Ever feel like crypto markets never sleep—and you’re always a step behind?

That’s because they don’t. But what if you could trade 24/7 without staring at charts all day? That’s where free crypto trading bots come in.

These bots automate your trades based on pre-set rules, saving you time and emotion. And the best part? Some of them are completely free.

Whether you’re new to crypto or just tired of FOMO-driven mistakes, this guide will help you discover the smartest way to automate your trades—without paying a dime.

- Free Crypto Trading Bots

- How Free Bots Differ From Paid Versions

- Benefits of Using Free Crypto Trading Bots

- Key Features to Look For

- Potential Downsides and Risks

- Popular Free Crypto Trading Bots

- Open-Source Bots

- Freemium Bots (Free Tier Available)

- Setting Up a Free Crypto Trading Bot

- Backtesting Strategies Safely

- Why Backtesting Is Crucial

- Key Metrics to Monitor

- Steps to Backtest Safely

- Backtesting Tools (Free Options)

- Common Strategy Types Used

- 1. Momentum Trading

- 2. Mean Reversion

- 3. Arbitrage Trading

- 4. Grid Trading

- 5. Dollar-Cost Averaging (DCA)

- 6. Breakout Strategies

- Risk Management Features to Implement

- 1. Stop-Loss Orders

- 2. Take-Profit Orders

- 3. Position Sizing

- 4. Daily or Weekly Loss Limits

- 5. Diversification Controls

- 6. Trailing Stop-Loss

- 7. Paper Trading Mode

- Bot Tip: Never give full API withdrawal permissions. Keep the bot’s control limited to trading only. That way, even if compromised, your funds can’t be stolen—just moved within the exchange.

- Security Best Practices

- 1. Use API Keys with Limited Permissions

- 2. Store API Keys Securely

- 3. Avoid Unverified Bots

- 4. Keep Your Software Updated

- 5. Use Two-Factor Authentication (2FA)

- 6. Run Bots on Secure Machines

- 7. Monitor Activity Logs

- 8. Backup Your Configurations

- Case Studies or User Experiences

- Case Study 1: The Curious Coder Using Freqtrade

- Case Study 2: The Busy Investor with Pionex

- Case Study 3: The Cautionary Tale of an Overconfident Trader

- Lessons Across the Board

- Improving Performance with Add-Ons

- 1. Community Plugins and Scripts

- 2. Custom Indicators

- 3. Telegram or Discord Notifications

- 4. Integration with Google Sheets

- 5. VPS Hosting for Stability

- 6. Strategy Optimizers

- 7. Third-Party Visual Interfaces

- Important Reminder: Don’t get caught up in endless tweaking.

- When to Consider Paid Solutions

- 1. When You Need Better Strategy Tools

- 2. When You Want Cross-Exchange Trading

- 3. When You Need 24/7 Customer Support

- 4. When You Want Built-In Risk Management

- 5. When You’re Trading Larger Capital

- 6. When You Want Simplicity

- Popular Paid Bots Worth Exploring

- Final Tip: Many platforms offer free tiers or trial periods. You don’t have to jump in with a paid plan right away. Test it, compare features, and decide if the upgrade really aligns with your trading goals.

- Regulatory and Tax Considerations

- 1. Crypto Trading = Taxable Events

- 2. Record-Keeping Is Essential

- 3. Know Your Local Laws

- 4. Regulatory Restrictions on Bots

- 5. Anti-Money Laundering (AML) and KYC

- 6. Reporting Crypto Income

- FAQs

- Conclusion

- Here’s a quick recap of what you’ve learned:

Free Crypto Trading Bots

A free crypto trading bot is a software tool that uses algorithms to place buy and sell orders for cryptocurrencies on your behalf. Once connected to your exchange account via an API key, it can react to price movements, market conditions, or indicators—faster and more accurately than a human ever could.

These bots follow rules. You define a strategy—like buying Bitcoin when RSI hits 30 or selling ETH when it hits a 5% gain—and they execute trades based on that logic.

Why are they free? Many are open-source projects created by developers who believe in decentralization and democratizing access to finance. Others are commercial platforms offering limited free tiers to attract users.

So, unlike costly subscription bots, these free tools let you explore algorithmic trading without financial risk—except, of course, the usual crypto market volatility.

How Free Bots Differ From Paid Versions

The key difference? Features and support.

Paid bots usually offer:

- Advanced strategy builders

- Integrated technical indicators

- 24/7 customer support

- Priority updates and bug fixes

- Access to multiple exchanges or high-volume trading

Free crypto trading bots, especially open-source ones, offer:

- Basic strategy automation

- Access to source code for customization

- Zero cost (but more DIY setup)

- Limited or community-driven support

So, if you’re tech-savvy, a free bot may be all you need. But if you want plug-and-play ease, a paid bot might save you time and frustration.

Benefits of Using Free Crypto Trading Bots

So why go free when crypto is already risky? Because free bots offer real advantages:

- Cost-effective experimentation – Test without burning money on subscriptions.

- Skill development – You’ll learn coding, strategy development, and risk management.

- Customizability – Many free bots let you tweak the source code for your own needs.

- Backtesting features – Run strategies on historical data to see how they’d perform.

- Access to a global community – Forums and GitHub repos provide updates, support, and strategy ideas.

And let’s be honest: when markets are choppy and emotions run high, a bot sticks to the plan. No fear. No greed.

Key Features to Look For

Not all free bots are created equal. Here’s what to look for before committing your funds:

| Feature | Why It Matters |

|---|---|

| Backtesting | Lets you test strategies without risking real funds |

| Strategy customization | Helps tailor trading behavior to your risk profile |

| API integration | Essential to connect to exchanges like Binance, Coinbase |

| Paper trading | Simulated trading helps practice without losses |

| Community support | Active devs and users keep the project alive and secure |

| Security options | Protect your funds through safe API handling |

A great bot doesn’t just automate trades—it gives you peace of mind.

Potential Downsides and Risks

While free crypto trading bots sound amazing—and they often are—they’re not without their downsides. Let’s break down the most common risks you need to watch for before hitting “Run” on your bot.

1. Security Vulnerabilities

Free bots, especially open-source ones, require access to your exchange via API keys. If not set up correctly, someone could gain unauthorized access to your funds. And if you’re downloading from sketchy sources, you could even install malware.

2. No Professional Support

With free bots, you usually rely on community forums or GitHub issues. There’s no dedicated customer service. If something breaks—or your funds are at risk—you’re often on your own.

3. Steeper Learning Curve

Most free bots don’t come with friendly interfaces. You’ll often need to know basic coding, terminal commands, and how to edit configuration files. If you’re not tech-savvy, this could be overwhelming.

4. Limited Features

While paid bots offer rich features like AI-based optimization or real-time analytics, free bots are more bare-bones. You may have to install third-party add-ons or build features yourself.

5. Strategy Risk

No bot guarantees profits. A bad strategy will lose money whether it’s running on a free or premium tool. And if you don’t properly test it first, the bot could trade you into serious losses.

In short: Free bots are powerful but require responsibility. Do your homework, use test environments, and always apply strict security practices.

Popular Free Crypto Trading Bots

Now for the fun part—tools that can trade for you while you sleep (or sip coffee). Below are some battle-tested free crypto trading bots used by thousands worldwide:

Open-Source Bots

1. Freqtrade

- Python-based and actively maintained on GitHub

- Supports backtesting, paper trading, and custom strategies

- Requires moderate coding knowledge

- Large and helpful community

2. Gekko

- One of the oldest crypto trading bots

- Lightweight and ideal for beginners

- Good for backtesting and paper trading

- Not actively developed anymore but still functional

3. Zenbot

- Fully command-line driven

- Capable of high-frequency trading

- Supports multiple cryptocurrencies

- Requires deep customization for best results

Freemium Bots (Free Tier Available)

4. Pionex

- Comes with free built-in bots like Grid, DCA, and Infinity bots

- No coding required

- Runs directly on exchange (no API setup)

- Limited advanced custom strategies unless you pay

5. 3Commas (Free Plan)

- Offers a basic free tier for portfolio tracking and limited bot usage

- Clean, beginner-friendly interface

- Paid plans unlock more features like SmartTrade, trailing bots

6. Kryll.io (Trial Mode)

- Drag-and-drop strategy editor

- Ideal for visual thinkers

- Free credits let you try before you buy

- Cloud-based and mobile friendly

These bots are popular for a reason—they balance power, simplicity, and freedom.

Setting Up a Free Crypto Trading Bot

Feeling brave enough to launch your first bot? Here’s a basic overview of the setup process using a tool like Freqtrade or Gekko:

- Install Software

- Download the bot from GitHub

- Install Python and dependencies

- Use terminal commands to run it

- Connect Exchange

- Generate API keys from your exchange (like Binance or KuCoin)

- Plug those into your bot’s config file

- Use read-only access for testing or trade-only access for live runs

- Choose or Write a Strategy

- Start with pre-built strategies

- Or, tweak parameters like RSI, MACD, Bollinger Bands

- Save and backtest

- Backtest with Historical Data

- Run simulations on past market data

- Check profit/loss, drawdowns, and performance

- Run Paper Trading (Optional but Recommended)

- Test your setup without real funds

- Tweak until you’re confident

- Go Live (With Caution)

- Set small limits

- Monitor logs and trades

- Scale up slowly

Remember: one typo or bad config line can cost you. Double-check everything.

Backtesting Strategies Safely

Before you let your bot run wild on real funds, you need to know one thing: how well will your strategy work in real-world conditions? That’s where backtesting comes in.

Backtesting allows you to simulate how your trading strategy would’ve performed in the past using historical price data. Done right, it helps you understand risk, refine parameters, and avoid costly surprises.

Why Backtesting Is Crucial

Imagine building a bot that buys Bitcoin every time it dips 5%—sounds solid, right? But what if the bot keeps buying during a crash, compounding losses?

With backtesting, you’d see that coming.

Backtesting gives you:

- A performance snapshot – Win/loss ratios, drawdowns, profits

- Behavioral insight – When your bot enters/exits and why

- Risk assessment – Volatility, max losses, number of trades

Key Metrics to Monitor

Here’s what you should look for when evaluating your backtest:

| Metric | What It Tells You |

|---|---|

| Win Rate (%) | How often your trades are profitable |

| Profit Factor | Total gross profit ÷ total gross loss |

| Max Drawdown (%) | The biggest loss from a peak before recovery |

| Sharpe Ratio | Risk-adjusted return of the strategy |

| Number of Trades | Indicates activity level and market suitability |

Steps to Backtest Safely

- Use Quality Data

Poor data = poor results. Use accurate, time-synced, historical data for the specific exchange and trading pair. - Avoid Overfitting

Don’t tweak your strategy until it performs too well in the past. That usually means it won’t do well in the future. - Forward Test on Paper

Before live trading, let your bot run in simulation with real-time prices to validate its behavior in the current market. - Test in Different Market Conditions

Make sure your strategy works in bull, bear, and sideways markets. Don’t test only in one scenario. - Keep It Realistic

Include trading fees, slippage, and execution delays to mimic real-world conditions.

Backtesting Tools (Free Options)

- Freqtrade’s built-in backtester – CLI-based but powerful

- Backtrader – Python framework for strategy simulation

- Gekko UI – Visual backtesting for easier analysis

- TradingView (with Pine Script) – Ideal for strategy logic testing before bot coding

Backtesting won’t make your bot perfect—but it will help you avoid the biggest disasters.

Common Strategy Types Used

Free crypto trading bots are only as smart as the strategies they follow. You don’t need to reinvent the wheel—many traders start with proven methods that work well in different market conditions. Here are the most popular types of strategies you can automate with a bot.

1. Momentum Trading

This strategy chases strength. The idea? Buy when the asset shows strong upward momentum and sell when it weakens.

Bots often use indicators like RSI, MACD, or Moving Averages to detect these shifts.

Example: Buy Bitcoin when RSI crosses above 30 (signaling recovery), and sell when it crosses below 70.

Pros:

- Works well in trending markets

- Easy to automate

- Commonly backtested and documented

Cons:

- Can suffer in sideways or choppy markets

- May generate false signals during high volatility

2. Mean Reversion

Here, the bot assumes that prices eventually revert to their average. When a coin’s price moves far from its average, the bot either buys or sells expecting a bounce back.

Example: Buy ETH when it dips 10% below its 20-day moving average, and sell when it returns to the mean.

Pros:

- Good for range-bound markets

- Simple rules make it beginner-friendly

Cons:

- Breakouts can result in large losses

- Works poorly in strong trends

3. Arbitrage Trading

This strategy exploits price differences between exchanges. Your bot buys from the cheaper exchange and sells on the more expensive one—locking in profits from price gaps.

Example: Buy USDT on KuCoin at $0.997 and sell on Binance at $1.001.

Pros:

- Potential for low-risk, fast profits

- Ideal for high-volume traders

Cons:

- Needs fast execution

- Exchange fees and network delays can kill profit

- Not supported on all free bots

4. Grid Trading

Grid bots place buy and sell orders at set intervals—capitalizing on small price movements. This is ideal in sideways markets with frequent ups and downs.

Example: Buy BTC every $100 drop from $25,000 to $24,000; sell every $100 gain from $24,000 to $25,000.

Pros:

- Hands-off automation

- Profits from volatility

- Works great with stable ranges

Cons:

- Doesn’t handle sharp breakouts well

- Needs proper spacing and funding to be effective

5. Dollar-Cost Averaging (DCA)

Bots using DCA invest fixed amounts at regular intervals, regardless of price. It’s a long-term approach to reduce the impact of volatility.

Example: Buy $50 worth of BTC every Monday.

Pros:

- Ideal for passive investors

- Reduces emotional trading

- Easy to automate

Cons:

- Not a short-term profit strategy

- Market may stay down for long periods

6. Breakout Strategies

These bots look for price levels where coins are expected to “break out” either up or down. It’s like catching a rocket just before takeoff—or avoiding a crash.

Example: Buy when price breaks above a 30-day high with high volume.

Pros:

- Can lead to big gains

- Works well with proper risk management

Cons:

- High false breakout rate

- Needs confirmation indicators

Each of these strategies can be tailored, combined, and optimized using your free crypto trading bot. The real magic lies in backtesting and customizing them to fit your risk profile and goals.

Risk Management Features to Implement

Even the smartest crypto bot is only as safe as the risk controls you program into it. Without solid risk management, your bot could drain your funds faster than you can say “market crash.”

Below are key features and practices that can help protect your capital—whether you’re trading $100 or $10,000.

1. Stop-Loss Orders

A stop-loss automatically sells your asset if it drops below a specific price. It’s your emergency exit.

Example: If you’re holding BTC at $30,000, you could set a stop-loss at $28,000.

Why It Matters:

- Prevents emotional holding

- Limits losses on bad trades

- Critical in volatile markets

2. Take-Profit Orders

The flip side of stop-loss, take-profit triggers a sell when your trade reaches a set profit level.

Example: Sell ETH once it gains 10% from your entry price.

Why It Matters:

- Locks in profits before trend reversals

- Helps enforce trading discipline

- Avoids greed-based decisions

3. Position Sizing

This is about how much capital you allocate per trade. Good bots allow you to set max investment per position—like 2% of your portfolio.

Why It Matters:

- Limits exposure per trade

- Preserves capital in losing streaks

- Smooths portfolio performance

4. Daily or Weekly Loss Limits

Bots should pause automatically after losing a certain amount in a day or week.

Example: Stop all trading if you lose 5% in a single day.

Why It Matters:

- Prevents spirals during market crashes

- Enforces cool-off periods

- Encourages reevaluation of strategy

5. Diversification Controls

Don’t let your bot put all your capital into one coin. Good bots let you define how much to invest across multiple assets.

Why It Matters:

- Reduces risk from one coin collapsing

- Helps balance your exposure

- Encourages long-term portfolio health

6. Trailing Stop-Loss

A dynamic stop-loss that moves up with price gains and locks in profits as the asset rises.

Example: If BTC goes from $30,000 to $35,000, your stop-loss automatically adjusts from $28,000 to $33,000.

Why It Matters:

- Allows gains to run

- Secures profits without exiting too early

- Protects from sudden reversals

7. Paper Trading Mode

Always test your risk settings in a simulated environment before going live. Even if your strategy seems bulletproof, market behavior can surprise you.

Bot Tip: Never give full API withdrawal permissions. Keep the bot’s control limited to trading only. That way, even if compromised, your funds can’t be stolen—just moved within the exchange.

Using a free crypto trading bot without risk management is like driving a race car without brakes. These features are your safety net—use them wisely.

Security Best Practices

When you’re using a free crypto trading bot, security becomes your personal responsibility. There’s no official customer support or insurance. So, if something goes wrong—whether due to a hack, a misconfiguration, or a rogue bot—you could lose your funds.

Below are essential security best practices you should follow religiously.

1. Use API Keys with Limited Permissions

Never give your bot full control of your exchange account.

Best Practice:

- Enable only trading permissions

- Disable withdrawals on the API key

- Use IP whitelisting if your exchange supports it

This protects you even if your bot or local system is compromised.

2. Store API Keys Securely

Treat your API keys like your crypto wallet private keys.

Avoid:

- Storing them in plain text

- Committing them to GitHub

- Sharing bot files online

Use:

- Environment variables

- .env files with

.gitignore - Encrypted password managers

3. Avoid Unverified Bots

There are many bots floating around forums and Telegram groups that promise huge profits—but come packed with malware or backdoors.

Use only:

- Bots from reputable GitHub repositories

- Well-reviewed community projects

- Tools recommended by seasoned traders

Always audit the code if you can—or have someone you trust review it.

4. Keep Your Software Updated

Outdated bots can contain vulnerabilities or bugs that expose your funds.

Update regularly:

- Trading bot software

- Dependencies (Python packages, Node modules)

- System packages on your machine

Set calendar reminders if you’re not actively following the dev channels.

5. Use Two-Factor Authentication (2FA)

Enable 2FA on your exchange accounts and cloud platforms (like GitHub or cloud VPS providers).

Why?

If someone steals your password, 2FA adds a second wall of defense.

6. Run Bots on Secure Machines

Don’t run bots on random laptops or public computers.

Options:

- Use a secure VPS (like DigitalOcean, Vultr, AWS)

- Run from a dedicated Raspberry Pi or clean Linux install

- Avoid running bots on machines with pirated software or unknown apps

7. Monitor Activity Logs

Keep an eye on:

- Trade logs from your bot

- Exchange account activity

- IP login history

The sooner you spot strange activity, the faster you can kill API keys and protect your funds.

8. Backup Your Configurations

If you’ve spent hours tweaking a winning strategy, back it up securely. Keep encrypted copies in a cloud vault or external drive.

Security isn’t a one-time thing—it’s an ongoing habit. The best free crypto trading bots are powerful tools, but without the right protections in place, you’re leaving yourself open to unnecessary risk.

Case Studies or User Experiences

Nothing drives the point home like real-world results. Let’s look at a few real trader stories that highlight both the promise and the pitfalls of using free crypto trading bots.

Case Study 1: The Curious Coder Using Freqtrade

Trader: Alex, a software engineer from Berlin

Bot: Freqtrade

Strategy: RSI-based mean reversion

Capital: $2,500

Duration: 6 months (paper + live trading)

Experience:

Alex started by paper trading on Binance using a custom strategy he wrote in Python. After four weeks of positive simulated results, he deployed $500 live and added more over time. His bot traded only BTC and ETH pairs.

Results:

- 14.2% net profit over 6 months

- 3 drawdowns, but none over 5%

- Tweaked the strategy mid-way based on live logs

Takeaway:

Technical users can get great results using open-source bots with minimal capital—if they’re disciplined.

Case Study 2: The Busy Investor with Pionex

Trader: Naomi, a full-time nurse in the U.S.

Bot: Pionex Grid Bot

Strategy: Grid trading on sideways ETH/USDT pair

Capital: $1,000

Duration: 4 months

Experience:

Naomi didn’t know how to code, but Pionex’s plug-and-play interface made it easy. She activated a bot during a flat market and let it run passively while she focused on her day job.

Results:

- 6.8% return in 4 months

- Minimal management required

- Learned how crypto volatility can work in her favor

Takeaway:

Even non-coders can benefit from automated trading, especially with free built-in bots.

Case Study 3: The Cautionary Tale of an Overconfident Trader

Trader: Raj, student from India

Bot: Gekko

Strategy: Trend-following with no stop-loss

Capital: $800

Duration: 3 weeks

Experience:

Raj was excited about automation but didn’t test his strategy thoroughly. He ran Gekko live without a stop-loss on a volatile altcoin.

Results:

- Lost 47% of his capital in one week

- No safety net or alerts set up

- Admitted to skipping backtesting and running the bot overnight without monitoring

Takeaway:

Bots amplify both your strategy’s strengths and its flaws. Without solid risk controls, automation can magnify losses.

Lessons Across the Board

- Backtesting and paper trading are non-negotiable

- Start small and scale with experience

- Use built-in safety features like stop-loss and DCA

- Monitor your bot regularly (even passive setups)

- Avoid altcoins with low volume—they’re bot killers

Free crypto trading bots can be life-changing tools—but only if you treat them like serious financial instruments, not shortcuts to easy money.

Improving Performance with Add-Ons

Free crypto trading bots offer a solid foundation, but you don’t have to stop there. With a little effort, you can extend their functionality using add-ons, plugins, and integrations to squeeze more performance, safety, and customization out of them.

Here’s how to supercharge your bot—without spending a dime.

1. Community Plugins and Scripts

Open-source bots like Freqtrade and Gekko have large communities that contribute add-ons such as:

- Advanced indicators (e.g., Ichimoku, ADX, custom EMA crossovers)

- Strategy templates (pre-configured bots for specific markets)

- Trade trackers and PnL dashboards

Where to Find Them:

- GitHub repos

- Telegram and Discord communities

- Reddit threads like r/algotrading and r/cryptobots

Tip: Always vet the code before plugging it in!

2. Custom Indicators

If you’re technically inclined, you can add or code your own indicators like:

- Custom RSI bands

- Volume-weighted average price (VWAP)

- Multi-timeframe analysis (e.g., combine 1-hour and daily charts)

Benefit: More tailored strategies often outperform generic ones in specific market conditions.

3. Telegram or Discord Notifications

Want real-time updates from your bot while you’re away from your laptop?

- Set up Telegram bots to send trade alerts, performance summaries, and error messages.

- Or use Discord webhooks to notify you (or your trading group) of every action.

Why This Rocks: You stay informed without constantly checking the exchange or VPS logs.

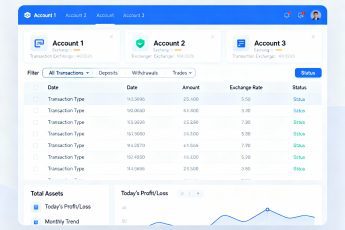

4. Integration with Google Sheets

Log trades and performance directly to Google Sheets using APIs or scripts.

Why?

- Monitor performance in real-time

- Create custom dashboards and graphs

- Set alerts when certain thresholds are met

Example Use Case: Send every completed trade to a shared sheet so you can analyze patterns over time.

5. VPS Hosting for Stability

While not exactly an “add-on,” running your bot 24/7 from a Virtual Private Server (VPS) improves:

- Uptime reliability (no Wi-Fi drops)

- Speed of execution

- Security (compared to local machines)

Free credits from providers like AWS, Azure, or Google Cloud can help you get started without cost.

6. Strategy Optimizers

Some communities have built optimization tools to help you:

- Auto-test hundreds of parameter combinations

- Find the most profitable stop-loss or take-profit settings

- Discover the best indicator values for your chosen asset

While these tools can be CPU-intensive, they help squeeze out extra performance from the same strategy.

7. Third-Party Visual Interfaces

Even if your bot is command-line based, some devs create GUIs for easier control. Examples:

- FreqUI for Freqtrade

- Gekko Plus (discontinued) but clones are still out there

- Custom dashboards on Flask or Node.js

They don’t change bot logic but make management more intuitive.

Important Reminder: Don’t get caught up in endless tweaking.

More add-ons ≠ better results. The real edge comes from understanding your strategy, not from flashy dashboards.

When to Consider Paid Solutions

Free crypto trading bots are an excellent way to get started. But at some point, you may find yourself outgrowing the limitations—especially if you’re scaling up, managing larger capital, or seeking enterprise-level features.

So, when should you consider upgrading to a paid solution?

1. When You Need Better Strategy Tools

Most free bots use basic indicators and simple buy/sell logic. Paid platforms like 3Commas, Quadency, or CryptoHopper offer:

- Advanced strategy builders

- Drag-and-drop visual editors

- Multi-layer conditional logic

- Pre-built templates from professionals

This becomes crucial when you want to manage complex trades or test multiple hypotheses quickly.

2. When You Want Cross-Exchange Trading

Free bots often support only one exchange at a time. Paid bots can:

- Trade across multiple exchanges from one dashboard

- Rebalance portfolios automatically

- Arbitrage between platforms

This is ideal for diversified traders and high-volume accounts.

3. When You Need 24/7 Customer Support

Free bots rely on community forums and GitHub issues. If something breaks on a Friday night, you’re on your own.

Paid services usually provide:

- Email and live chat support

- Dedicated account managers (at higher tiers)

- Real-time troubleshooting

This peace of mind can be priceless—especially during volatile markets.

4. When You Want Built-In Risk Management

While some free bots allow basic stop-loss or take-profit settings, premium tools often offer:

- Advanced trailing stop algorithms

- Multiple risk profiles

- AI-assisted position sizing

- Portfolio-level risk caps

These can drastically reduce downside risk, especially for newer traders.

5. When You’re Trading Larger Capital

Let’s face it—managing $500 with a free bot is one thing. But if you’re trading $10,000 or more, saving a few bucks on bot fees isn’t worth the potential losses due to:

- Lack of execution speed

- Poor uptime

- Limited analytics

Paid bots often offer priority servers or cloud hosting, minimizing delays.

6. When You Want Simplicity

Not everyone wants to code, configure .env files, or debug Python errors at midnight.

Paid bots offer:

- Intuitive user interfaces

- Mobile apps for trading on the go

- Real-time charts and logs

You get automation without the hassle.

Popular Paid Bots Worth Exploring

| Bot Name | Notable Features | Free Trial |

|---|---|---|

| 3Commas | Smart trading terminal, portfolio bots | Yes |

| CryptoHopper | AI strategies, strategy marketplace | Yes |

| Bitsgap | Grid bots, arbitrage tools | Yes |

| TradeSanta | User-friendly, cloud-hosted bots | Yes |

| Shrimpy | Portfolio rebalancing and automation | Limited |

Final Tip: Many platforms offer free tiers or trial periods. You don’t have to jump in with a paid plan right away. Test it, compare features, and decide if the upgrade really aligns with your trading goals.

Regulatory and Tax Considerations

Trading with a free crypto bot might feel like playing in the Wild West—but make no mistake: regulations and taxes still apply. Whether you’re using a paid platform or an open-source script, the laws don’t change based on your software.

Let’s break down what you need to know to stay compliant and avoid legal trouble.

1. Crypto Trading = Taxable Events

In most countries, every time your bot makes a trade (buying, selling, swapping), it could trigger a taxable event.

Examples of taxable events:

- Selling BTC for USDT at a profit

- Swapping ETH for SOL

- Using crypto to buy a service or product

Even if you’re not manually clicking “sell,” the bot’s actions are your responsibility.

2. Record-Keeping Is Essential

Your tax authority (IRS, HMRC, ATO, etc.) won’t care if you used a bot—they’ll want accurate records.

What to track:

- Timestamp of each trade

- Buy and sell prices

- Trading pairs

- Transaction fees

- Total capital gains or losses

Most exchanges let you export trade history. For bots, some offer CSV logs. Still, it’s smart to use crypto tax software like:

- Koinly

- CoinTracker

- ZenLedger

- TokenTax

Many of these tools integrate directly with exchanges and even some bots.

3. Know Your Local Laws

Crypto regulations vary widely:

- USA: IRS treats crypto as property; detailed Form 8949 reporting required

- UK: HMRC taxes crypto as a capital asset; CGT applies

- Australia: The ATO requires declarations of capital gains

- Germany: Crypto held for 1+ year may be tax-free

Always consult a tax professional or accountant familiar with crypto in your jurisdiction.

4. Regulatory Restrictions on Bots

Some countries have restrictions on:

- Automated trading tools

- API access to exchanges

- Specific exchanges themselves (e.g., Binance banned in some regions)

If you’re using a bot that connects to an exchange banned in your country, you’re possibly violating local financial laws.

Stay informed:

- Read your country’s crypto trading regulations

- Check with licensed advisors

- Don’t rely solely on forums for legal advice

5. Anti-Money Laundering (AML) and KYC

Most major exchanges now require KYC (Know Your Customer) verification. That means:

- You must verify your identity to trade

- Your bot operates under your name—not anonymously

- Authorities can request records of your trades

If your bot engages in high-frequency trading across platforms, make sure it doesn’t trigger AML red flags, especially if you’re withdrawing large sums.

6. Reporting Crypto Income

If your bot made you $100 or $10,000—it’s income.

- Declare gains properly

- Separate long-term vs short-term holdings (if applicable)

- Include staking, airdrops, and referral bonuses if used alongside your bot

Penalties for misreporting crypto income can be serious—don’t risk it.

In short, free crypto trading bots don’t give you a pass from taxes or laws. They may help you trade better, but you’re still responsible for playing by the rules.

FAQs

Here are the most frequently asked questions about free crypto trading bots, answered clearly and concisely to help you make informed decisions.

Are free crypto trading bots safe to use?

Yes—if you use well-known bots from reputable sources and apply security best practices like restricting API permissions and not enabling withdrawals. Always review the code and avoid shady downloads.

Can I make money using free crypto trading bots?

Yes, many traders generate consistent returns, especially with solid strategies and risk management. However, profits are not guaranteed. Bots follow your logic—so if your strategy is flawed, the bot will simply execute bad trades faster.

Do I need to know how to code to use these bots?

Not always. Some bots like Pionex and TradeSanta offer user-friendly interfaces. Others like Freqtrade or Gekko require some technical skill for setup and strategy customization.

What exchanges work best with free trading bots?

Most bots support major exchanges like Binance, KuCoin, Coinbase Pro, Kraken, and Bitfinex. Check the bot’s documentation for supported exchanges and specific API configurations.

Is backtesting necessary before going live?

Absolutely. Backtesting shows how your strategy would have performed using historical data. It helps you avoid big losses by identifying weaknesses before risking real money.

Can free bots handle multiple trading pairs?

Yes. Many free bots allow multi-pair setups, letting you diversify across coins. Just ensure your system and bot configuration can handle the added load without lagging.

Conclusion

If you’ve ever felt overwhelmed trying to time the market or exhausted from staring at charts, free crypto trading bots might just be the edge you’ve been looking for. They offer a hands-free way to trade smarter, reduce emotion-driven mistakes, and take advantage of opportunities—even while you sleep.

From open-source powerhouses like Freqtrade and Gekko to user-friendly platforms like Pionex, there’s a bot for every skill level. And while the idea of “free” might sound too good to be true, these bots can be legitimate, effective, and secure—if you take the time to learn how to use them properly.

Here’s a quick recap of what you’ve learned:

- What free crypto bots are, how they work, and why they exist

- How they compare to paid tools

- Strategies you can automate

- Security measures and risk management you must implement

- How to backtest and optimize your strategy

- Real-world case studies and when it’s time to upgrade

Ultimately, free bots are a gateway into the world of algorithmic trading without the upfront investment. They’re not magic money machines—but with the right approach, they can become a key tool in your crypto toolkit.

So, test them, tweak them, and treat them with respect. Because in the fast-paced world of crypto, automation isn’t just a luxury—it’s becoming a necessity.