- Introduction

- What Makes a Great Crypto Trading App in 2025?

- Security First

- Transparent Fees

- Advanced Features

- Regulation and Compliance

- The Best Crypto Trading Apps in 2025

- Coinbase

- Binance

- Kraken

- Uniswap (DEX)

- dYdX

- Comparison Table: Top Crypto Trading Apps 2025

- Key Takeaways

- FAQ (People Also Asks)

- What is a crypto trading app?

- What is AI crypto trading?

- Which is the best crypto trading app in 2025?

- Is AI crypto trading safe?

- How does regulation affect crypto trading apps?

- Conclusion

Introduction

The crypto market has matured in 2025, and with it, so have the tools traders use. Crypto trading apps are no longer simple buy-and-sell portals — they are now ecosystems offering AI-driven strategies, regulatory compliance, and access to both centralized and decentralized finance. But not all apps are equal. Some prioritize security and transparency, while others excel in fees, features, or decentralization.

This guide reviews the best crypto trading apps in 2025—Coinbase, Binance, Kraken, Uniswap, and dYdX—comparing custody models, fees, features, and ideal user profiles.

What Makes a Great Crypto Trading App in 2025?

Security First

Security remains the single most important factor. Hacks, phishing, and rug pulls continue to haunt crypto, so the right app must:

- Offer two-factor authentication (2FA) or passkeys.

- Prove solvency via proof-of-reserves plus proof-of-liabilities.

- Provide non-custodial options or safe wallet integrations.

Transparent Fees

Hidden spreads are the silent killers of profit. Fee structures vary:

- CEX apps (Coinbase, Binance, Kraken) use maker/taker fees.

- DEX apps (Uniswap, dYdX) rely on gas fees and liquidity pool costs.

- Advanced users benefit from volume-tiered discounts, while casual users need apps with low entry-level fees.

Advanced Features

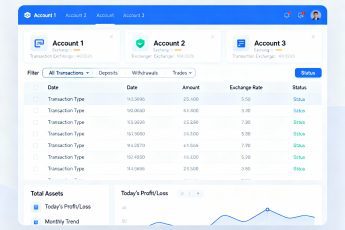

A modern trading app should do more than execute orders:

- Order types: Market, limit, stop-loss, TWAP/VWAP.

- Portfolio tools: Risk dashboards, PnL tracking, tax exports.

- AI tools: Trading bots, smart routing, predictive analytics.

Regulation and Compliance

In 2025, regulation shapes everything:

- In the EU, MiCA demands transparency, disclosures, and licensing.

- In the US, apps offering ETF-linked products must register and comply with SEC oversight.

- Globally, apps are judged on licensing and audit transparency.

The Best Crypto Trading Apps in 2025

Coinbase

- Custody: Custodial with FDIC-insured USD balances; users can also connect non-custodial wallets.

- Fees: Higher than competitors (0.40% taker, 0.25% maker for mid-tier traders).

- Features:

- Clean user interface, excellent for beginners.

- Advanced dashboard for pro traders with depth charts, order books, and indicators.

- Fiat on-ramps in 100+ countries.

- Staking and ETF-linked crypto exposure (US).

- Best for: Beginners and US traders prioritizing compliance and regulated access.

- Downside: Higher fees than peers, limited advanced features compared to Binance.

Binance

- Custody: Custodial, with wallet integration (Trust Wallet).

- Fees: Among the lowest (0.10% maker/taker base fee, with discounts for BNB usage).

- Features:

- Spot, futures, options, copy trading, and launchpad access.

- AI-powered bots for grid and futures trading.

- Wide token coverage across majors and alts.

- Deep liquidity in almost every pair.

- Best for: High-volume global traders and those seeking advanced features.

- Downside: Ongoing regulatory scrutiny in some regions; limited fiat access in restricted countries.

Kraken

- Custody: Custodial, with transparent proof-of-reserves audits.

- Fees: Competitive maker/taker (0.16% / 0.26% for lower tiers, cheaper at higher volumes).

- Features:

- Spot, futures, and staking with regulatory alignment.

- Advanced security: hardware key integrations, whitelisted withdrawal addresses.

- Clean compliance history compared to Binance.

- Best for: Traders prioritizing security and transparency with a regulatory-first mindset.

- Downside: Fewer altcoins than Binance; UX less flashy than Coinbase.

Uniswap (DEX)

- Custody: 100% non-custodial — connect MetaMask or other wallets.

- Fees: 0.05%–1% swap fees depending on pool + gas costs.

- Features:

- Wide token availability (including new projects).

- Smart order routing across liquidity pools.

- Governance through UNI token.

- Best for: On-chain traders who want full control and composability.

- Downside: Gas fees can be high; risk of front-running/MEV unless using private relays.

dYdX

- Custody: Non-custodial, built on a Cosmos rollup for speed.

- Fees: Very low, tiered by volume; makers may even receive rebates.

- Features:

- Advanced perpetual futures markets.

- API access for algo traders.

- High-performance decentralized trading engine rivaling CEX speed.

- Best for: Derivatives traders who value decentralization and low fees.

- Downside: Focused mainly on derivatives, not ideal for casual spot traders.

Comparison Table: Top Crypto Trading Apps 2025

| App | Custody | Fees | Features | Best For |

|---|---|---|---|---|

| Coinbase | Custodial | 0.25–0.40% maker/taker | Beginner UX, pro dashboard, staking, ETFs | Beginners, US compliance-focused |

| Binance | Custodial | 0.10% maker/taker | Futures, options, AI bots, copy trading | Global high-volume traders |

| Kraken | Custodial | 0.16–0.26% base | Proof-of-reserves, futures, staking | Transparency-focused traders |

| Uniswap | Non-custodial | 0.05–1% + gas | Token swaps, composability, UNI governance | On-chain traders |

| dYdX | Non-custodial | Low, volume-tiered | Perps, API trading, fast rollup execution | Derivatives + decentralization |

Key Takeaways

- Security and regulation should be your first filter when selecting an app.

- Coinbase and Kraken: great for compliance-minded and beginner-friendly trading.

- Binance: unmatched in features, liquidity, and fees.

- Uniswap: leader for non-custodial, on-chain swaps.

- dYdX: top choice for decentralized derivatives.

FAQ (People Also Asks)

What is a crypto trading app?

What is AI crypto trading?

Which is the best crypto trading app in 2025?

Is AI crypto trading safe?

How does regulation affect crypto trading apps?

Conclusion

In 2025, the best crypto trading app depends on your goals. Beginners should lean toward Coinbase for regulation and simplicity. Advanced traders get more value from Binance and Kraken. On-chain natives thrive on Uniswap and dYdX.

No matter which app you choose, remember:

- Prioritize security and transparency.

- Watch out for hidden fees.

- Choose the custody model that fits your risk appetite.

Apps will keep evolving, especially with AI-driven trading and stricter regulation, so staying informed is the real edge.

The crypto market in 2025 is bigger, faster, and more regulated than ever. Traders expect apps to offer more than buy/sell buttons — they want security, low fees, AI-powered tools, and smooth user experiences. This article reviews the best crypto trading apps of 2025, comparing security, features, and fees, so you can choose the right platform for your trading style.