Securities market participants face a fundamental tax classification decision that can dramatically affect their financial outcomes. The distinction between being classified as a trader versus an investor by the Internal Revenue Service determines not only how you report income and losses, but also which deductions you can claim and what tax rates apply to your gains.

This classification impacts everything from your ability to deduct home office expenses to whether the dreaded wash sale rule limits your loss deductions. Understanding these differences and properly positioning yourself can mean thousands or even tens of thousands of dollars in tax savings annually.

- The Three-Way Tax Classification System

- Investors

- Traders

- Dealers

- Qualifying for Trader Tax Status: The Golden Rules

- The Two-Part Test for Trading Business Status

- Part 1: Substantial, Regular, Frequent, and Continuous Activity

- Part 2: Seeking Short-Term Market Profits

- Critical Operational Requirements

- The Mark-to-Market Election: Powerful but Permanent

- Benefits of Section 475(f) Election

- Election Timing Requirements

- Tax Treatment Differences: Investors vs. Traders

- Understanding the Wash Sale Rule Impact

- Wash Sale Triggers to Avoid

- Automatic Reinvestment

- Option Contracts

- IRA Purchases

- Spouse’s Account

- Business Expenses Available to Qualified Traders

- Entity Structures for Trading Businesses

- LLC with S-Corporation Election

- Common Pitfalls and Audit Triggers

- Red Flags That Attract IRS Attention

- Documentation Requirements for TTS Claims

- Essential Documentation Checklist

- Special Considerations for Different Trading Styles

- Day Trading

- Swing Trading

- Options Trading

- Cryptocurrency Trading

- Year-End Tax Planning Strategies

- For Investors

- For Non-Electing Traders

- For Mark-to-Market Traders

- Practical Examples and Case Studies

- Example 1: The Active Investor Trap

- Example 2: Successful Trader Status

- Working with Tax Professionals

- Questions to Ask Potential Tax Advisors

- Future Considerations and Legislative Changes

- Potential Future Changes

- Making the Right Choice for Your Situation

- TTS Makes Sense If You:

- TTS May Not Benefit You If:

- Conclusion: Strategic Tax Planning for Market Participants

The Three-Way Tax Classification System

The IRS recognizes three distinct categories for individuals who buy and sell securities, each with unique tax implications. These classifications determine everything from which forms you file to what expenses you can deduct.

Investors

Most individuals fall into this category. Investors buy and sell securities seeking dividends, interest, and long-term capital appreciation. They report gains and losses on Schedule D and cannot deduct trading-related business expenses.

Traders

Traders operate a legitimate business of buying and selling securities for short-term profit from market fluctuations. They can deduct business expenses on Schedule C while still reporting trading gains and losses on Schedule D.

Dealers

Dealers maintain inventory and sell securities to customers in the ordinary course of business. They report all activity as ordinary business income on Schedule C, similar to any retail business.

Each classification carries profound tax implications that extend far beyond simple reporting requirements. The category you qualify for determines your access to valuable tax benefits and shapes your overall tax strategy.

Qualifying for Trader Tax Status: The Golden Rules

Achieving Trader Tax Status (TTS) requires meeting stringent criteria that demonstrate you’re genuinely operating a trading business rather than simply investing frequently. The IRS applies both quantitative and qualitative tests to determine your status.

| Qualification Factor | Minimum Threshold | Ideal Target |

|---|---|---|

| Annual Trade Volume | 720+ trades (open/close counted separately) | 1,000+ trades |

| Monthly Trade Frequency | 60+ trades per month | 80+ trades per month |

| Trading Days | 75% of available market days | 85% of available market days |

| Average Holding Period | Less than 31 days | Less than 7 days |

| Daily Time Commitment | 4+ hours | 6+ hours |

| Minimum Account Size | $15,000 | $25,000+ (PDT status) |

Volume, frequency, and holding period constitute the “big three” factors because they’re easily verifiable through brokerage statements. The IRS examines these metrics first when evaluating TTS claims during audits.

The Two-Part Test for Trading Business Status

Beyond meeting quantitative thresholds, traders must satisfy a two-pronged qualitative test that examines the nature and intent of their trading activities. This test, derived from case law rather than statute, focuses on substance over form.

Part 1: Substantial, Regular, Frequent, and Continuous Activity

Your trading pattern must demonstrate consistent market participation without significant lapses. Sporadic trading, even if intense during active periods, typically fails this test. The IRS looks for traders who maintain steady activity throughout the tax year, with minimal interruptions beyond reasonable vacations or brief illness.

The landmark case Poppe vs. Commissioner established important precedents. Poppe executed 720 total trades annually, averaging 60 monthly transactions. This volume became a benchmark for TTS qualification discussions.

Part 2: Seeking Short-Term Market Profits

Traders must demonstrate they seek profits from daily market movements rather than long-term appreciation, dividends, or interest. This intention manifests through short holding periods, minimal dividend income relative to trading gains, and a focus on technical rather than fundamental analysis.

Critical Operational Requirements

Successfully claiming TTS requires more than just frequent trading. The IRS examines whether you operate like a legitimate business, maintaining proper infrastructure and demonstrating professional commitment to trading.

| Operational Element | Requirements | Red Flags to Avoid |

|---|---|---|

| Business Equipment | Dedicated computer, multiple monitors, professional software | Using only a smartphone or tablet for trading |

| Home Office | Exclusive space used regularly for trading | Trading from kitchen table or shared spaces |

| Education & Training | Ongoing education, seminars, subscriptions | No investment in trading education |

| Record Keeping | Detailed trade logs, separate investment accounts | Commingling trading and investment positions |

| Business Services | Data feeds, analysis tools, professional subscriptions | Using only free brokerage tools |

The Mark-to-Market Election: Powerful but Permanent

Traders qualifying for TTS can make a Section 475(f) mark-to-market election, fundamentally changing how their trading income gets taxed. This election offers substantial benefits but comes with important trade-offs.

Benefits of Section 475(f) Election

- Wash Sale Immunity: The wash sale rule no longer applies, allowing unlimited loss harvesting without waiting periods

- Unlimited Loss Deductions: Trading losses become ordinary business losses, bypassing the $3,000 annual capital loss limitation

- Simplified Accounting: No need to track wash sales or adjust cost basis for disallowed losses

- Current Year Recognition: All positions marked to market value on December 31st, recognizing gains and losses immediately

However, this election converts all trading gains to ordinary income, eliminating preferential long-term capital gains rates. Once made, the election requires IRS permission to revoke, making it essentially permanent for most traders.

Election Timing Requirements

The mark-to-market election follows strict deadlines that cannot be extended:

- For Individuals: Must elect by April 15 of the current year for that tax year (attached to prior year return or extension)

- For Entities: Must elect by March 15 for S-Corps and partnerships

- New Traders: Can elect within 2 months and 15 days of starting trading business

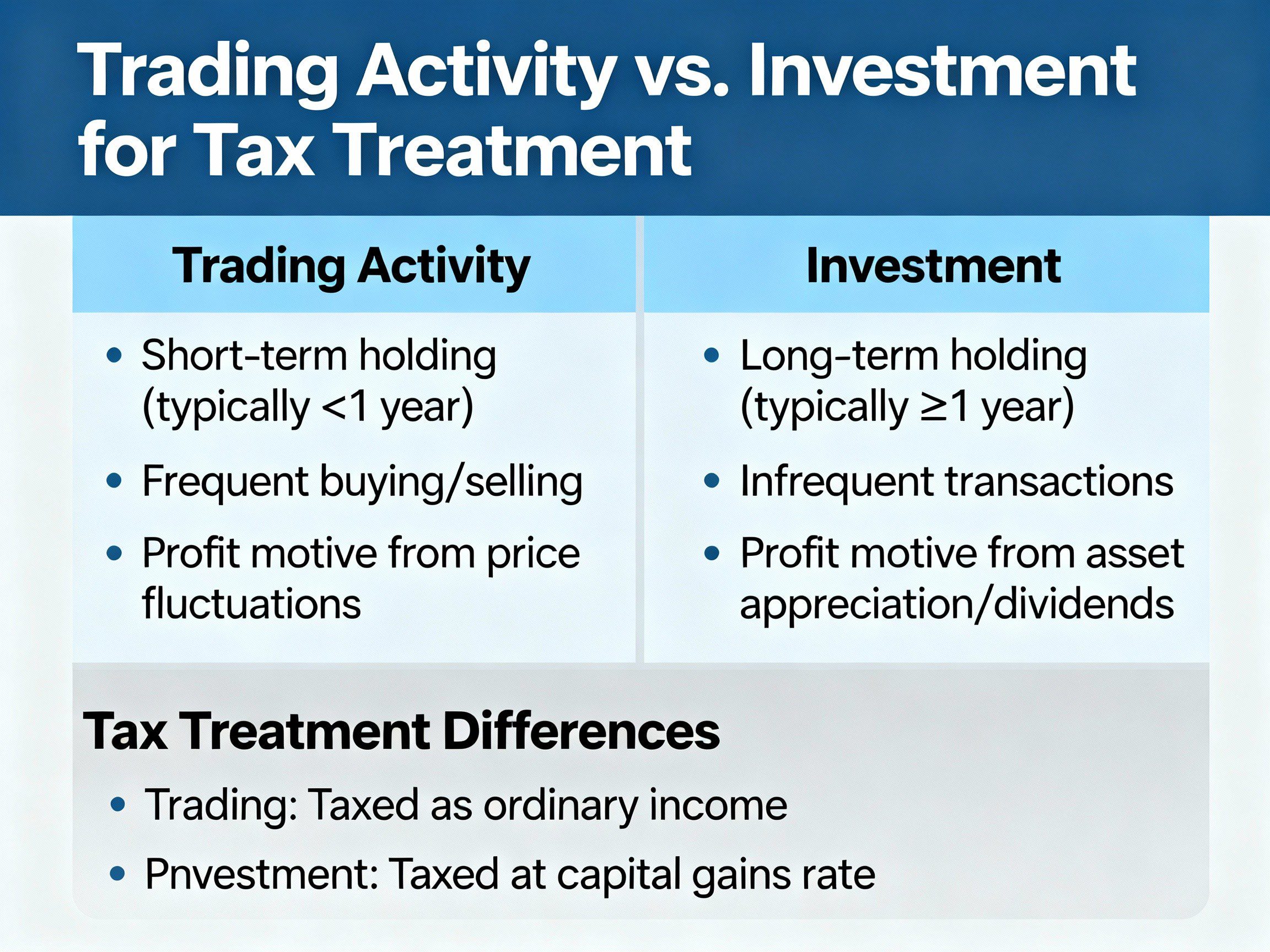

Tax Treatment Differences: Investors vs. Traders

The tax implications between investor and trader status create dramatically different financial outcomes, especially for active market participants. Understanding these differences helps determine whether pursuing TTS makes sense for your situation.

| Tax Aspect | Investor Treatment | Trader Treatment (No 475) | Trader with 475(f) |

|---|---|---|---|

| Business Expense Deductions | None allowed | Full Schedule C deductions | Full Schedule C deductions |

| Wash Sale Rules | Fully applicable | Fully applicable | Not applicable |

| Loss Limitations | $3,000 annual limit | $3,000 annual limit | No limit (ordinary loss) |

| Self-Employment Tax | Not applicable | Not applicable | Not applicable |

| Long-Term Capital Gains | Available (0-20% rates) | Available (0-20% rates) | Not available (ordinary rates) |

| Home Office Deduction | Not allowed | Allowed if qualified | Allowed if qualified |

| Education Expenses | Not deductible | Fully deductible | Fully deductible |

Understanding the Wash Sale Rule Impact

The wash sale rule represents one of the most frustrating aspects of tax law for active investors. This rule prevents claiming losses when you repurchase substantially identical securities within a 61-day window (30 days before and after the sale).

For investors and non-electing traders, wash sales can devastate tax efficiency. Consider this scenario: An active investor makes 1,000 trades annually, frequently re-entering positions. Without careful management, wash sales could disallow 40-60% of realized losses, pushing significant tax deductions into future years or eliminating them entirely.

Wash Sale Triggers to Avoid

Multiple scenarios can unexpectedly trigger wash sales beyond simple repurchases:

Automatic Reinvestment

Dividend reinvestment plans (DRIPs) automatically purchasing shares after you’ve sold at a loss triggers wash sales. Many investors overlook this common trap.

Option Contracts

Buying call options on a stock you’ve sold at a loss creates a wash sale, as options represent the right to acquire substantially identical securities.

IRA Purchases

Buying the same security in your IRA after selling at a loss in a taxable account triggers wash sales, permanently eliminating the loss deduction.

Spouse’s Account

Your spouse purchasing substantially identical securities can trigger wash sales on your losses, requiring coordination between accounts.

Business Expenses Available to Qualified Traders

TTS qualification unlocks substantial deduction opportunities through Schedule C business expense treatment. These deductions can offset not only trading income but also W-2 wages and other ordinary income.

| Expense Category | Examples | Typical Annual Range |

|---|---|---|

| Technology & Equipment | Computers, monitors, smartphones, tablets | $3,000 – $10,000 |

| Data & Subscriptions | Real-time quotes, analysis platforms, news services | $2,000 – $15,000 |

| Education & Training | Courses, seminars, coaching, books | $1,000 – $10,000 |

| Home Office | Percentage of rent/mortgage, utilities, insurance | $3,000 – $12,000 |

| Professional Services | Tax preparation, legal advice, consulting | $1,500 – $5,000 |

| Travel & Meals | Investment conferences, meeting advisors | $500 – $5,000 |

| Office Supplies | Furniture, supplies, software licenses | $500 – $2,000 |

Traders often underestimate these deductions’ cumulative value. A trader with $30,000 in legitimate business expenses saves $6,600 in taxes at the 22% bracket, or $11,100 at the 37% bracket.

Entity Structures for Trading Businesses

While individuals can qualify for TTS, establishing a formal business entity provides additional benefits and stronger audit defense. Entity trading demonstrates business intent and enables advanced tax strategies.

LLC with S-Corporation Election

This structure combines liability protection with tax efficiency. The LLC provides asset protection while the S-Corp election enables additional benefits:

- Health insurance premiums become fully deductible above-the-line

- Retirement plan contributions up to $69,000 annually (2025 limits)

- State and local tax (SALT) cap workarounds in certain states

- Stronger substantiation of business purpose for IRS

Common Pitfalls and Audit Triggers

Understanding what raises IRS scrutiny helps traders avoid costly audits and successfully defend their TTS claims when challenged.

Red Flags That Attract IRS Attention

| Audit Trigger | Why It’s Problematic | How to Avoid |

|---|---|---|

| Part-Year Trading | Starting/stopping trading suggests hobby not business | Maintain consistent year-round activity |

| Large Investment Holdings | Indicates primary focus on investing not trading | Keep investment/trading accounts separate |

| Significant W-2 Income | Questions dedication to trading business | Document time spent on trading despite employment |

| Automated Trading Only | Suggests passive activity not active business | Show active involvement in strategy development |

| Poor Record Keeping | Cannot substantiate business operations | Maintain detailed logs and documentation |

| Losses Every Year | IRS may invoke hobby loss rules | Show profit motive through business planning |

Documentation Requirements for TTS Claims

Proper documentation provides your first line of defense during IRS examinations. Traders should maintain comprehensive records demonstrating business operations and trading activity.

Essential Documentation Checklist

- Daily trading logs showing time spent and activities performed

- Separate brokerage statements for trading vs. investment accounts

- Business plan outlining trading strategy and profit objectives

- Education records proving ongoing skill development

- Receipts for all business expenses claimed

- Home office photos and exclusive use documentation

- Analysis showing trading volume, frequency, and holding periods

- Screenshots of trading workstation setup

Special Considerations for Different Trading Styles

Not all trading approaches qualify equally for TTS. Understanding how the IRS views different strategies helps traders structure their activities appropriately.

Day Trading

Day traders typically have the strongest TTS cases, holding positions for hours or minutes. Their high volume and frequency naturally meet most quantitative tests. However, pattern day trader rules requiring $25,000 minimum equity can create barriers for smaller accounts.

Swing Trading

Swing traders holding positions for days or weeks face greater scrutiny. Success requires higher trade volumes to compensate for longer holding periods. Maintaining an average holding period under 31 days becomes critical.

Options Trading

Options traders can qualify for TTS, but complexity increases. Weekly options strategies often meet frequency requirements, while monthly options may struggle. The IRS examines whether traders seek premium income (investment-like) versus price movement profits (trading).

Cryptocurrency Trading

Crypto traders face unique challenges since cryptocurrency currently isn’t subject to wash sale rules. While this provides advantages, the IRS may view crypto trading differently than securities trading for TTS purposes. Proposed legislation could change crypto’s tax treatment significantly.

Year-End Tax Planning Strategies

Strategic year-end planning maximizes tax benefits while avoiding common pitfalls that trap unwary traders.

For Investors

Harvest losses by November 30 to avoid December wash sales. Consider bunching investment expenses in high-income years. Evaluate whether pursuing TTS next year makes sense.

For Non-Electing Traders

Maximize Schedule C deductions before year-end. Plan Section 475 election for next year if beneficial. Separate investment positions from trading positions.

For Mark-to-Market Traders

All positions automatically marked on December 31. Consider closing losing positions earlier if cash needed. Plan for ordinary income tax on all gains.

Practical Examples and Case Studies

Real-world examples illustrate how trading classification impacts actual tax outcomes.

Example 1: The Active Investor Trap

Sarah executes 500 trades annually, spending 3 hours daily on research. Despite substantial activity, she fails TTS requirements due to 45-day average holding period and missing 40% of trading days. Her $15,000 in trading expenses cannot be deducted, and wash sales disallow $8,000 of her $12,000 in losses.

Tax Impact: Only $3,000 loss deduction allowed, no expense deductions, creating $18,000 difference from trader treatment.

Example 2: Successful Trader Status

Michael trades 1,200 times annually with 7-day average holding period, maintaining detailed records and dedicated home office. He qualifies for TTS and makes Section 475 election.

Tax Benefits: Deducts $25,000 in business expenses, claims $40,000 trading loss without limitation, saves approximately $19,000 in taxes versus investor treatment.

Working with Tax Professionals

Given the complexity and stakes involved, most traders benefit from professional tax guidance. However, many tax preparers lack expertise in trader tax issues.

Questions to Ask Potential Tax Advisors

- How many trader tax returns have you prepared?

- Can you explain the Poppe case significance?

- What documentation do you require for TTS claims?

- How do you handle Section 475 elections?

- Will you represent me in an IRS audit?

Specialized trader tax professionals understand nuances that general practitioners miss. Their expertise often pays for itself through additional deductions and audit avoidance.

Future Considerations and Legislative Changes

Tax law continues evolving, particularly regarding digital assets and automated trading. Staying informed about proposed changes helps traders adapt strategies proactively.

Potential Future Changes

| Proposed Change | Current Status | Potential Impact |

|---|---|---|

| Cryptocurrency wash sale rules | Under congressional consideration | Would eliminate crypto tax-loss harvesting advantage |

| Automated trading restrictions | IRS studying enforcement | Could limit TTS for algorithm-only traders |

| Enhanced reporting requirements | Phased implementation ongoing | Brokers providing more detailed tax reporting |

| Mark-to-market modifications | Periodic proposals | Could change election timing or requirements |

Making the Right Choice for Your Situation

Determining whether to pursue trader tax status requires honest assessment of your trading activity, business commitment, and tax situation. Not everyone benefits from TTS, even if they qualify.

TTS Makes Sense If You:

- Trade substantially full-time or dedicate 30+ hours weekly

- Generate significant short-term gains needing offset

- Incur substantial trading-related expenses

- Maintain disciplined business operations and records

- Can meet IRS requirements consistently

TTS May Not Benefit You If:

- Trading is truly a hobby or side activity

- You prefer long-term investment strategies

- Your trading is sporadic or seasonal

- Business expenses are minimal

- You cannot maintain required documentation

Conclusion: Strategic Tax Planning for Market Participants

The distinction between trading and investing for tax purposes represents more than technical classification—it fundamentally shapes your financial outcomes. Understanding these differences empowers market participants to structure their activities optimally and legitimately minimize tax obligations.

Successful traders recognize that tax planning is integral to overall profitability. Whether you qualify for trader tax status or remain an investor, understanding the rules helps you make informed decisions and avoid costly mistakes.

The key lies in aligning your actual market activity with your tax position. Forcing inappropriate classification invites IRS challenges and penalties. However, traders who genuinely qualify for TTS while maintaining proper documentation can access substantial tax benefits that significantly enhance their bottom line.

Remember that tax law complexity demands professional guidance. The investment in qualified tax advice typically returns multiples through proper planning, legitimate deductions, and audit avoidance. As markets and tax laws evolve, staying informed and adaptable ensures you maintain optimal tax efficiency while pursuing your financial objectives.

Disclaimer: This article provides general information about tax concepts and should not be considered personal tax advice. Tax laws are complex and change frequently. Always consult with a qualified tax professional about your specific situation before making tax-related decisions.