- Feeling lost in crypto’s wild price swings?

- What Is the DCA Crypto Strategy?

- Breaking Down Dollar-Cost Averaging

- Why DCA Is Gaining Popularity in Crypto

- How DCA Works in Crypto Investing

- Regular Intervals vs. Market Timing

- Automating Your DCA Strategy

- Benefits of Using a DCA Strategy for Crypto

- Reducing Emotional Investing

- Minimizing the Impact of Volatility

- Easy for Beginners

- Drawbacks of the DCA Crypto Strategy

- Slower Gains in Bull Markets

- Requires Discipline Over Time

- Real-World Examples of DCA in Crypto

- Case Study: Investing in Bitcoin Over 2 Years

- Comparing Lump Sum vs. DCA Performance

- Best Cryptocurrencies to Use with DCA

- Bitcoin (BTC)

- Ethereum (ETH)

- Stablecoins and Other Assets

- Setting Up Your First DCA Crypto Strategy

- Choosing an Exchange or App

- Deciding the Amount and Frequency

- Tracking Your Results Over Time

- Common Mistakes to Avoid with DCA

- Changing Strategy Midway

- Not Understanding Fees and Taxes

- Tips to Optimize Your DCA Crypto Strategy

- Use Volatility to Your Advantage

- Reevaluate Regularly Based on Goals

- Is the DCA Crypto Strategy Right for You?

- Who Should Consider DCA?

- When to Avoid DCA

- FAQs About the DCA Crypto Strategy

- Is DCA better than lump sum investing in crypto?

- Can I DCA with any cryptocurrency?

- How often should I DCA?

- What happens if the market crashes after I start DCAing?

- Do I need a special app for DCA?

- Is DCA legal and safe?

- Conclusion: Smart Investing with DCA in Crypto

Feeling lost in crypto’s wild price swings?

You’re not alone. One day Bitcoin’s booming, the next it’s crashing. For many beginners (and even seasoned investors), the crypto market can feel like a rollercoaster. But there’s a strategy that calms the chaos—and it’s called DCA, or Dollar-Cost Averaging.

If you’ve ever felt like you’re buying at the wrong time, panicking during dips, or just want a smarter way to grow your crypto without the drama—this is for you.

What Is the DCA Crypto Strategy?

Breaking Down Dollar-Cost Averaging

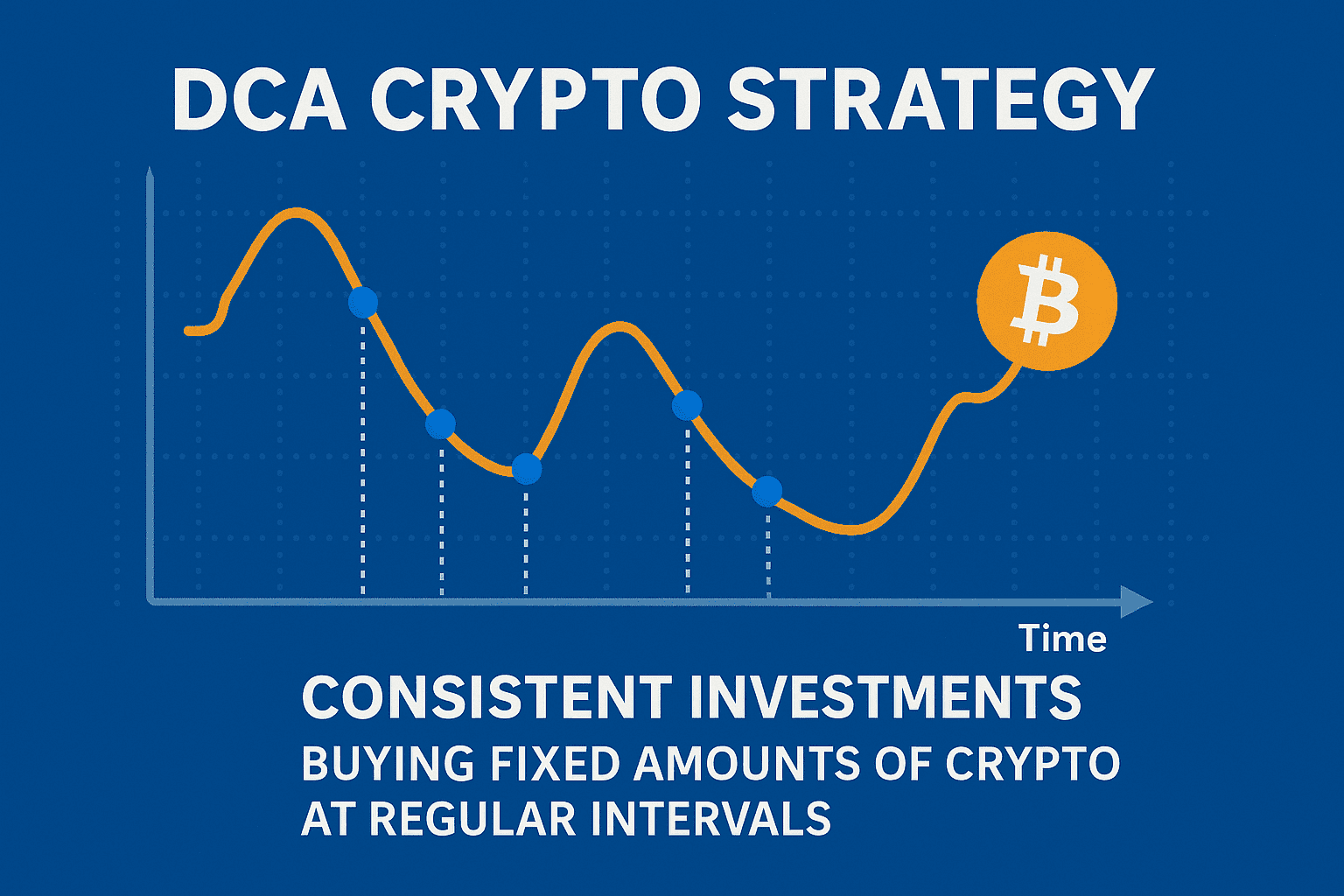

Dollar-Cost Averaging (DCA) is a simple yet powerful investment method. It means you invest a fixed amount of money into a cryptocurrency at regular intervals—weekly, bi-weekly, or monthly—no matter what the price is.

Instead of trying to “buy the dip,” you spread your purchases over time. Some buys will be at a higher price, some lower, but it evens out. Over time, this approach can lower your average cost per coin—hence the name.

Why DCA Is Gaining Popularity in Crypto

With crypto being highly volatile, DCA offers a stress-free way to build a position without worrying about timing the market. It’s popular with Bitcoin believers, Ethereum investors, and anyone looking for long-term growth.

How DCA Works in Crypto Investing

Regular Intervals vs. Market Timing

Traditional traders try to buy low and sell high. But let’s be real—it’s hard to predict crypto markets. DCA removes this guesswork. Instead of trying to time it, you set a schedule (like $100 every Monday) and stick to it.

Automating Your DCA Strategy

Most crypto exchanges offer recurring buys. Set it and forget it. Platforms like Coinbase, Binance, Kraken, and Bitstamp let you automate DCA strategies with just a few clicks.

Benefits of Using a DCA Strategy for Crypto

Reducing Emotional Investing

DCA takes emotions out of the equation. No panic selling. No FOMO buying. Just consistent, calm investing.

Minimizing the Impact of Volatility

Since you’re spreading purchases, you’re less affected by sudden dips or spikes. This smooths out your average cost and can lead to better long-term results.

Easy for Beginners

New to crypto? DCA is perfect. No charts, no signals—just steady investing.

Drawbacks of the DCA Crypto Strategy

Slower Gains in Bull Markets

One of the biggest criticisms of DCA is that it may underperform during a strong bull run. If the market is trending sharply upward, buying slowly means you miss out on lower prices at the beginning. A lump-sum investment during a bull market might have yielded higher returns.

However, that’s the trade-off for safety. DCA isn’t about maximizing gains in short bursts—it’s about long-term consistency.

Requires Discipline Over Time

DCA only works if you commit. Many investors start with good intentions but stop when prices fall or skip contributions when money feels tight. Skipping intervals or making irregular deposits defeats the whole purpose of DCA.

Staying disciplined—especially during market crashes—is key to letting this strategy pay off.

Real-World Examples of DCA in Crypto

Case Study: Investing in Bitcoin Over 2 Years

Let’s say you started investing $100 per month into Bitcoin starting in September 2021. Over two years, you’d have invested $2,400.

Now imagine Bitcoin’s price was fluctuating wildly—ranging from $65,000 down to $16,000. With DCA, you’d have bought more BTC when prices dropped and less when prices spiked.

As of today, your average cost would likely be significantly lower than someone who bought all at once at the peak. Historical data supports this—DCA reduces the risk of buying during price bubbles.

Comparing Lump Sum vs. DCA Performance

In volatile markets like crypto, lump-sum investing often leads to either huge gains or massive losses. DCA smooths that curve. While you might not hit the jackpot, you’re far less likely to crash out completely.

It’s a long-term play—one that many studies show outperforms emotional, irregular investing habits.

Best Cryptocurrencies to Use with DCA

Bitcoin (BTC)

Bitcoin remains the most DCA’d asset in crypto. Many long-term holders swear by this strategy, and data shows that long-term DCA into BTC tends to outperform short-term trading for most people.

Ethereum (ETH)

Ethereum is another solid candidate. With its growing role in DeFi, NFTs, and smart contracts, ETH has shown resilience and growth. DCA into ETH is a common approach among developers, investors, and even institutions.

Stablecoins and Other Assets

While stablecoins are mostly used for holding and transferring funds, some investors DCA into high-yield stablecoin savings or lending platforms to earn passive income. Others use DCA with altcoins—but these carry more risk, so it’s crucial to research thoroughly.

Setting Up Your First DCA Crypto Strategy

Choosing an Exchange or App

Pick a reliable platform with low fees and good security. Coinbase, Binance, Kraken, Gemini, and Bitstamp all support automated DCA plans. Look for user-friendly interfaces and transparent policies.

Deciding the Amount and Frequency

Start with what you can afford. $10, $50, or $200 per week—it doesn’t matter, as long as it’s consistent. Many investors choose weekly intervals to smooth out the buying process even more.

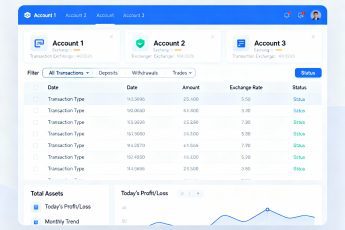

Tracking Your Results Over Time

Use tools like CoinTracking, Accointing, or even simple spreadsheets to monitor your purchases, total invested, and portfolio value. This helps keep you motivated and informed.

Common Mistakes to Avoid with DCA

Changing Strategy Midway

One of the biggest DCA pitfalls is second-guessing your plan. If the market drops and you stop buying, you miss out on the very dips that improve your average cost. Stick with it—even when it’s scary.

Not Understanding Fees and Taxes

Some platforms charge fees on every buy. Over time, this adds up. Always check fee structures and consider using exchanges with lower DCA transaction costs. And remember—crypto is taxable in many countries. Track everything and consult a tax professional when needed.

Tips to Optimize Your DCA Crypto Strategy

Use Volatility to Your Advantage

While DCA naturally helps during volatile markets, you can take it one step further. Some investors set alerts for major dips and add extra on top of their regular DCA amounts. This way, they stay consistent but also capitalize on opportunities.

That said—don’t overthink it. The core principle is simplicity and consistency. If it becomes emotional or stressful, you’re defeating the purpose.

Reevaluate Regularly Based on Goals

Every 6 or 12 months, take a moment to review your portfolio. Are your goals still the same? Has the crypto market shifted significantly? While you shouldn’t time the market, it’s smart to reassess your strategy based on personal goals or big life changes.

DCA isn’t about being static—it’s about being steady and intentional.

Is the DCA Crypto Strategy Right for You?

Who Should Consider DCA?

- Beginners: It’s a great entry strategy with minimal risk and emotional involvement.

- Busy professionals: If you don’t have time to study charts daily, DCA gives you a hands-off approach.

- Long-term believers: If you believe in crypto’s future and want to build wealth over years—not weeks—DCA aligns perfectly with that vision.

When to Avoid DCA

- If you’re trying to capitalize on a short-term pump, DCA may not give you the quick returns you’re after.

- If you can’t commit to consistent investing over time, this approach may frustrate you.

- If your budget is very tight and you need fast liquidity, locking funds in crypto may not be ideal.

FAQs About the DCA Crypto Strategy

Is DCA better than lump sum investing in crypto?

Can I DCA with any cryptocurrency?

How often should I DCA?

What happens if the market crashes after I start DCAing?

Do I need a special app for DCA?

Is DCA legal and safe?

Conclusion: Smart Investing with DCA in Crypto

The DCA crypto strategy isn’t flashy. It won’t make you rich overnight. But what it offers is something far more powerful—peace of mind and financial discipline in one of the world’s most chaotic markets.

Instead of worrying about peaks and crashes, you follow a plan. You build wealth quietly, consistently, and with far less stress.

Whether you’re investing in Bitcoin, Ethereum, or beyond, DCA helps you remove emotion, reduce risk, and stay the course—rain or shine.

So if you’re tired of guessing the market… maybe it’s time to stop timing and start trusting the process.