic Grid

Orders are spaced equally in price (e.g., every $100). It’s simple and easy to understand. Best for beginners and assets with modest volatility. - Geometric Grid

Orders are spaced by percentage instead of fixed price (e.g., every +2%). This gives tighter spacing at lower prices and wider spacing at higher prices. It adapts better to assets with large relative swings like altcoins. - Neutral Grid

Classic version, placing buy orders below the starting price and sell orders above it. Profits accumulate in small, steady increments as long as the market bounces inside the grid. - Reverse Grid

Designed for shorting or profiting in downtrends. Instead of buying dips, it sells into strength and buys back lower. More complex, but useful for traders expecting declines.

Each of these strategies comes with trade-offs. For example, an arithmetic grid might miss opportunities when price growth is exponential, while geometric spacing scales better in trending environments.

Dynamic / Adaptive Grids (Next-Gen Approach)

Recent research introduced Dynamic Grid Trading (DGT) strategies. Instead of sticking to a fixed range, the grid adjusts itself as the market moves.

For example, if Bitcoin drifts steadily upward, a static grid may “run out” of sell orders at the top. A dynamic grid resets its boundaries, ensuring it continues to harvest volatility. Backtests suggest DGT can outperform static grids by balancing risk and capturing more trades.

Platforms like Pionex and Binance are beginning to experiment with adaptive bots, and some third-party tools allow custom scripts for dynamic adjustment. For intermediate traders, these evolving tools can provide a competitive edge in unpredictable crypto environments.

When to Use Each Strategy

- Arithmetic: Beginners, stablecoins, or blue-chip cryptos in narrow ranges.

- Geometric: Altcoins or volatile pairs with percentage-based swings.

- Neutral: General sideways markets where no clear trend dominates.

- Reverse: Downtrending markets or short-biased strategies.

- Dynamic: Medium to long-term setups where ranges may shift over time.

Choosing the right strategy isn’t about finding the “best” one—it’s about matching the grid to market behavior. As with any tool, context is everything.

How to Set Up a Grid Trading Bot

Choose Your Platform

The first decision is where to run your bot. Most major exchanges now offer built-in grid bots:

- Binance has a powerful Spot Grid Bot and even a copy-trading marketplace, where you can mirror other traders’ strategies.

- Pionex integrates bots directly into its exchange, offering both manual grids and AI-assisted grid suggestions based on backtesting.

- Bitsgap, KuCoin, and 3Commas give multi-exchange access and custom features like trailing stop-loss or indicator-based triggers.

For beginners, starting with Binance or Pionex is often the easiest, since you avoid the hassle of API connections to third-party bots.

Defining Grid Range (Upper & Lower Boundaries)

Think of the range as the playground where your bot operates.

- Lower boundary = price where your bot stops buying (protects you from catching a falling knife).

- Upper boundary = price where the bot stops selling (avoids missing upside breakouts).

Pick ranges wide enough to cover typical volatility but not so wide that your grid becomes inactive. For instance, if ETH trades at $1,700, a sensible grid might span $1,500–$1,900.

Selecting Number of Grids & Grid Spacing

This choice determines how sensitive your bot is.

- More grids (narrow spacing): More trades, smaller profit per trade, higher fee impact.

- Fewer grids (wider spacing): Fewer trades, larger profit per trade, lower fees.

Beginners often start with 20–50 grids in their range. Platforms like Binance suggest defaults, but customization improves results.

Position Size, Allocation & Reinvestment

Your investment is split across grids. The more grids you use, the smaller each order becomes.

- Allocate only what you’re comfortable with—grid bots are not risk-free.

- Decide whether profits reinvest (compounding) or stay in balance. Reinvestment grows profits but increases exposure.

Adding Stop-Loss, Trailing, Safety Orders

Many traders skip this step, but it’s critical.

- Stop-loss: Shuts down the bot if price breaks far below your grid (e.g., 10–15% lower).

- Trailing stop: Lets the grid follow the market if it trends upward, capturing more profit.

- Safety orders: Additional buys placed when the market crashes, lowering your average entry price.

Proper risk management separates sustainable bot users from blown-up accounts.

Final Setup

After defining all parameters, you simply hit “Start.” The bot immediately places all buy and sell orders in the exchange’s order book. From that moment, it quietly works in the background—buying dips, selling rallies, and repeating the cycle endlessly.

Optimal Settings for Different Market Conditions

Sideways / Range-Bound Markets

This is the sweet spot for any grid trading bot. When an asset bounces back and forth without a clear trend, grids quietly scoop up profits.

- Tight grid spacing works well here—20 to 50 grids within a narrow band. This maximizes the number of executed trades.

- Moderate range width is ideal. If Bitcoin sits around $30,000, a grid between $28,000–$32,000 could deliver dozens of micro-profits per week.

- Use smaller trade sizes to spread risk across all grids.

In sideways markets, traders often compound their gains by reinvesting profits. However, watch fees—if trades are too small, fee drag may eat into results.

Trending / Uptrend Adjustments

Grid bots can struggle in strong uptrends if they run out of sell orders. To adapt:

- Set a wider upper boundary so the bot doesn’t stop trading too early.

- Enable trailing grid features (if available) so the range shifts upward with the trend.

- Consider combining with Dollar-Cost Averaging (DCA) bots to balance long-term accumulation with short-term grid profits.

Example: Ethereum in a slow uptrend from $1,500 to $2,000 might still allow profitable grid trading if the bot dynamically expands its range.

Downtrend / Bear Market Adjustments

This is where beginners often get burned. A bot will happily keep buying dips—but in a relentless downtrend, those buys may just trap capital. To manage risk:

- Use a narrower range closer to current price, rather than a wide band below.

- Add a stop-loss 10–20% below your grid’s lower bound to prevent catastrophic losses.

- Consider the reverse grid strategy (short-biased), if your platform supports it.

Some traders pause grid bots during steep declines and switch to accumulation strategies instead.

Common Mistakes and How to Avoid Them

- Grids too tight: Generates many trades but profits are swallowed by fees.

- Grids too wide: Hardly trades, defeating the purpose of automation.

- Ignoring market regime: Running a grid bot in a trending market without adjustment leads to poor performance.

- Set-and-forget mindset: Even though bots automate trades, they still need human oversight for range resets and market shifts.

The golden rule: match your grid’s personality to the market’s behavior. Think of it as tailoring a suit—off-the-rack works sometimes, but custom fitting always looks sharper.

Popular Platforms and Tools for Grid Bots

Binance Spot Grid & Copy-Trading Marketplace

Binance, the world’s largest exchange, has a built-in Spot Grid Trading Bot that millions of users rely on. What makes it stand out:

- Ease of use: You can launch a bot directly from the trading interface in just a few clicks.

- Custom or AI-assisted settings: Binance suggests ranges and grid counts based on historical data, but you can also configure everything manually.

- Copy-trading marketplace: You can mirror strategies from experienced traders. This is especially helpful for beginners who want to learn by example.

Since Binance offers deep liquidity, orders are filled quickly, making the grid more efficient. However, fees (0.1% per trade, unless reduced with BNB) must be considered when setting profit per grid.

Pionex: AI and Built-In Bots

Pionex is often called the “bot-first exchange.” Its edge lies in the fact that bots aren’t an add-on—they’re the core product.

- 16+ free bots built into the platform, including Spot Grid, Infinity Grid, and Leveraged Grid.

- AI grid advisor: Suggests parameters based on backtesting results.

- Low fees (0.05%) make it attractive for high-frequency grids.

Beginners can start with the AI mode, while intermediate traders often tweak ranges and grid counts to improve performance.

Bitsgap, 3Commas, KuCoin, Quadency, BitUniverse

If you want to manage bots across multiple exchanges, Bitsgap and 3Commas are popular third-party platforms.

- Bitsgap: Clean interface, backtesting tools, demo trading, and advanced features like futures grid.

- 3Commas: Known for copy-trading and smart trading terminals, offering extensive customization.

- KuCoin: Offers a free built-in grid bot, widely used in Asia, with flexible parameters and decent liquidity.

- Quadency and BitUniverse: Niche players that appeal to advanced users looking for multi-exchange coverage.

Each platform balances cost, usability, and customization. Beginners usually stick to Binance or Pionex, while intermediate traders graduate to Bitsgap or 3Commas for greater control.

Platform Comparisons: Fees, Features, Ease-of-Use

- Best for beginners: Pionex (AI guidance, lowest fees).

- Best liquidity: Binance (deep order books, widest asset coverage).

- Best for customization: Bitsgap & 3Commas (multi-exchange, backtesting).

- Best free option: KuCoin (simple, no upfront fees, good starter bot).

The choice comes down to personal style: convenience vs. control. If you want plug-and-play simplicity, Pionex is a natural fit. If you crave analytics and backtests, Bitsgap or 3Commas give you more knobs to turn.

Risks and Challenges

Grid Exit Scenarios & Stuck Orders

A grid trading bot is designed to operate inside a defined range. But what if the market breaks out?

- If price rockets above your upper boundary, all buy orders are filled but no new sell orders exist — your bot sits idle, holding assets.

- If price collapses below your lower boundary, you’re left holding positions that may keep losing value, with no active sells to exit.

This is called a grid exit scenario, and it’s one of the most common pitfalls beginners face. Without manual intervention, the bot just stops being effective.

Fee Drag, Poor Range Choice, Strong Trends

Trading fees are the silent killers of grid strategies. If your grid spacing is too tight, the bot may execute dozens of trades with little profit per trade — and fees eat up gains.

Similarly, choosing the wrong range is dangerous:

- Too narrow: The bot burns capital on excessive micro-trades.

- Too wide: Hardly any trades trigger, defeating the purpose.

Finally, in strongly trending markets, grid bots underperform. For instance, if Bitcoin free-falls 30% in a week, the bot keeps buying dips but may never sell them profitably. In strong uptrends, it may sell too early and miss large moves.

“Set and Forget” Pitfalls – Need for Monitoring

A big myth is that bots are truly hands-off. While they reduce screen time, they still require monitoring and adjustments:

- Resetting the grid if the market shifts ranges.

- Stopping the bot during extreme volatility (e.g., news events, flash crashes).

- Adjusting position sizes when liquidity changes.

Ignoring your bot for weeks can turn steady profits into large, unrealized losses.

Security & Trust Issues with Third-Party Bots

If you use bots outside exchange-built platforms, you often need to connect via API keys. While most platforms enforce strict “no withdrawal” settings, there is always risk. Hacks, bugs, or poor platform security can compromise your funds.

Even exchange-native bots carry operational risk — outages, liquidity mismatches, or sudden rule changes may impact performance. Trusting automation doesn’t mean abandoning diligence.

The Reality Check

Grid bots are excellent at harvesting volatility in the right conditions, but they are not profit machines. Their success depends on:

- Careful setup (range, grids, allocation).

- Ongoing monitoring.

- A clear understanding of market conditions.

Approach them as disciplined assistants, not miracle workers.

Advanced Concepts and Unique Insights

Dynamic Grid Trading (DGT) Overview

Traditional bots operate within fixed upper and lower boundaries. But markets don’t sit still. Enter Dynamic Grid Trading (DGT) — a next-generation strategy where the grid shifts along with price action.

For example, if Bitcoin drifts steadily from $30,000 to $35,000, a static grid set at $28,000–$32,000 stops functioning once price leaves the band. A dynamic grid, however, adjusts boundaries upward, maintaining active buy and sell orders.

Academic backtests suggest that DGT strategies can outperform static grids by both improving return and reducing risk. They capture the same micro-profits but avoid being stranded when trends emerge. Platforms like WunderTrading and Pionex have started experimenting with adaptive features that mimic this approach.

When Grid Bots Underperform – and Why

Grid trading isn’t a universal solution. Advanced users recognize situations where bots should be paused:

- News-driven volatility: Big events (like SEC approvals or exchange hacks) can push prices sharply out of grid ranges.

- Strong directional trends: In trending markets, holding a grid may trap capital in losing positions or cause early selling.

- Illiquid assets: Thinly traded coins widen spreads and create slippage, reducing bot efficiency.

Seasoned traders sometimes switch bots off in these scenarios, opting for manual trades or trend-following strategies until conditions normalize.

Hybrid Strategies: Combining Grid with DCA or Indicators

Some traders experiment by blending strategies:

- Grid + Dollar-Cost Averaging (DCA): While the grid captures short-term volatility, a DCA layer accumulates long-term holdings regardless of trend. This creates both micro and macro profit streams.

- Grid + Technical Indicators: Advanced bots can integrate signals (like RSI or moving averages) to trigger grid resets, adjust spacing, or pause trading during extreme conditions.

- Reverse + Neutral Mix: Running two bots on the same asset (one neutral, one reverse) can hedge positions while maintaining volatility capture.

These hybrid setups require experimentation but can dramatically improve resilience across market regimes.

Unique Insight: Think Like a Liquidity Provider

In many ways, running a grid trading bot is like becoming a miniature market maker. You’re constantly providing liquidity — buying when others sell and selling when others buy. Instead of predicting, you profit from other traders’ impatience.

Seen this way, grid trading is less about gambling and more about acting like an exchange: steady, systematic, and indifferent to hype. This mindset helps beginners avoid unrealistic expectations and view their bot as a long-term tool rather than a quick win machine.

Tracking Performance and Iterating

Metrics to Watch: PnL, ROI, Win Rate

Running a grid trading bot isn’t just about starting it and hoping for the best. To know whether your bot is performing well, you’ll need to monitor a few key metrics:

- PnL (Profit and Loss): Shows your realized gains from completed trades.

- ROI (Return on Investment): Expresses profitability as a percentage of capital deployed. Useful for comparing bots.

- Win rate: The percentage of trades closed in profit. A low win rate may indicate poor grid spacing or bad market conditions.

While many platforms display these by default, it’s worth exporting results into a spreadsheet for deeper review over weeks or months.

Platform Tools & Backtesting Features

Some exchanges (like Pionex and Binance) provide basic reporting dashboards, while advanced platforms (Bitsgap, 3Commas) go further:

- Backtesting: Lets you simulate how your chosen grid would have performed in past markets. While not predictive, it reveals whether your parameters were realistic.

- Analytics dashboards: Show trade frequency, average profit per trade, fee impact, and unrealized PnL.

- Performance alerts: Some bots can ping you when performance dips below a certain ROI threshold.

These tools help traders refine setups before committing large amounts of capital.

When to Pause or Adjust Your Grid

Even the best bot setups eventually need recalibration. Common adjustment triggers include:

- Price breaks range: If BTC breaks above your grid’s top, expand or reset the grid to capture the new zone.

- Low trade activity: If trades aren’t triggering, spacing is likely too wide.

- Fee drag detected: If small profits are consistently erased by fees, reduce grid count or widen spacing.

- Market regime change: A previously sideways market starts trending — time to pause or switch strategies.

Experienced traders don’t fear pausing bots. They see it as part of active risk management, not failure.

Iterative Learning

Think of grid bot trading as a cycle: Set → Test → Measure → Adjust. Beginners might start with exchange defaults, then refine based on actual performance. Intermediate traders experiment with different pairs, ranges, and hybrid strategies.

Over time, this iterative process builds intuition. Instead of asking, “What’s the best grid setting?”, you’ll think, “What settings match today’s market mood?” That’s when grid trading transforms from automation gimmick to disciplined trading system.

Quick Takeaways

- A grid trading bot places layered buy and sell orders to profit from volatility — it thrives in sideways or range-bound crypto markets.

- The magic is in automation: bots execute consistently and emotion-free, even while you sleep.

- Choosing the right grid range, spacing, and platform (e.g., Binance, Pionex, Bitsgap) directly impacts profitability.

- Fees, poor range choices, and ignoring market shifts are the most common mistakes beginners make.

- Advanced strategies like dynamic grids (DGT) and hybrid setups (grid + DCA or indicators) offer adaptability beyond static models.

- Monitoring metrics like PnL, ROI, and trade frequency is crucial — “set and forget” doesn’t work.

- Think of a grid bot as a mini market maker: it profits not by predicting the future, but by patiently buying low and selling high over and over again.

Frequently Asked Questions (FAQs)

What is a crypto grid trading bot?

When should I use a grid trading strategy?

How do I pick the right grid spacing?

Wider spacing: Fewer trades, bigger profit per trade, less fee drag.

The sweet spot depends on the asset’s volatility and your fee structure.

What happens if price breaks out of my grid range?

Which platforms offer the best grid trading bots?

Pionex: AI-assisted bot settings, low fees, beginner-friendly.

Bitsgap & 3Commas: Advanced customization, backtesting, multi-exchange control.

KuCoin: Free built-in bot, good for practice

Can grid bots perform badly in strong trends?

Is dynamic grid trading better than static?

Conclusion

A grid trading bot isn’t a crystal ball for the crypto markets — it’s a disciplined assistant. By layering buy and sell orders across a defined range, the bot transforms volatility into steady opportunity, one micro-trade at a time.

We’ve walked through the essentials: how bots work, why they shine in sideways markets, and the critical choices around range, spacing, and allocation. We explored leading platforms like Binance, Pionex, Bitsgap, and 3Commas, each balancing ease of use with customization. We also examined the risks — from fee drag and poor range selection to the dangers of “set and forget.”

For traders ready to take it further, advanced options like dynamic grids (DGT) and hybrid strategies (grid + DCA or indicators) expand the toolkit. The real edge comes not from automation alone but from combining automation with thoughtful oversight: tracking performance, resetting ranges, and pausing bots when market regimes change.

Treat your grid bot as a mini market maker: calm, methodical, and profit-focused. With patience and practice, you can let the bot handle the grind while you focus on strategy, risk control, and long-term growth.

Ready to turn crypto’s noise into rhythm? The grid awaits.

Join the Conversation

Tried a grid trading bot before, or still deciding if it fits your strategy? I’d love to hear your take. Which platform or setup worked best for you — and did your bot behave as expected when the market went wild?

Drop your thoughts in the comments below, and let’s compare notes. Your story might help another beginner avoid common mistakes or inspire someone to try a new approach.

If this guide helped you, please share it with your trading circle — whether it’s your Telegram group, Discord server, or that one friend who can’t stop staring at crypto charts. The more we trade smarter, the stronger the community becomes.

Question for you: What’s the most surprising win (or loss) you’ve seen from a grid bot?

Popular Posts:

Best Crypto Trading Apps 2025: Secure, Low-Fee Platforms for Smarter Trading

AI Crypto Trading Apps & Bots (2025 Guide for U.S. Traders)

References

- Coinbase Learn – What is a Grid Trading Bot and How Does It Work?

coinbase.com - BitDegree – Grid Trading Bot: Strategy, Pros & Cons

bitdegree.org - The Money Mongers – Best Crypto Grid Trading Bots (Binance, Pionex, Bitsgap…)

themoneymongers.com