Building a comprehensive transaction tracking system for multiple exchange accounts represents one of the most critical challenges facing cryptocurrency traders and developers in 2025. As digital asset portfolios become increasingly fragmented across numerous platforms, the need for centralized monitoring and management has never been more pressing. Whether you’re managing personal investments across Binance, Coinbase, and Kraken, or developing software for institutional clients, understanding how to construct a robust transaction tracking system will fundamentally transform your approach to cryptocurrency portfolio management.

- Understanding the Architecture of a Modern Transaction Tracking System

- Setting Up Exchange API Connections for Your Transaction Tracking System

- Data Normalization and Storage Strategies for Transaction Tracking Systems

- Implementing Real-Time Synchronization in Your Transaction Tracking System

- Building Analytics and Reporting Features for Transaction Tracking Systems

- Security Best Practices for Transaction Tracking System Development

- Handling Exchange-Specific Challenges in Transaction Tracking Systems

- Scaling Your Transaction Tracking System for Growth

- Advanced Features for Professional Transaction Tracking Systems

- Testing and Quality Assurance for Transaction Tracking Systems

- Deployment and Monitoring Strategies for Transaction Tracking Systems

- Future-Proofing Your Transaction Tracking System

- Conclusion: Building Robust Transaction Tracking Systems for the Future

Understanding the Architecture of a Modern Transaction Tracking System

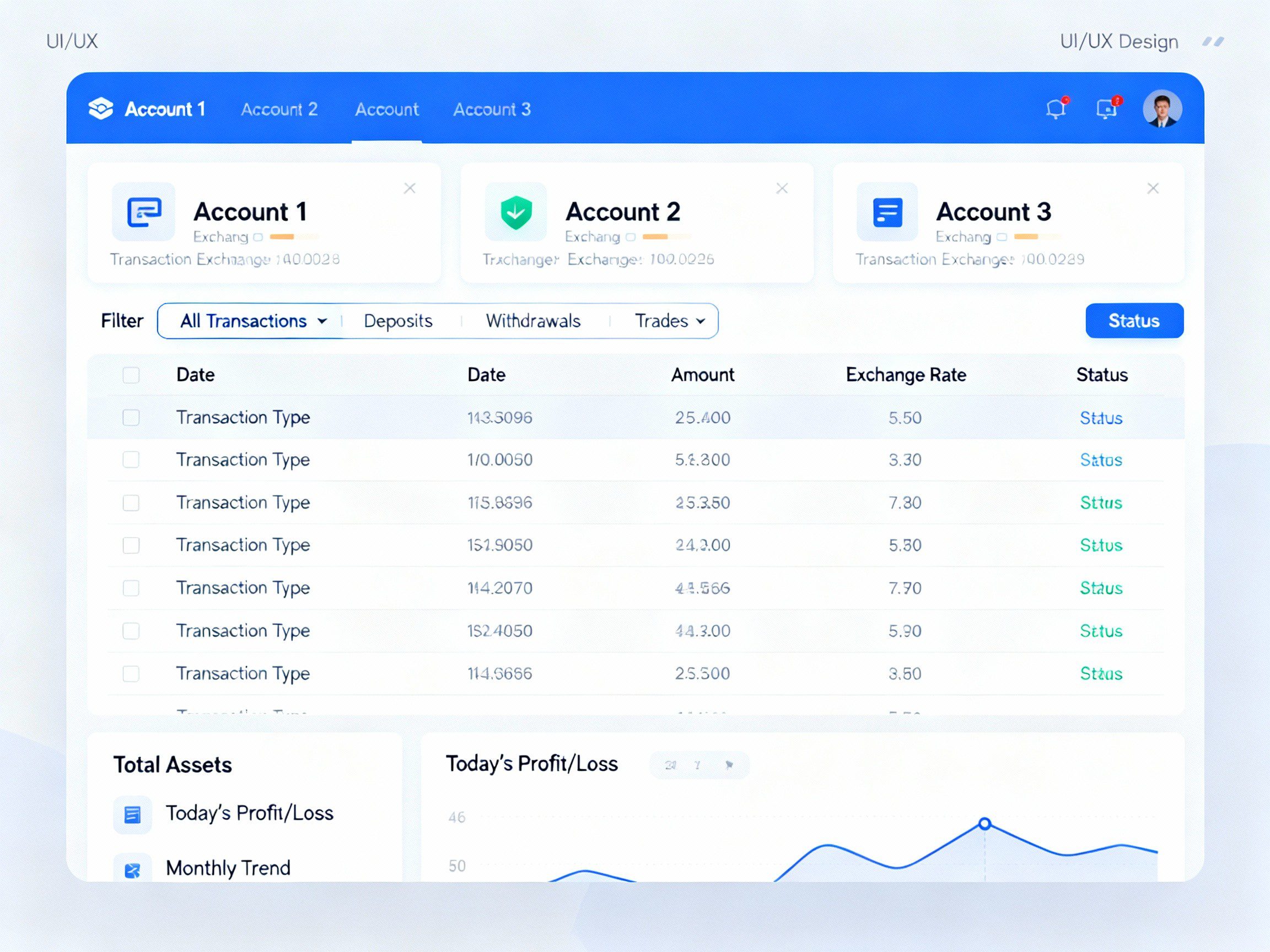

The foundation of any effective transaction tracking system begins with understanding the complex ecosystem of cryptocurrency exchanges and how they communicate with external applications. When you trade cryptocurrencies, each exchange maintains its own isolated record of your transactions, balances, and trading history. This fragmentation creates significant challenges for investors who need a unified view of their portfolio performance. A well-designed transaction tracking system acts as a central hub, aggregating data from multiple sources into a single, coherent interface that provides real-time insights and historical analysis capabilities.

Modern cryptocurrency APIs provide fast, reliable and unified data access to cryptocurrency markets, enabling developers to centralize execution with smart routing and order management built for high-frequency and institutional trading. This capability forms the backbone of any sophisticated transaction tracking system. The architecture typically consists of three primary layers: the data ingestion layer that connects to exchange APIs, the processing layer that normalizes and stores transaction data, and the presentation layer that displays information to users in meaningful ways.

Consider the typical workflow of a transaction tracking system. When a user executes a trade on Binance, the exchange records this transaction in its internal database. Your transaction tracking system needs to retrieve this information through Binance’s API, process it to extract relevant details like price, quantity, and timestamp, then store it in a format that allows for efficient querying and analysis. This same process must occur simultaneously across all connected exchanges, with the system intelligently handling different data formats, update frequencies, and API limitations.

Table 1: Core Components of a Transaction Tracking System

| Component | Primary Function | Key Technologies | Critical Considerations |

|---|---|---|---|

| API Integration Layer | Connect to exchange APIs | REST, WebSocket, OAuth | Rate limiting, authentication |

| Data Normalization | Standardize formats | JSON parsing, data mapping | Exchange-specific formats |

| Storage Engine | Persist transaction data | PostgreSQL, MongoDB | Scalability, indexing |

| Synchronization Service | Keep data current | Cron jobs, event streams | Latency, consistency |

| Analytics Engine | Calculate metrics | Python, pandas | Performance optimization |

| User Interface | Display information | React, Vue.js | Real-time updates |

Setting Up Exchange API Connections for Your Transaction Tracking System

The first practical step in building your transaction tracking system involves establishing secure connections to cryptocurrency exchange APIs. Each major exchange provides its own API with unique authentication methods, endpoint structures, and data formats. Leading exchanges like Coinbase offer APIs that provide developers with access to real-time and historical price data, as well as market statistics for hundreds of cryptocurrencies, with secure transaction capabilities integrated directly with the exchange infrastructure.

Begin by creating API credentials for each exchange you plan to integrate. This process typically involves logging into your exchange account, navigating to the API management section, and generating a new API key pair. Most exchanges provide three types of permissions: read-only access for viewing balances and history, trading permissions for executing orders, and withdrawal permissions for moving funds. For a transaction tracking system, you should exclusively use read-only permissions to minimize security risks. Store these credentials securely using environment variables or a dedicated secrets management service, never hardcoding them directly into your application.

The authentication process varies significantly between exchanges. Binance uses HMAC-SHA256 signatures with API keys and secrets, while Kraken’s API employs a combination of API keys and nonces for request validation. Your transaction tracking system must implement exchange-specific authentication logic while maintaining a consistent internal interface. This abstraction layer allows you to add new exchanges without modifying your core application logic.

Here’s a practical example of how to structure your API connection module for multiple exchanges. Create a base class that defines the common interface, then implement exchange-specific subclasses that handle the unique requirements of each platform. This object-oriented approach ensures your transaction tracking system remains maintainable as you add support for additional exchanges.

Data Normalization and Storage Strategies for Transaction Tracking Systems

Once you’ve established connections to multiple exchanges, your transaction tracking system faces the challenge of normalizing diverse data formats into a unified structure. Exchange APIs connect directly to trading platforms to fetch balances, trade history, and transaction data, but each platform presents this information differently. Binance might represent a Bitcoin trade as a JSON object with fields like “symbol”, “price”, and “qty”, while Coinbase uses “product_id”, “rate”, and “size” for the same information.

The normalization process in your transaction tracking system should transform these varied formats into a standardized schema that supports efficient querying and analysis. Design a universal transaction model that captures all essential information while remaining flexible enough to accommodate exchange-specific metadata. Your schema might include core fields like transaction_id, exchange, timestamp, asset_pair, side (buy/sell), quantity, price, fee, and fee_currency, along with a JSON field for storing additional exchange-specific data that doesn’t fit the standard model.

Table 2: Data Normalization Mapping for Major Exchanges

| Standard Field | Binance API | Coinbase API | Kraken API | Data Type |

|---|---|---|---|---|

| transaction_id | orderId | order_id | txid | String |

| timestamp | time | created_at | time | Unix timestamp |

| asset_pair | symbol | product_id | pair | String |

| quantity | qty | size | vol | Decimal |

| price | price | rate | price | Decimal |

| fee | commission | fee | fee | Decimal |

| side | side | side | type | Enum (buy/sell) |

Database selection plays a crucial role in your transaction tracking system’s performance and scalability. PostgreSQL offers excellent support for complex queries and ACID compliance, making it ideal for financial data where consistency is paramount. The JSONB data type in PostgreSQL allows you to store exchange-specific metadata while maintaining query performance through GIN indexes. Alternatively, time-series databases like TimescaleDB (built on PostgreSQL) provide optimized storage and querying for time-ordered transaction data, which aligns perfectly with the nature of trading records.

Implement a robust data validation layer in your transaction tracking system to ensure data integrity. Check for duplicate transactions, validate numerical ranges, and verify that timestamps fall within expected boundaries. Some exchanges occasionally return duplicate data or transactions with incorrect timestamps, and your system must handle these edge cases gracefully. Maintain an audit log of all data ingestion activities, including successful imports, validation failures, and API errors, to facilitate debugging and compliance requirements.

Implementing Real-Time Synchronization in Your Transaction Tracking System

The effectiveness of a transaction tracking system largely depends on its ability to maintain current, accurate data across all connected exchanges. Modern exchange APIs offer WebSocket connections for low-latency streaming data, providing real-time updates on new blocks and transactions through JSON formatted messages. This real-time capability transforms your transaction tracking system from a historical reporting tool into an active portfolio management platform.

Implementing real-time synchronization requires balancing several competing concerns: minimizing latency, respecting API rate limits, handling connection failures gracefully, and maintaining data consistency across multiple data sources. Design your synchronization strategy around a hybrid approach that combines periodic polling for comprehensive updates with WebSocket subscriptions for real-time notifications of new transactions.

Create a synchronization scheduler in your transaction tracking system that intelligently manages update frequencies based on trading activity patterns. During active trading periods, increase the polling frequency for exchanges where you’re executing trades, while maintaining lower update rates for dormant accounts. Implement exponential backoff algorithms for handling API errors and rate limit responses, preventing your system from overwhelming exchange servers during high-traffic periods.

WebSocket connections require special attention in production environments. Unlike HTTP requests that complete and close, WebSocket connections must be actively maintained, monitored for disconnections, and reconnected when failures occur. Your transaction tracking system should implement heartbeat mechanisms to detect stale connections, automatic reconnection logic with jittered delays to prevent thundering herd problems, and message deduplication to handle potential replay scenarios during reconnection.

Building Analytics and Reporting Features for Transaction Tracking Systems

The true value of a transaction tracking system emerges when it transforms raw transaction data into actionable insights. Using a crypto API for portfolio tracking means you can automatically aggregate holdings from multiple wallets or exchanges, monitor portfolio value with up-to-date price data, and analyze allocations, performance, and exposure across assets and chains. Your analytics engine should calculate essential metrics like total portfolio value, profit and loss by asset, trading volume patterns, and fee analysis across exchanges.

Start by implementing basic portfolio metrics in your transaction tracking system. Calculate the current value of holdings by combining balance data with real-time price feeds. Track cost basis for each asset by analyzing historical purchase transactions, accounting for different calculation methods like FIFO (First In, First Out), LIFO (Last In, First Out), or weighted average. These calculations become complex when dealing with partial fills, multiple purchase lots, and transfers between exchanges.

Performance analytics require careful consideration of time-weighted returns versus money-weighted returns. Your transaction tracking system should support both methodologies, as they provide different perspectives on portfolio performance. Time-weighted returns eliminate the impact of deposits and withdrawals, showing pure investment performance, while money-weighted returns account for the timing of cash flows, providing a more personalized view of investor returns.

Table 3: Essential Analytics Metrics for Transaction Tracking Systems

| Metric Category | Key Calculations | Update Frequency | Use Case |

|---|---|---|---|

| Portfolio Value | Total USD value, asset allocation | Real-time | Dashboard display |

| P&L Analysis | Realized/unrealized gains | On transaction | Tax reporting |

| Trading Volume | 24h, 7d, 30d volumes | Hourly | Activity monitoring |

| Fee Analysis | Trading fees by exchange | Daily | Cost optimization |

| Performance | ROI, Sharpe ratio | Daily | Investment analysis |

| Risk Metrics | Value at Risk, correlation | Daily | Risk management |

Implement sophisticated charting capabilities in your transaction tracking system to visualize portfolio evolution over time. Line charts showing portfolio value progression help users understand long-term trends, while pie charts illustrating asset allocation provide insights into diversification. Candlestick charts for individual assets, overlaid with transaction markers, allow users to evaluate their trading decisions in context. Consider integrating libraries like Chart.js or D3.js for creating interactive, responsive visualizations that enhance user engagement.

Security Best Practices for Transaction Tracking System Development

Security considerations permeate every aspect of building a transaction tracking system, from API credential management to user data protection. Prioritize trackers with two-factor authentication, data encryption, and secure API key management, while regularly reviewing and updating security practices. The sensitive nature of financial data demands a comprehensive security strategy that addresses both external threats and internal vulnerabilities.

API key management represents the first critical security challenge in your transaction tracking system. Never store API credentials in plain text, whether in databases, configuration files, or version control systems. Implement encryption at rest using industry-standard algorithms like AES-256, with encryption keys stored separately from the encrypted data. Consider using dedicated secrets management services like HashiCorp Vault or AWS Secrets Manager, which provide additional features like automatic key rotation and audit logging.

Implement comprehensive access controls throughout your transaction tracking system. Apply the principle of least privilege, granting users and system components only the minimum permissions necessary for their functions. Use role-based access control (RBAC) to manage user permissions, separating read-only users from those who can modify system configuration. Implement multi-factor authentication for all user accounts, especially those with administrative privileges.

Network security requires equal attention in your transaction tracking system architecture. Use TLS encryption for all API communications, validating SSL certificates to prevent man-in-the-middle attacks. Implement IP whitelisting where supported by exchange APIs, restricting API access to your application servers. Deploy your transaction tracking system behind a properly configured firewall, exposing only necessary ports and services to the internet.

Handling Exchange-Specific Challenges in Transaction Tracking Systems

Each cryptocurrency exchange presents unique challenges that your transaction tracking system must address. In 2025, top cryptocurrency APIs like Binance, Coinbase, and Kraken provide robust features including real-time data, security, and advanced trading capabilities, but each requires specific implementation considerations. Understanding these exchange-specific nuances ensures your system handles edge cases gracefully and provides accurate data to users.

Binance, as one of the largest exchanges by volume, offers comprehensive API coverage but implements aggressive rate limiting during peak trading periods. Your transaction tracking system must implement intelligent request batching for Binance, combining multiple balance queries into single requests where possible. Binance also uses a weight-based rate limiting system where different endpoints consume different amounts of your rate limit quota, requiring careful request prioritization during synchronization cycles.

Coinbase Pro (now Coinbase Advanced Trade) structures its data differently from most exchanges, using a ledger-based system that records every balance change as a separate entry. Your transaction tracking system must reconstruct trading history by parsing these ledger entries, identifying matching pairs of entries that represent complete trades. This approach provides excellent auditability but requires more complex processing logic compared to exchanges that provide pre-computed trade records.

Table 4: Exchange-Specific Implementation Considerations

| Exchange | Rate Limits | Data Structure | Special Features | Common Issues |

|---|---|---|---|---|

| Binance | Weight-based (1200/min) | Order-centric | Extensive market data | Complex fee structure |

| Coinbase | 10-15 requests/sec | Ledger-based | Fiat integration | Partial fill handling |

| Kraken | Tier-based system | Trade-centric | Margin trading data | Nonce management |

| FTX | 30 requests/sec | Unified format | Subaccounts | Limited history |

| KuCoin | 1800/min general | Standard REST | Lending products | Pagination quirks |

Handling exchange downtime and maintenance windows requires robust error handling in your transaction tracking system. Implement circuit breaker patterns that temporarily disable connections to unresponsive exchanges while continuing to update data from operational platforms. Maintain a status monitoring system that tracks the health of each exchange connection, alerting administrators when persistent failures occur. Design your user interface to clearly communicate when data from specific exchanges may be stale or unavailable.

Scaling Your Transaction Tracking System for Growth

As your transaction tracking system evolves from handling a few personal accounts to potentially managing hundreds or thousands of user portfolios, scalability becomes a critical concern. The architecture decisions you make early in development will significantly impact your ability to scale efficiently. Design your system with horizontal scalability in mind, allowing you to add additional servers to handle increased load rather than relying solely on vertical scaling of individual machines.

Implement database sharding strategies in your transaction tracking system to distribute data across multiple database servers. A common approach involves sharding by user ID, ensuring that all transactions for a given user reside on the same database shard. This strategy simplifies query patterns while enabling linear scalability as user numbers grow. Consider using database proxy solutions like ProxySQL or PgBouncer to manage connection pooling and query routing, reducing the overhead of maintaining multiple database connections.

Caching plays a vital role in scaling your transaction tracking system effectively. Modern portfolio tracking platforms can handle just about any complex transaction you can throw at them, with automation being a real lifesaver for managing data from 300+ exchanges, blockchains, and wallets. Implement multi-layer caching strategies using Redis or Memcached to store frequently accessed data like current prices, user balances, and calculated metrics. Design your cache invalidation strategy carefully to balance data freshness with system performance, using techniques like cache-aside patterns or write-through caching depending on data characteristics.

Message queue systems enable asynchronous processing in your transaction tracking system, improving responsiveness and reliability. Use platforms like RabbitMQ or Apache Kafka to decouple data ingestion from processing, allowing your system to handle traffic spikes gracefully. When a user connects a new exchange account, queue the initial synchronization task rather than processing it synchronously, preventing long-running operations from blocking other users. Implement retry mechanisms with exponential backoff for failed tasks, ensuring temporary failures don’t result in permanent data loss.

Advanced Features for Professional Transaction Tracking Systems

Professional-grade transaction tracking systems extend beyond basic balance and transaction monitoring to provide sophisticated features that support complex trading strategies and compliance requirements. Tax reporting capabilities have become essential, as cryptocurrency taxation grows increasingly complex across jurisdictions. Your transaction tracking system should calculate capital gains using various accounting methods, generate IRS Form 8949 compatible reports, and support jurisdiction-specific tax rules.

Implement automated alerting systems that notify users of significant portfolio events. Price alerts inform users when assets reach specified thresholds, while unusual activity alerts detect potential security issues like unexpected withdrawals or login attempts from new locations. Advanced systems can identify arbitrage opportunities across different exchanges by comparing prices using real-time quote data and order book analysis. Your transaction tracking system might alert users when price disparities exceed profitable thresholds after accounting for trading fees and transfer costs.

Table 5: Advanced Features for Transaction Tracking Systems

| Feature Category | Functionality | Technical Requirements | User Benefit |

|---|---|---|---|

| Tax Reporting | Capital gains calculation | Historical price data | Compliance simplification |

| DeFi Integration | Protocol monitoring | Web3 libraries | Complete portfolio view |

| Risk Analytics | VaR, correlation analysis | Statistical computing | Informed decision-making |

| Trade Automation | Strategy execution | Low-latency infrastructure | Efficiency improvement |

| Audit Trail | Complete transaction history | Immutable logging | Regulatory compliance |

| Multi-currency | Fiat conversion | Exchange rate feeds | Global accessibility |

Portfolio rebalancing tools help users maintain desired asset allocations as market movements shift portfolio compositions. Your transaction tracking system can calculate the trades necessary to restore target allocations, considering factors like minimum trade sizes, trading fees, and tax implications. Provide simulation capabilities that allow users to test rebalancing strategies before execution, showing projected outcomes and potential tax consequences.

Integration with DeFi protocols represents an emerging requirement for comprehensive transaction tracking systems. Many best crypto tracking tools support popular exchanges and wallets through integrated APIs, reducing complexity while providing real-time analytics and performance metrics. Supporting DeFi requires connecting to blockchain nodes or services like Infura to read smart contract states, tracking liquidity pool positions, yield farming rewards, and governance tokens. The complexity of DeFi interactions demands sophisticated parsing logic to correctly categorize and value these positions.

Testing and Quality Assurance for Transaction Tracking Systems

Rigorous testing ensures your transaction tracking system maintains data accuracy and reliability across diverse operating conditions. Implement comprehensive test suites covering unit tests for individual functions, integration tests for API connections, and end-to-end tests simulating complete user workflows. Mock exchange API responses during testing to ensure your system handles both successful responses and various error conditions appropriately.

Create detailed test scenarios that reflect real-world usage patterns of your transaction tracking system. Test simultaneous transactions across multiple exchanges, verifying that your system correctly handles race conditions and maintains data consistency. Simulate exchange API failures, rate limiting responses, and malformed data to ensure your error handling logic functions correctly. Implement continuous integration pipelines that run these tests automatically whenever code changes are committed.

Performance testing reveals bottlenecks in your transaction tracking system before they impact users. Use tools like Apache JMeter or Gatling to simulate concurrent users accessing the system, measuring response times and resource utilization under load. Profile database queries to identify slow operations, adding appropriate indexes or restructuring queries as needed. Monitor memory usage patterns to detect potential memory leaks, especially in long-running processes like WebSocket connections.

Data accuracy validation represents a critical testing component for any transaction tracking system. Implement reconciliation processes that compare calculated portfolio values against exchange-reported balances, flagging discrepancies for investigation. Create automated tests that verify transaction import accuracy by comparing known test cases against system outputs. Maintain checksums or hash values for imported data, enabling detection of unintended modifications during processing or storage.

Deployment and Monitoring Strategies for Transaction Tracking Systems

Deploying a transaction tracking system to production requires careful planning to ensure reliability and maintainability. Container orchestration platforms like Kubernetes provide excellent foundations for deploying scalable, resilient applications. Containerize your application components using Docker, defining clear service boundaries and dependencies. This approach enables independent scaling of different components based on load patterns, such as scaling API connector services during peak trading hours while maintaining fewer analytics processing instances.

Implement comprehensive monitoring throughout your transaction tracking system to detect and respond to issues quickly. Use application performance monitoring (APM) tools like New Relic or DataDog to track response times, error rates, and resource utilization. Create custom metrics specific to your domain, such as successful API calls per exchange, synchronization lag times, and data freshness indicators. Set up alerting thresholds that notify operators of potential issues before they impact users.

Table 6: Monitoring Metrics for Transaction Tracking Systems

| Metric Type | Key Indicators | Alert Thresholds | Response Actions |

|---|---|---|---|

| API Health | Success rate, latency | <95% success, >2s latency | Check exchange status |

| Data Freshness | Sync lag time | >5 minutes lag | Investigate sync service |

| System Resources | CPU, memory, disk | >80% utilization | Scale resources |

| Error Rates | Exception frequency | >1% of requests | Review error logs |

| User Activity | Active sessions | Unusual patterns | Security review |

| Database Performance | Query time, connections | >1s queries, >80% connections | Optimize queries |

Log aggregation systems like ELK Stack (Elasticsearch, Logstash, Kibana) or Splunk centralize logs from all components of your transaction tracking system, enabling efficient troubleshooting and analysis. Structure your logs consistently using JSON formatting, including correlation IDs that allow tracing requests across multiple services. Implement log rotation and retention policies that balance storage costs with compliance requirements, typically retaining detailed logs for 30-90 days and aggregated metrics for longer periods.

Disaster recovery planning ensures your transaction tracking system can recover from catastrophic failures. Implement automated backup strategies for both databases and configuration files, storing backups in geographically distributed locations. Test recovery procedures regularly, measuring recovery time objectives (RTO) and recovery point objectives (RPO) to ensure they meet business requirements. Document runbooks for common operational procedures, enabling rapid response to incidents even when key personnel are unavailable.

Future-Proofing Your Transaction Tracking System

The cryptocurrency landscape evolves rapidly, and your transaction tracking system must adapt to remain relevant. The most comprehensive cryptocurrency and DEX data APIs now provide access to everything from individual developers to the largest finance and crypto institutions, with instant access to live prices, market caps, and historical data. Stay informed about emerging standards like the Financial Information eXchange (FIX) protocol adaptations for cryptocurrency markets, which may become industry standards for institutional trading.

Artificial intelligence and machine learning capabilities increasingly differentiate advanced transaction tracking systems from basic tools. Implement pattern recognition algorithms that identify trading opportunities or detect anomalous behavior. Natural language processing can enable conversational interfaces, allowing users to query their portfolios using plain English rather than navigating complex menus. Machine learning models can predict likely tax obligations based on trading patterns, helping users make more informed trading decisions.

Regulatory compliance will likely become more stringent as cryptocurrency markets mature. Design your transaction tracking system with compliance in mind, implementing features like know-your-customer (KYC) verification, anti-money laundering (AML) monitoring, and regulatory reporting capabilities. Stay informed about evolving regulations in major markets, adapting your system to meet new requirements as they emerge. Consider joining industry associations or working groups that shape regulatory frameworks, ensuring your voice contributes to practical, implementable standards.

Blockchain interoperability presents both challenges and opportunities for transaction tracking systems. As cross-chain bridges and atomic swaps become more prevalent, your system must track assets moving between different blockchains accurately. Implement support for emerging standards like the Inter-Blockchain Communication (IBC) protocol, enabling comprehensive tracking of assets regardless of their underlying blockchain. Consider integrating with decentralized identity solutions that may become standard for user authentication across Web3 applications.

Conclusion: Building Robust Transaction Tracking Systems for the Future

Creating a comprehensive transaction tracking system for multiple exchange accounts requires careful attention to architecture, security, scalability, and user experience. The system you build today must not only meet current needs but also adapt to the rapidly evolving cryptocurrency ecosystem. By following the principles and practices outlined in this guide, you can develop a transaction tracking system that provides real value to users while maintaining the flexibility to incorporate new exchanges, features, and technologies as they emerge.

Remember that building a transaction tracking system is an iterative process. Start with core functionality like basic API integration and transaction import, then gradually add advanced features based on user feedback and market demands. Prioritize data accuracy and security throughout development, as these fundamental qualities determine whether users can trust your system with their financial information. Engage with the developer community through forums, conferences, and open-source contributions to stay current with best practices and emerging trends.

The investment in building a robust transaction tracking system pays dividends through improved portfolio visibility, better trading decisions, simplified tax compliance, and reduced operational overhead. Whether you’re building for personal use or developing a commercial product, the principles covered in this guide provide a solid foundation for creating systems that effectively manage the complexity of multi-exchange cryptocurrency portfolios. As the cryptocurrency market continues to mature and institutional adoption accelerates, well-designed transaction tracking systems will become increasingly valuable tools for navigating this dynamic landscape.

For ongoing updates on cryptocurrency API development and best practices, bookmark resources like CoinAPI documentation, CoinGecko’s API portal, and consider joining developer communities focused on cryptocurrency application development. The journey of building a transaction tracking system challenges you to solve complex technical problems while creating tools that genuinely improve how people interact with cryptocurrency markets.