- The Essential Role of Market Makers in Digital Asset Markets

- Understanding Market Making Fundamentals

- The Economic Theory Behind Market Making

- The Mechanics of Automated Market Making

- Risk and Inventory Management

- Building Advanced Market Making Systems

- Multi-Exchange Market Making Strategies

- Machine Learning in Modern Market Making

- High-Frequency Optimization Techniques

- Managing Complex Risk Scenarios

- Handling Market Volatility and Black Swan Events

- Competitive Dynamics and Game Theory

- Regulatory Compliance and Operational Considerations

- Real-World Implementation Strategies

- Choosing Your Technology Stack

- Backtesting and Simulation Frameworks

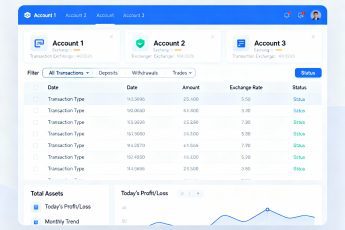

- Performance Monitoring and Optimization

- Conclusion: The Future of Automated Market Making

The Essential Role of Market Makers in Digital Asset Markets

Imagine walking into a marketplace where you want to buy apples, but there’s no one immediately selling them at the exact moment you arrive. You’d have to wait around hoping a seller shows up, or leave empty-handed. Now imagine another scenario where there’s always someone in that marketplace ready to sell you apples at a slightly higher price and willing to buy them from you at a slightly lower price. This permanent presence, this constant readiness to trade, is exactly what market makers provide to financial markets, and understanding how automated bots perform this function in cryptocurrency markets opens up one of the most sophisticated yet misunderstood trading strategies in the digital asset ecosystem.

To truly appreciate why market making bots have become so crucial to cryptocurrency markets, we need to understand the fundamental problem they solve. Unlike traditional stock markets where large banks and specialized firms have provided liquidity for decades, cryptocurrency markets started as peer-to-peer networks where buyers and sellers had to find each other organically. This created a chicken-and-egg problem that plagued early Bitcoin exchanges: traders wouldn’t use exchanges without liquidity, but liquidity couldn’t develop without active traders. Market making bots emerged as the solution, providing constant buy and sell orders that allow other traders to execute immediately whenever they want.

The evolution from human market makers clicking buttons on screens to sophisticated algorithms managing millions of dollars worth of orders represents a fascinating intersection of finance, technology, and game theory. These bots must simultaneously solve multiple complex problems: maintaining profitable spreads while competing with other market makers, managing inventory risk as prices fluctuate, avoiding adverse selection from informed traders who know something the bot doesn’t, and adapting to changing market conditions that can shift from calm to chaotic in seconds. Each of these challenges requires different mathematical models, technical solutions, and risk management approaches that we’ll explore in detail.

What makes cryptocurrency market making particularly interesting compared to traditional markets is the unique combination of opportunities and challenges. On one hand, crypto markets operate 24/7 across hundreds of venues with varying levels of sophistication, creating inefficiencies that skilled market makers can exploit. The absence of traditional regulatory requirements and market structure constraints allows for innovative approaches impossible in conventional finance. On the other hand, the volatility, fragmentation, and technical challenges of cryptocurrency markets demand robust systems capable of handling extreme conditions that would break traditional market making strategies.

Understanding Market Making Fundamentals

The Economic Theory Behind Market Making

At its core, market making represents a fascinating economic function where profit derives not from predicting price direction but from facilitating transactions between other participants. To understand this properly, let’s build up from first principles. When you act as a market maker, you’re essentially running a small exchange within an exchange, offering to buy from anyone who wants to sell (at your bid price) and sell to anyone who wants to buy (at your ask price). The difference between these prices, called the spread, compensates you for the service and risks you’re taking.

Think about what risks a market maker actually faces to earn that spread. First, there’s inventory risk—if you buy Bitcoin at $40,000 and the price drops to $39,000 before you can sell it, you’ve lost $1,000 regardless of your spread. Second, there’s adverse selection risk, which is more subtle but equally important. This occurs when informed traders (those who know something you don’t) systematically trade against your quotes. For instance, if someone knows bad news is about to break, they’ll hit your bid before the price drops, leaving you holding depreciated inventory. Understanding these risks helps explain why spreads exist and how market makers must price them.

The mathematical framework for optimal market making involves solving what economists call a stochastic control problem. The market maker must continuously decide what prices to quote based on current inventory, market volatility, order flow patterns, and competition from other market makers. The seminal academic work by Avellaneda and Stoikov provides a mathematical solution showing that optimal quotes should adjust based on inventory position—widening spreads and skewing prices to reduce inventory when position limits are approached. This theoretical foundation underlies most modern market making algorithms, though practical implementations add numerous refinements and adaptations.

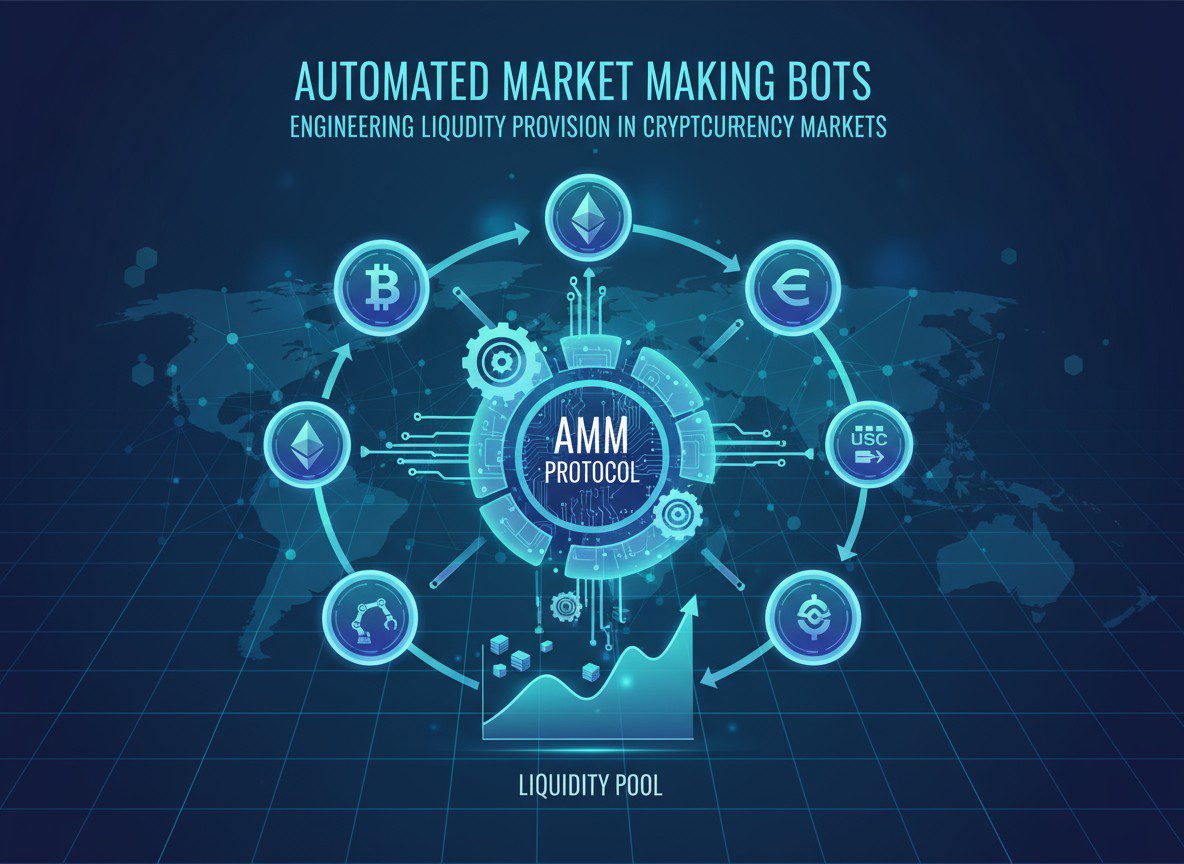

The Mechanics of Automated Market Making

Now let’s examine how automated market making actually works in practice, starting with the simplest possible implementation and building toward more sophisticated approaches. A basic market making bot might start by placing a buy order 0.1% below the current mid-price and a sell order 0.1% above it. When either order fills, the bot immediately replaces it while hoping the other side fills before prices move too much. This naive strategy can actually be profitable in stable, high-volume markets, but it quickly breaks down under real-world conditions.

Table 1: Evolution of Market Making Bot Complexity

| Generation | Strategy Type | Key Features | Risk Management | Typical Performance |

|---|---|---|---|---|

| First Gen (Basic) | Fixed spread around mid | Simple percentage offsets | Stop-loss only | Profitable only in ideal conditions |

| Second Gen (Dynamic) | Volatility-adjusted spreads | Spreads widen with volatility | Position limits | Consistent small profits |

| Third Gen (Inventory) | Inventory-based pricing | Skews quotes based on position | Dynamic hedging | Better risk-adjusted returns |

| Fourth Gen (Predictive) | ML-enhanced prediction | Anticipates price movements | Multi-venue hedging | Superior performance |

| Fifth Gen (Adaptive) | Self-optimizing parameters | Learns from market feedback | Portfolio-level risk | Robust across conditions |

Modern market making bots implement sophisticated order management systems that go far beyond simple bid-ask placement. They maintain order books across multiple price levels, creating what traders call a “ladder” of orders that provides depth to the market while capturing different types of order flow. The bot might place smaller orders close to the mid-price to capture high-frequency flow while maintaining larger orders further out to catch institutional trades or price spikes. This multi-level approach requires careful capital allocation and risk management, as each order represents a potential obligation that could be filled simultaneously during volatile periods.

The technical implementation involves several interconnected components working in perfect harmony. The pricing engine calculates optimal quotes based on market conditions and inventory. The risk management system monitors exposure and adjusts parameters when limits are approached. The execution system handles order placement, modification, and cancellation across potentially dozens of trading pairs and multiple exchanges. The monitoring system tracks performance metrics and alerts operators to unusual conditions. Each component must operate with microsecond precision while handling thousands of market data updates per second.

Risk and Inventory Management

Understanding inventory management separates profitable market makers from those who merely provide liquidity at a loss. Every trade that fills changes your inventory position, and managing this inventory becomes the central challenge of market making. Think of it like running a store where the value of your merchandise constantly fluctuates—you need to maintain enough inventory to serve customers, but not so much that a price drop devastates your capital.

The fundamental tension in inventory management comes from competing objectives. On one hand, you want to maintain balanced inventory (equal values of base and quote currencies) to minimize directional risk. On the other hand, customer order flow naturally creates imbalances—during bull markets, everyone wants to buy, leaving you short inventory; during bear markets, everyone sells, leaving you long. Successful market makers must find ways to manage these imbalances without sacrificing too much spread revenue.

Sophisticated inventory management strategies have evolved to address these challenges. One approach involves dynamically adjusting quote prices based on inventory position. If the bot accumulates too much Bitcoin, it might lower its ask price and raise its bid price, encouraging sales while discouraging further purchases. The mathematical formula for this adjustment typically follows:

Adjusted Bid = Mid Price – Half Spread – Inventory Skew × Inventory Position Adjusted Ask = Mid Price + Half Spread – Inventory Skew × Inventory Position

Where the inventory skew parameter controls how aggressively the bot tries to reduce inventory imbalances.

Building Advanced Market Making Systems

Multi-Exchange Market Making Strategies

Operating across multiple exchanges transforms market making from a local optimization problem into a global one, introducing both opportunities and complexities that single-exchange strategies can’t address. When you’re making markets on Binance, Coinbase, and Kraken simultaneously, you’re not just providing liquidity—you’re also connecting these markets, profiting from temporary price discrepancies while helping maintain efficient global prices. This multi-exchange approach requires sophisticated infrastructure and risk management but offers several compelling advantages.

The primary benefit of multi-exchange market making lies in risk distribution and opportunity multiplication. By spreading your activity across venues, you reduce dependence on any single exchange’s technical stability, regulatory status, or liquidity conditions. When one exchange experiences technical issues or unusual volatility, you can shift inventory and trading to other venues. Moreover, price discrepancies between exchanges create additional profit opportunities beyond simple spread capture. Your market making bot can buy on the cheaper exchange while simultaneously selling on the more expensive one, earning both the spread and the arbitrage profit.

Table 2: Multi-Exchange Coordination Challenges

| Challenge Category | Specific Issues | Impact on Strategy | Solution Approaches |

|---|---|---|---|

| Technical Synchronization | Different APIs, latencies, data formats | Execution delays, missed opportunities | Unified abstraction layer, predictive modeling |

| Capital Management | Fragmented balances across venues | Reduced capital efficiency | Dynamic rebalancing, credit facilities |

| Risk Aggregation | Positions spread across exchanges | Hidden risk concentration | Real-time portfolio system |

| Fee Optimization | Varying fee structures and tiers | Profitability differences | Smart order routing |

| Regulatory Compliance | Different rules per jurisdiction | Operational complexity | Automated compliance checking |

Implementing multi-exchange strategies requires solving the complex problem of optimal capital allocation. You need enough capital on each exchange to maintain meaningful market presence, but keeping too much idle capital reduces returns. Advanced systems implement predictive models that forecast volume and volatility patterns across exchanges, dynamically moving capital to where it’s most needed. Some sophisticated operators use credit facilities or margin trading to maintain market presence without fully funding positions, though this introduces additional risks that must be carefully managed.

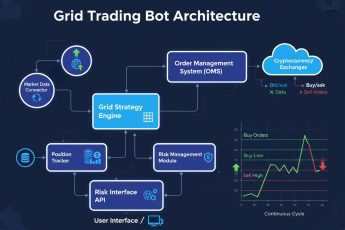

The technical architecture for multi-exchange market making resembles a distributed system more than a traditional trading application. Each exchange connection runs as an independent service, maintaining its own order state and connection management. A central coordination layer aggregates positions across all venues, calculates global risk metrics, and makes allocation decisions. This architecture must handle various failure modes—what happens if one exchange connection drops, if transfer delays prevent rebalancing, or if different exchanges show conflicting prices? Building resilience into every layer becomes essential for maintaining continuous operation.

Machine Learning in Modern Market Making

The integration of machine learning into market making strategies represents one of the most significant advances in recent years, transforming how bots predict price movements, detect toxic flow, and optimize parameters. Rather than relying on fixed rules or simple statistical models, ML-powered market makers learn from vast amounts of historical data to identify subtle patterns that human traders and traditional algorithms might miss. Understanding how these systems work and their advantages helps explain why institutional market makers invest millions in developing proprietary ML models.

Let’s start with the problem of toxic flow detection, which exemplifies how machine learning enhances market making. Toxic flow refers to orders from informed traders who know something the market maker doesn’t—perhaps they’ve seen news before it’s public, detected an arbitrage opportunity, or identified a pricing error. These traders systematically trade against market makers’ quotes when they’re mispriced, generating losses that can overwhelm spread revenues. Traditional approaches might flag unusually large orders or rapid successive trades, but these crude filters catch many false positives while missing sophisticated toxic traders.

Machine learning approaches this problem by analyzing hundreds of features from each trade and order. The model might examine factors like order size relative to recent average, time since last trade, correlation with trades on other exchanges, order book imbalance before the trade, and even patterns in the trader’s historical behavior if identifiable. By training on labeled historical data where toxic trades were identified after the fact, the model learns complex patterns that indicate informed trading. A gradient boosting model might discover that orders placed exactly 100 milliseconds after specific order book changes have an 80% probability of being toxic, a pattern too subtle for human detection.

Table 3: ML Applications in Market Making

| Application Area | Traditional Approach | ML Enhancement | Typical Improvement |

|---|---|---|---|

| Price Prediction | Moving averages, momentum | LSTM, Transformer models | 15-30% better accuracy |

| Spread Optimization | Fixed rules, volatility-based | Reinforcement learning | 20-40% more revenue |

| Toxic Flow Detection | Volume/frequency filters | Ensemble classifiers | 50-70% fewer losses |

| Inventory Management | Linear skewing | Deep Q-learning | 25-35% lower risk |

| Parameter Tuning | Manual backtesting | Bayesian optimization | 10-20% better Sharpe |

The implementation of ML systems requires careful consideration of the feedback loops inherent in market making. Unlike passive prediction problems, your market making bot’s actions influence the market, creating a complex dynamic system. If your bot learns to quote tighter spreads on Monday mornings based on historical patterns, other bots might detect and exploit this behavior, invalidating the original pattern. This adversarial aspect requires techniques from game theory and multi-agent reinforcement learning, where the model explicitly accounts for competitor adaptation.

Training and deploying ML models for market making presents unique challenges. The models must be retrained frequently to adapt to changing market conditions, but not so frequently that they overfit to noise. Feature engineering becomes crucial—raw price data rarely provides good signals, but derived features like order flow imbalance, microstructure indicators, and cross-market correlations can be highly predictive. The infrastructure must support rapid model updates while ensuring that a faulty model can’t cause catastrophic losses, requiring sophisticated testing and gradual rollout procedures.

High-Frequency Optimization Techniques

When we talk about high-frequency optimization in market making, we’re entering a realm where microseconds matter and technical excellence determines success. The difference between receiving market data 100 microseconds faster than competitors can translate to millions in additional profits over a year. Understanding these optimizations helps explain why successful market making operations invest heavily in technology infrastructure and why the barriers to entry keep rising.

Network optimization forms the foundation of high-frequency market making. Every network hop adds latency, so professional operations often colocate their servers in the same data centers as exchange matching engines. But colocation is just the beginning. The network path from your server to the exchange must be optimized at every level—using kernel bypass networking that avoids the operating system overhead, implementing custom network protocols that minimize packet size, and even selecting specific network interface cards known for lower latency. Some firms measure and optimize the physical cable lengths in their racks, as even a few extra feet of fiber optic cable adds measurable nanoseconds.

The software architecture for high-frequency market making diverges radically from traditional trading systems. Instead of using general-purpose programming languages and standard libraries, competitive market makers often write critical components in assembly language or use hardware acceleration through FPGAs (Field Programmable Gate Arrays). An FPGA can parse market data and make trading decisions in under a microsecond, compared to hundreds of microseconds for traditional software. The development complexity increases enormously—what might be ten lines of Python becomes thousands of lines of hardware description language—but the performance gains justify the investment for firms trading billions in volume.

Memory management becomes critical at high frequencies. Traditional memory allocation is far too slow, so market making systems pre-allocate all memory at startup and use custom memory pools. Data structures are carefully chosen for cache efficiency—a poorly chosen data structure that causes cache misses can slow critical paths by orders of magnitude. Some systems go further, pinning specific threads to CPU cores and carefully managing NUMA (Non-Uniform Memory Access) effects in multi-socket servers to ensure memory accesses stay within the same CPU’s local memory.

Managing Complex Risk Scenarios

Handling Market Volatility and Black Swan Events

Market making during extreme volatility presents challenges that can destroy unprepared operations in minutes. While normal market conditions might see price movements of 1-2% hourly, cryptocurrency markets can experience 10-20% moves in seconds during black swan events. Understanding how to build systems that survive and even profit from these extremes separates professional market makers from amateurs who provide liquidity only during calm periods when it’s least needed.

The first challenge during volatility spikes is maintaining system stability under extreme load. When prices move dramatically, order flow can increase 100-fold as traders rush to exit positions or capitalize on volatility. Your market making bot might normally process 1,000 orders per second but suddenly face 100,000. Every component must gracefully handle this load—message queues must not overflow, databases must not lock up, and risk calculations must still complete within acceptable timeframes. This requires extensive load testing and capacity planning, with systems typically designed to handle 10-100x normal load.

Table 4: Volatility Regime Adaptations

| Market Regime | Volatility Level | Spread Adjustment | Inventory Target | Risk Limits | Special Measures |

|---|---|---|---|---|---|

| Ultra-Calm | <10% annualized | 0.05-0.10% | ±50% of capital | Normal | Aggressive positioning |

| Normal | 10-50% annualized | 0.10-0.25% | ±30% of capital | Normal | Standard operation |

| Elevated | 50-100% annualized | 0.25-0.50% | ±20% of capital | Tightened | Increase monitoring |

| High | 100-200% annualized | 0.50-1.00% | ±10% of capital | Strict | Reduce position sizes |

| Extreme | >200% annualized | 1.00-2.00% | ±5% of capital | Minimal | Consider suspension |

| Black Swan | Unprecedented | Withdraw quotes | Neutral | Zero new risk | Emergency protocols |

Dynamic parameter adjustment during volatility requires sophisticated real-time analytics. The system must continuously estimate current volatility using multiple methods—GARCH models for statistical volatility, implied volatility from options markets where available, and high-frequency realized volatility from recent price movements. These estimates feed into parameter adjustment algorithms that might widen spreads linearly with volatility or use more complex non-linear relationships discovered through machine learning. The key is making these adjustments smoothly to avoid sudden changes that could be exploited by other traders.

Emergency protocols for extreme events go beyond normal parameter adjustments. When detecting anomalous conditions—perhaps prices moving more than 5% in under a second or order flow exceeding 50 times normal—the system might enter a defensive mode. This could involve immediately canceling all outstanding orders, closing positions through aggressive market orders regardless of spread, or even completely withdrawing from the market until conditions stabilize. These protocols must be carefully designed to avoid false triggers while ensuring activation when truly needed.

Competitive Dynamics and Game Theory

Market making isn’t performed in isolation—you’re constantly competing with other market makers for order flow while trying to avoid being exploited by sophisticated traders. This competitive dynamic creates a complex game-theoretic environment where your optimal strategy depends on what others are doing, and their strategies depend on yours. Understanding these dynamics helps explain seemingly irrational market behaviors and informs the design of robust market making strategies.

Consider what happens when multiple market makers compete on the same exchange. If you quote a spread of 0.20%, competitors might quote 0.19% to capture more order flow. You could respond by quoting 0.18%, triggering a race to the bottom that continues until spreads reach unprofitable levels. This dynamic explains why spreads on major cryptocurrency pairs have compressed dramatically over the years, from several percent in early Bitcoin markets to mere basis points today. The game theory suggests that the equilibrium spread should equal the marginal cost of market making, including risk costs, technical infrastructure, and capital costs.

But the competition goes beyond simple spread compression. Sophisticated market makers engage in complex strategic behaviors designed to disadvantage competitors. One strategy involves “pennying,” where you place orders one tick better than competitors’ quotes, capturing order flow while forcing them to provide liquidity at worse prices. Another involves “quote stuffing,” rapidly placing and canceling orders to slow down competitors’ systems or trigger their risk limits. While some of these practices raise ethical concerns, understanding them is essential for building systems that can operate in adversarial environments.

The presence of informed traders adds another layer to the game theory. These traders might split large orders across time to hide their information, use iceberg orders that only display part of their size, or even place deceptive orders in the opposite direction before executing their real trades. Market makers must model these behaviors and adjust their strategies accordingly. This might involve asymmetric responses to buy versus sell orders if flow toxicity differs, maintaining shadow books that track hidden liquidity, or using machine learning to identify patterns that reveal informed trading.

Regulatory Compliance and Operational Considerations

Operating a market making bot involves navigating complex regulatory landscapes that vary significantly across jurisdictions and continue evolving as authorities grapple with cryptocurrency markets. While market making itself is generally viewed as beneficial for markets, specific practices and operational aspects can trigger regulatory scrutiny. Understanding these requirements helps ensure sustainable operations that won’t be disrupted by regulatory actions.

In the United States, professional market making in cryptocurrencies might trigger registration requirements as a money services business (MSB) or even as a broker-dealer depending on the specific activities and tokens traded. The Financial Crimes Enforcement Network (FinCEN) requires MSBs to implement anti-money laundering programs, file suspicious activity reports, and maintain detailed transaction records. For market makers handling significant volumes, these compliance costs can be substantial, requiring dedicated compliance personnel and sophisticated transaction monitoring systems.

European regulations under MiFID II impose even more stringent requirements on algorithmic trading, including market making. These include obligations to maintain orderly markets, implement circuit breakers to prevent algorithmic errors from causing market disruption, and provide detailed documentation of trading algorithms to regulators upon request. The regulations also mandate minimum tick presence requirements—market makers must maintain quotes for a certain percentage of trading hours, preventing them from withdrawing during volatile periods when liquidity is most needed.

Tax treatment of market making activities creates additional complexity. The high frequency of trades generates thousands or millions of taxable events annually, each requiring precise record-keeping for tax reporting. In many jurisdictions, market making profits might be treated as ordinary income rather than capital gains, resulting in higher tax rates. Some jurisdictions offer specific tax treatments for registered market makers, but qualifying requires meeting specific criteria and maintaining detailed documentation of market making activities versus proprietary trading.

Real-World Implementation Strategies

Choosing Your Technology Stack

Building a market making bot requires careful selection of technologies that balance performance, reliability, development speed, and maintenance costs. The choice of programming language, databases, message queues, and deployment infrastructure fundamentally impacts what strategies you can implement and how successfully you can compete. Understanding the trade-offs helps you make informed decisions aligned with your specific goals and constraints.

For the core trading engine, language choice depends on your performance requirements and team expertise. Python offers rapid development and extensive libraries for data analysis and machine learning, making it popular for research and initial implementations. However, Python’s interpreted nature and Global Interpreter Lock create performance limitations that become problematic at higher frequencies. Many teams start with Python for prototyping then rewrite critical components in C++ or Rust for production. Rust, in particular, has gained popularity for its memory safety guarantees and performance comparable to C++ without the risk of segmentation faults that could crash your bot during critical market events.

Table 5: Technology Stack Comparisons

| Component | Option A | Option B | Option C | Selection Criteria |

|---|---|---|---|---|

| Core Language | Python | C++ | Rust | Performance vs development speed |

| Database | PostgreSQL | TimescaleDB | KDB+ | Query complexity vs ingestion speed |

| Message Queue | RabbitMQ | Kafka | Custom Ring Buffer | Latency vs reliability |

| Market Data | REST APIs | WebSocket | FIX/Binary | Data freshness vs complexity |

| Deployment | AWS EC2 | Bare Metal | Kubernetes | Control vs operational overhead |

| Monitoring | Grafana | Custom Dashboard | Datadog | Cost vs features |

The data storage layer presents interesting challenges for market making systems. You need to store vast amounts of tick data for backtesting and analysis—potentially terabytes of order book snapshots, trades, and your own order history. Time-series databases like TimescaleDB or InfluxDB excel at this workload, providing efficient compression and time-based queries. However, you also need fast key-value storage for maintaining current state, position tracking, and risk metrics. Many systems use a hybrid approach with Redis for hot data and PostgreSQL or TimescaleDB for historical data.

Infrastructure decisions significantly impact both performance and costs. Cloud providers like AWS or Google Cloud offer flexibility and managed services that reduce operational overhead, but the best compute instances can cost thousands per month and still have higher latency than dedicated hardware. Colocation in data centers near exchange servers provides superior performance but requires significant upfront investment and operational expertise. Some teams use a hybrid approach, running development and backtesting in the cloud while deploying production systems on colocated servers.

Backtesting and Simulation Frameworks

Developing a realistic backtesting framework for market making strategies presents unique challenges compared to simple directional strategies. You can’t just replay historical prices and assume your orders would have filled—you need to simulate the entire order book dynamics, including how your own orders would have affected the market. This requires sophisticated modeling that balances realism with computational feasibility.

The fundamental challenge in backtesting market making strategies stems from the fact that you’re simulating a counterfactual scenario. Historical data shows what happened without your bot participating, but your bot’s presence would have changed the order flow. If your bot had been quoting tight spreads, some traders might have taken your quotes instead of crossing the spread, changing the entire sequence of events. Professional backtesting frameworks address this through various approximations, such as assuming your orders only fill when the price trades through your level with sufficient volume.

Building accurate simulation environments requires modeling multiple layers of market behavior. At the most basic level, you need to simulate order matching—when would your orders have filled given historical trades? Next, you must model market impact—how would your orders have affected the order book? More sophisticated simulations include adverse selection modeling (are you more likely to get filled when you’re wrong about direction?), competitor responses (would other market makers have adjusted their quotes?), and even latency simulation (accounting for delays between seeing market data and having your orders in the book).

The technical implementation of backtesting systems often involves event-driven architectures that replay historical market events while maintaining full system state. Each historical trade, order book update, or other market event triggers the same logic that would execute in production, but with simulated order fills instead of real ones. This approach ensures consistency between backtesting and production behavior, though it requires careful handling of look-ahead bias and other statistical pitfalls that can make backtest results unrealistically optimistic.

Performance Monitoring and Optimization

Running a profitable market making operation requires sophisticated monitoring and continuous optimization based on real performance data. The metrics you track, how you analyze them, and how quickly you can identify and fix issues often determine the difference between success and failure. Understanding what to monitor and how to interpret the signals helps you maintain consistent profitability while avoiding catastrophic failures.

Real-time monitoring for market making goes far beyond simple profit and loss tracking. You need to monitor spread capture rates (what percentage of your spread are you actually earning?), inventory turnover (how quickly does inventory cycle through your book?), adverse selection metrics (are you consistently losing money on certain types of fills?), and competitive dynamics (are you winning appropriate market share?). Each metric provides insights into different aspects of your operation and might trigger different responses.

Table 6: Key Performance Metrics for Market Making

| Metric Category | Specific Metrics | Warning Thresholds | Critical Thresholds | Response Actions |

|---|---|---|---|---|

| Profitability | Spread capture rate, Daily P&L | <50% of spread | Negative daily P&L | Review pricing logic |

| Risk | Max inventory, VaR | >30% of capital | >50% of capital | Reduce position sizes |

| Execution | Fill rate, Queue position | <10% fills | <1% fills | Adjust price levels |

| Competition | Market share, Spread rank | <5% share | <1% share | Tighten spreads |

| Technical | Latency, Message queue depth | >10ms latency | >100ms latency | Investigate bottlenecks |

| Adverse Selection | Toxic fill rate | >20% toxic | >40% toxic | Improve flow filtering |

Performance attribution helps identify what’s driving your results. Is profitability coming from spread capture, inventory appreciation, or perhaps arbitrage opportunities? Are losses concentrated in specific time periods, tokens, or market conditions? Advanced attribution systems decompose returns into multiple factors—base spread revenue, timing gains or losses from inventory changes, costs from adverse selection, and fees. This decomposition guides optimization efforts by highlighting which components need improvement.

Continuous optimization based on performance data requires balancing exploration with exploitation. You want to exploit strategies that are working while exploring improvements that might work better. Techniques from multi-armed bandit problems and Bayesian optimization help navigate this trade-off. For instance, you might allocate 90% of capital to proven strategies while testing variations with the remaining 10%, gradually shifting allocation based on statistical evidence of superior performance.

Conclusion: The Future of Automated Market Making

As we’ve explored throughout this deep dive into automated market making, what appears on the surface as simply placing buy and sell orders actually involves sophisticated interplay between mathematical models, technical infrastructure, risk management, and competitive dynamics. The journey from understanding basic spread capture to implementing production-grade market making systems reveals layers of complexity that explain why successful market making remains challenging despite conceptual simplicity.

The evolution of market making in cryptocurrency markets mirrors broader trends in financial technology—increasing automation, growing importance of technical excellence, and convergence toward efficiency that benefits end users through tighter spreads and deeper liquidity. We’ve seen how strategies evolved from simple fixed spreads to dynamic inventory management, from single-exchange focus to global multi-venue optimization, and from rule-based systems to machine learning-powered adaptation. Each advancement raised the bar for new entrants while improving market quality for all participants.

Looking forward, several trends will shape the future of automated market making. The integration of artificial intelligence will deepen, with models becoming increasingly sophisticated at predicting short-term price movements, detecting toxic flow, and optimizing parameters. We’ll likely see the emergence of fully autonomous market making systems that require no human intervention, continuously learning and adapting to changing conditions. The development of decentralized market making protocols on blockchain platforms will create new opportunities and challenges, requiring adaptation to entirely different technical architectures and economic models.

For practitioners looking to enter the market making space, the path forward requires careful consideration of your competitive advantages and realistic assessment of required resources. If you’re beginning this journey, start by deeply understanding one specific market or trading pair before expanding. Build robust backtesting frameworks that accurately simulate market conditions, and always prioritize risk management over potential returns. Remember that successful market making is a marathon, not a sprint—consistent small profits with controlled risk outperform aggressive strategies that eventually blow up.

The technical arms race in market making will continue accelerating, but opportunities remain for those who find unique angles or underserved markets. Perhaps you’ll focus on emerging tokens where competition is limited, develop expertise in specific market regimes like volatility events, or innovate on the technical front with novel approaches to inventory management or execution. The key is finding sustainable edges that can’t be easily replicated while building systems robust enough to survive inevitable market storms.

Market making ultimately serves a crucial function in creating efficient, liquid markets that benefit all participants. By understanding the complexities involved—from the mathematical foundations through technical implementation to risk management and regulatory compliance—you’re better equipped to appreciate this vital market function whether as a practitioner, investor, or simply someone seeking to understand modern financial markets’ inner workings. The bots quietly placing orders across cryptocurrency exchanges represent some of the most sophisticated trading systems ever developed, and their continued evolution will shape how digital asset markets function for years to come.