Every trader who ventures into cryptocurrency markets quickly learns the fundamental wisdom that pervades trading education: you must use stop-loss orders to protect your capital. The advice appears everywhere, from YouTube tutorials to professional trading courses, always emphasizing that stops are not optional but mandatory for survival. Yet despite this universal agreement on the importance of stops, most educational content stops at the most superficial level, telling you to place your stop-loss at some arbitrary percentage below your entry, perhaps two percent or five percent depending on the guru’s preference.

This basic approach to stop-loss placement treats all market conditions as identical, assumes all cryptocurrencies behave similarly, and ignores the actual structure of price action that determines whether a stop will save you from a losing trade or simply guarantee a loss on what would have been a winning position. The result is that countless traders dutifully place their stops according to these simple percentage rules, only to watch in frustration as the market repeatedly triggers their stops before moving in their anticipated direction, or conversely, as stops placed too far away allow small losses to become devastating drawdowns.

The reality that separates consistently profitable traders from those who struggle is far more nuanced than percentage-based stop placement. Effective stop-loss strategy requires adapting to volatility conditions, respecting the actual structure of support and resistance, accounting for the specific timeframe you are trading, and recognizing that different market environments demand fundamentally different approaches to protecting capital. A stop-loss strategy that works brilliantly during a low-volatility grinding uptrend may be completely inappropriate during a high-volatility correction, and a stop placement that makes sense for a four-hour swing trade would be absurd for a fifteen-minute scalp.

This article will take you beyond the beginner-level advice and teach you sophisticated stop-loss strategies that professional traders actually use in real market conditions. We will explore how to calculate volatility-adjusted stops that adapt to changing market conditions, how to use market structure to place stops in zones where they are least likely to be hunted, how to implement trailing stops that lock in profits without giving back gains, and how to recognize when market conditions suggest avoiding trades entirely rather than simply placing tighter stops. By the time you finish reading, you will have the knowledge to protect your capital intelligently rather than mechanically.

- The Fatal Flaws in Percentage-Based Stop-Loss Placement

- Stop Placement Quality Comparison Table

- Volatility-Adjusted Stop-Loss Calculations Using ATR

- ATR Multiplier Selection Guide

- Structure-Based Stop Placement: Respecting Support and Resistance

- Market Structure Stop Placement Framework

- Trailing Stops: Locking in Profits Without Giving Back Gains

- Trailing Stop Strategy Comparison

- Mental Stops Versus Hard Stops: The Execution Dilemma

- Stop Execution Method Comparison

- Conditional Stop Strategies: When Market Conditions Dictate Stop Placement

- Market Regime Stop Strategy Matrix

- The Psychology of Stops: Why Following Your Rules Is Harder Than Setting Them

- Psychological Barriers to Stop Execution and Solutions

- Building Your Personal Stop-Loss System: Integration and Implementation

- Complete Stop-Loss System Template

- Conclusion: Stop-Loss Strategy as Professional Risk Management

The Fatal Flaws in Percentage-Based Stop-Loss Placement

Before we can build better stop-loss strategies, we need to clearly diagnose what makes the basic percentage approach so problematic in cryptocurrency trading. The standard advice to place stops at some fixed percentage below your entry, whether that is two percent, three percent, or five percent, sounds logical on the surface. After all, you are limiting your risk to a known amount on each trade, which aligns with the fundamental principle of risk management.

The first critical flaw in this approach emerges when you consider the wildly different volatility characteristics across different cryptocurrencies. Bitcoin might have an average daily price movement of three to four percent during normal conditions, meaning a five percent stop gives you some breathing room beyond normal volatility. However, many smaller altcoins routinely swing eight to fifteen percent in a single day during ordinary market activity. Placing a five percent stop on such an asset means you are positioning your stop well within the range of normal noise, virtually guaranteeing it will be triggered by routine volatility rather than by a genuine change in the trade thesis.

Let me walk you through a concrete example that will make this crystal clear. Imagine you are trading Ethereum, which is displaying relatively stable price action with daily ranges around three percent. You enter a long position at two thousand dollars and place a five percent stop-loss at one thousand nine hundred dollars. This gives you one hundred dollars of room, which represents more than a full day’s typical movement. Your stop is positioned outside normal volatility, meaning it should only trigger if something genuinely wrong happens with your trade.

Now consider you take a position in a volatile altcoin that regularly moves twelve percent per day. You enter at ten dollars and place that same five percent stop at nine dollars and fifty cents. This fifty cent buffer represents less than half a typical daily range. The market does not need to move against your thesis to hit this stop. Simple random volatility, perhaps a few large sells from an automated market maker rebalancing or a whale taking profit, can trigger your stop even though nothing fundamental has changed about your trade setup. You have not limited your risk to positions with genuine problems. You have simply guaranteed that normal volatility will repeatedly stop you out.

The second fatal flaw involves ignoring market structure entirely. Markets do not move in straight lines but rather in waves, creating support and resistance levels where buying and selling pressure concentrates. These levels form at previous swing highs and lows, round psychological numbers, major moving averages, and other technical points that many traders watch. When you place a stop at an arbitrary percentage level, you randomly drop it somewhere that may have no relationship whatsoever to where the market is likely to find support or face resistance.

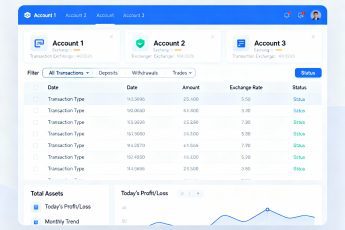

Stop Placement Quality Comparison Table

To illustrate how different approaches to stop placement perform under identical market conditions, consider this comparison showing the same trade setup with various stop-loss strategies.

| Stop-Loss Strategy | Stop Placement | Distance from Entry | Logic Behind Placement | Result in Volatile Market | Result in Trending Market |

|---|---|---|---|---|---|

| Fixed 3% Rule | $1,940 | 3% | Arbitrary percentage | Triggered by noise 60% | Works if trend continues |

| Fixed 5% Rule | $1,900 | 5% | Arbitrary percentage | Better survival 40% | Larger losses on reversals |

| Below Recent Low | $1,925 | 3.75% | Market structure | Respects support, 70% survival | Validates when broken |

| ATR-Based (1.5x) | $1,910 | 4.5% | Volatility-adjusted | Adapts to conditions 75% survival | Appropriate for environment |

| Time-Based Trail | Starts $1,900, trails up | 5% initial | Locks in gains | Converts to profits 65% | Excellent in trends 80% |

This comparison reveals that percentage-based stops are the worst performers across different market conditions because they have no relationship to how the market actually behaves. The structure-based and volatility-adjusted approaches survive more frequently because they respect the actual dynamics of price movement rather than imposing arbitrary numbers on complex market behavior.

The third fundamental flaw concerns the psychological game that market makers and large traders play around obvious stop-loss levels. When thousands of retail traders all learn to place stops at round percentage levels like three percent or five percent below entry, those levels become visible clusters where massive stop-loss orders accumulate. Sophisticated traders who can see order book depth recognize these clusters and have strong incentive to push price into those levels to trigger the stops, creating instant selling pressure that they can buy into before price reverses.

This phenomenon, often called stop hunting, is not a conspiracy theory but rather a rational response to visible market structure. If you can see that there are ten million dollars worth of sell stops clustered just below a level, and you have the capital to push price down into that level, you can trigger those stops, causing them to execute as market sells, which temporarily pushes price even lower. You then buy at this artificial low point before the natural buying pressure resumes and price recovers. Retail traders who used obvious percentage stops are left stopped out at the low, while the sophisticated trader profits from their predictability.

The solution to these flaws requires building stop-loss strategies that adapt to volatility, respect market structure, and avoid clustering at obvious levels where stops can be hunted. This means moving beyond the comfortable simplicity of percentage rules and embracing more sophisticated approaches that require understanding market dynamics rather than just following a formula.

Volatility-Adjusted Stop-Loss Calculations Using ATR

The foundation of professional stop-loss placement begins with adjusting your stops based on how much the asset actually moves rather than imposing arbitrary percentage distances. The most widely used tool for this purpose is the Average True Range indicator, commonly abbreviated as ATR, which measures the average distance between the high and low of each period over a specified number of periods.

The Average True Range gives you a quantified measure of normal volatility for any asset on any timeframe. When Bitcoin has an ATR of one thousand dollars on the daily chart, this tells you that on a typical day, the distance between the high and low is around one thousand dollars. When a volatile altcoin has an ATR of two dollars while trading at ten dollars, you know it routinely swings about twenty percent of its value in daily ranges. This information allows you to place stops that are appropriately sized for the actual behavior of each specific asset rather than treating all assets identically.

The basic formula for ATR-based stop placement works by multiplying the ATR by a coefficient that determines how many times the average range you want to allow before your stop triggers. A common starting point is using two times ATR, meaning you place your stop at a distance equal to twice the average daily range. This positioning gives price enough room to breathe through normal volatility while still limiting losses to a reasonable level if the trade thesis breaks down.

Let me show you exactly how this works with real numbers. Suppose you are considering a long trade in Ethereum at a current price of two thousand five hundred dollars. You check the ATR on the daily chart and find it is currently seventy-five dollars. This means typical daily ranges are around seventy-five dollars, so Ethereum commonly moves three percent up or down in normal daily action.

If you use a two times ATR stop, you multiply seventy-five dollars by two to get one hundred fifty dollars, then subtract this from your entry price. Your stop would be placed at two thousand three hundred fifty dollars, which is six percent below your entry. Notice this is a larger stop than a simple three percent rule would give you, but it is appropriate for Ethereum’s actual volatility. If Ethereum’s ATR were only fifty dollars during a calmer period, your two times ATR stop would be only one hundred dollars or four percent, automatically adjusting to the current volatility regime.

Now apply the same approach to a more volatile asset. You are considering a position in Solana at one hundred twenty dollars, and you check the ATR to find it is currently twelve dollars. The typical daily range is ten percent of the price. Using two times ATR, you multiply twelve by two to get twenty-four dollars, placing your stop at ninety-six dollars, which is twenty percent below entry. This much larger percentage distance is appropriate for Solana’s higher volatility, preventing you from being stopped out by normal price swings.

ATR Multiplier Selection Guide

The question naturally arises: how do you choose the right ATR multiplier? Using two times ATR is a starting point, but different trading styles and market conditions call for different multipliers. This table provides guidance on selecting appropriate multipliers based on your trading approach and current market conditions.

| Trading Style | Timeframe | Recommended ATR Multiplier | Typical Stop Distance | Rationale |

|---|---|---|---|---|

| Scalping | 1-5 minutes | 1.0-1.5x ATR | 0.3-0.8% | Tight stops, quick exits needed |

| Day Trading | 15min-1hour | 1.5-2.0x ATR | 1-3% | Balance between room and protection |

| Swing Trading | 4hour-Daily | 2.0-3.0x ATR | 3-8% | Need room for daily noise |

| Position Trading | Daily-Weekly | 3.0-4.0x ATR | 8-15% | Long-term holds need breathing room |

| High Volatility Period | Any timeframe | Add 0.5-1.0x to normal | Wider than usual | Extra protection during chaos |

| Low Volatility Period | Any timeframe | Subtract 0.5x from normal | Tighter than usual | Less room needed when calm |

This table demonstrates that ATR-based stops are not a one-size-fits-all formula but rather a flexible framework that adapts to both your trading style and current market conditions. Shorter timeframe traders use smaller multipliers because they are trying to capture smaller moves and cannot afford to give back large amounts. Longer timeframe traders use larger multipliers because they need to tolerate short-term noise that is irrelevant to their longer-term thesis.

The practical implementation of ATR stops requires having access to the indicator on your charting platform. Most major platforms including TradingView, Coinigy, and exchange platforms like Binance and Coinbase Advanced provide ATR as a standard indicator. You simply add the ATR indicator to your chart, note the current value, multiply by your chosen coefficient, and calculate your stop-loss level.

One refinement that professional traders often employ involves using the ATR value from when you enter the trade rather than constantly recalculating based on current ATR. This creates consistency in your risk management. When you enter a trade with ATR at seventy-five dollars and calculate a stop one hundred fifty dollars away, that stop remains fixed even if ATR increases to eighty dollars over the following days. This prevents your stop from moving further away and increasing your dollar risk after entry. However, if you are considering a new trade and ATR has changed significantly since your last trade, you always use the current ATR to calculate the appropriate stop distance.

Another advanced consideration involves recognizing that ATR measures volatility but does not distinguish between up volatility and down volatility. In strongly trending markets, price might make large moves in the trend direction while barely retracing, creating high ATR even though downside volatility is modest. In such cases, you might use a smaller ATR multiplier than normal because the market is trending cleanly rather than chopping around. Conversely, during choppy sideways markets where price whipsaws in both directions, you might increase your ATR multiplier to avoid being stopped out by the back-and-forth noise.

The mathematical beauty of ATR-based stops is that they automatically solve the problem of different assets having different volatility characteristics. You do not need different percentage rules for Bitcoin versus altcoins versus stablecoins. You simply apply the same ATR multiplier framework to each asset, and the resulting stop distances will naturally be appropriate for that asset’s behavior. This consistency across your trading approach reduces cognitive load and prevents the errors that come from trying to remember different percentage rules for different scenarios.

Structure-Based Stop Placement: Respecting Support and Resistance

While volatility-adjusted stops solve the problem of adapting to different assets and market conditions, they still place stops at somewhat arbitrary distances that may not align with meaningful price levels. The next level of sophistication involves placing stops based on market structure, meaning the actual support and resistance levels that emerge from accumulated buying and selling pressure at specific prices.

Market structure forms through the interaction of countless traders making decisions about where they are willing to buy and sell. When price declines to a level and then bounces higher, that low point represents a place where buying interest was strong enough to overwhelm selling pressure. This becomes a support level. If you are entering a long position above this support, placing your stop just below it creates a logical risk point: if price breaks through the support level, it invalidates the structure that gave you confidence in the trade, so exiting makes sense.

The key word in that logic is “just below” the support level, which requires thinking about where other traders are likely to place their stops. If support formed at two thousand dollars and you place your stop at one thousand nine hundred ninety-nine dollars, you are positioning it at exactly the obvious level where thousands of other traders are probably placing theirs. This creates the stop cluster that invites hunting. Better practice involves placing your stop a meaningful distance below the support level, far enough that minor stop hunts will not trigger you, but close enough that if price truly breaks the support, you are still protected.

Let me illustrate this with a detailed example that shows the thought process. Suppose you are analyzing Ethereum and you see that over the past week, price has declined to two thousand four hundred dollars three separate times and bounced higher each time. This creates a clear support level at two thousand four hundred dollars. You are considering entering a long position at the current price of two thousand five hundred dollars as price bounces away from support once again.

The naive approach would be to place a stop just below two thousand four hundred dollars, perhaps at two thousand three hundred ninety-five dollars, thinking you want to be stopped out the moment support breaks. The problem is that this is exactly where everyone else is placing stops. Large traders know this and have incentive to push price to two thousand three hundred ninety dollars, trigger all those stops, then buy at the resulting panic low before price recovers back above two thousand four hundred dollars. You get stopped out at two thousand three hundred ninety dollars, watch in frustration as price immediately returns to two thousand four hundred twenty dollars, then continues higher to your original profit target without you.

The sophisticated approach recognizes the game being played and positions your stop far enough below support to survive minor hunting while still exiting if support truly breaks. You might place your stop at two thousand three hundred fifty dollars, which is fifty dollars below the obvious support level. This gives you two percent of breathing room below support. If price pushes down to two thousand three hundred ninety dollars to hunt stops but then recovers, you remain in the trade. Only if price breaks meaningfully below support, indicating the structure has truly failed, will your stop trigger.

Market Structure Stop Placement Framework

To make structure-based stop placement systematic rather than arbitrary, professional traders use frameworks that define exactly how far below support or above resistance to place stops based on various factors. This table provides specific guidance.

| Market Condition | Support/Resistance Strength | Stop Placement Below Support | Reasoning | Example Calculation |

|---|---|---|---|---|

| Clear, Tested Multiple Times | Strong | 1.5-2.5% below | Support is reliable, small buffer needed | $2,400 support → $2,350-$2,360 stop |

| Only Tested Once | Moderate | 2.5-3.5% below | Less confident, need more buffer | $2,400 support → $2,315-$2,340 stop |

| Near Round Number | Variable | 3-4% below | Psychological level, often hunted | $2,000 support → $1,920-$1,940 stop |

| Major Moving Average | Strong | 2-3% below MA | Technical level, widely watched | $2,400 200-MA → $2,330-$2,350 stop |

| High Volatility Environment | Any strength | Add 0.5-1% to normal | More noise, need extra buffer | $2,400 support → $2,325-$2,350 stop |

| Low Liquidity Asset | Any strength | Add 1-2% to normal | Thin books allow manipulation | $2,400 support → $2,300-$2,325 stop |

This framework ensures you are not placing stops at the exact obvious levels while still maintaining stops close enough to support that genuine breaks will trigger exits. The specific distance you choose depends on how confident you are in the support level, how volatile the asset is, and how liquid the market is.

An important refinement involves combining structure-based placement with ATR calculations to ensure your stop distance is appropriate for volatility. You might identify support at two thousand four hundred dollars and decide to place your stop two percent below at two thousand three hundred fifty-two dollars based on structure. Then you check ATR and find it is currently one hundred dollars, suggesting a two times ATR stop would be two hundred dollars away. Your structure-based stop at one hundred forty-eight dollars away is well within the ATR-suggested range, confirming it is appropriately sized for volatility. If your structure-based stop were three hundred dollars away, exceeding reasonable ATR multiples, you might reconsider whether the trade offers acceptable risk-reward.

The opposite scenario applies for resistance levels when you are shorting or considering taking profits on long positions. If you short at two thousand five hundred dollars with resistance at two thousand six hundred dollars, you place stops above resistance far enough to avoid being hunted but close enough to exit if resistance breaks. The same percentages apply, typically placing stops one point five to four percent above resistance depending on the factors in the framework table.

Trailing Stops: Locking in Profits Without Giving Back Gains

One of the most frustrating experiences in trading occurs when you make a good entry, the trade moves in your favor generating substantial unrealized profits, then price reverses and your profits evaporate or even turn into a loss. You watch your position go from up fifteen percent to flat to down five percent, wondering whether you should have taken profits or moved your stop or just held on. Trailing stops provide a systematic solution to this problem by automatically moving your stop-loss level higher as price moves in your favor, locking in gains without requiring constant attention.

The basic concept of a trailing stop is elegantly simple. Instead of keeping your stop-loss at the initial level you set when entering the trade, you define a trailing distance and instruct your trading platform to automatically move the stop higher whenever price makes new highs. The stop never moves down, only up, creating a ratcheting effect that captures profits if price reverses significantly but does not force you out during minor pullbacks within a continuing trend.

Let me walk you through how this actually works with specific numbers. Suppose you buy Ethereum at two thousand dollars and set an initial stop-loss at one thousand nine hundred dollars, risking five percent. You also activate a trailing stop set to trail by five percent. Initially, this trailing stop sits at one thousand nine hundred dollars, identical to your initial stop. As price rises, the trailing mechanism begins working.

When Ethereum reaches two thousand two hundred dollars, representing a ten percent gain, your trailing stop automatically moves up to maintain the five percent trailing distance. The new stop is now at two thousand ninety dollars, five percent below the highest price reached. You have locked in four point five percent profit because even if price reverses, your stop at two thousand ninety dollars guarantees you exit with a gain. If price continues to two thousand five hundred dollars, your trailing stop moves to two thousand three hundred seventy-five dollars, locking in nearly nineteen percent profit.

The magic of trailing stops becomes apparent when price finally reverses. Ethereum peaks at two thousand six hundred dollars, moving your trailing stop to two thousand four hundred seventy dollars. Then a correction begins and price declines. You do nothing, simply allowing the trailing stop to do its job. When price falls to two thousand four hundred seventy dollars, your trailing stop triggers and you are automatically exited with a twenty-three point five percent profit. Without the trailing stop, you might have watched those gains evaporate, hoping the trend would resume, only to eventually exit at breakeven or even a loss.

Trailing Stop Strategy Comparison

Different trailing stop approaches suit different trading styles and market conditions. This comprehensive table compares the major variations to help you choose the right approach for your situation.

| Trailing Stop Type | How It Works | Best For | Advantages | Disadvantages | Example |

|---|---|---|---|---|---|

| Fixed Percentage Trail | Trails by constant % from peak | Trending markets, swing trades | Simple to set, reliable profit locking | Can trail too close in volatile markets | 5% trail on strong trend |

| ATR-Based Trail | Trails by multiple of ATR | All market conditions | Adapts to volatility automatically | Requires ATR recalculation | 2x ATR trail adjusts with conditions |

| Structure-Based Trail | Moves stop to successive support levels | Trending with clear pullback levels | Respects market structure | Requires manual adjustment | Trail to each swing low as trend rises |

| Time-Based Trail | Tightens trail after holding period | Position trades, long-term holds | Locks gains as conviction builds | Time-based logic may not match price action | Tighten trail every two weeks |

| Acceleration Trail | Trail tightens as profit increases | Explosive moves, momentum trades | Captures more of parabolic runs | Complex to implement | Trail 8% initially, 5% at 20% profit, 3% at 40% profit |

| Chandelier Trail | Trails below highest high minus ATR | Volatility trading | Excellent for volatile assets | Can trail too wide in calm markets | High minus 3x ATR |

This comparison reveals that trailing stops are not a single technique but rather a family of related approaches, each with specific use cases. Fixed percentage trails work beautifully in smooth trends but struggle in choppy markets where normal volatility repeatedly triggers the trail. ATR-based trails solve this by adapting to changing volatility, widening during chaos and tightening during calm. Structure-based trails require more manual work but often achieve the best results by respecting how the market actually moves rather than imposing mathematical formulas.

The acceleration trail concept deserves special attention because it solves a common problem with fixed trails. When you use a five percent trail from the start of a trade, you risk being stopped out early by normal pullbacks before the trend fully develops. But keeping a wider trail throughout the entire trend means giving back more profit when the trend finally ends. Acceleration trails start with a wider distance to give the trend room to develop, then progressively tighten as profits accumulate, capturing more of the trend on both ends.

Here is how an acceleration trail might work in practice. You enter long at two thousand dollars with an initial stop at one thousand nine hundred dollars. For the first ten percent of profit, up to two thousand two hundred dollars, you use an eight percent trail, giving the trade substantial breathing room. Once you reach twenty percent profit at two thousand four hundred dollars, you tighten to a five percent trail because you have confidence the trend is real. Once you reach forty percent profit at two thousand eight hundred dollars, you tighten further to a three percent trail because you want to lock in most of these substantial gains. This progressive tightening captures more of the trend than either a consistently wide or consistently tight trail would achieve.

Implementing trailing stops requires understanding what your trading platform offers. Most major exchanges including Kraken, Bybit, and Coinbase provide trailing stop functionality where you simply enter the trailing distance as a percentage or absolute value. The exchange automatically calculates and updates your stop as price moves. Some platforms like 3Commas and Cryptohopper offer even more sophisticated trailing options including the acceleration and ATR-based trails described above.

For traders using platforms without built-in trailing stops, manual trailing requires discipline. You establish a rule, such as “move my stop to breakeven after ten percent profit and then move it up to lock in seventy-five percent of subsequent gains,” and you commit to checking your positions regularly to execute this rule. Setting calendar reminders or price alerts helps ensure you actually move your stops rather than letting discretion and hope override your system.

Mental Stops Versus Hard Stops: The Execution Dilemma

A crucial decision that every trader must make involves whether to place stop-loss orders directly with the exchange as hard stops that execute automatically, or to maintain mental stops where you monitor price and manually execute when your stop level is reached. This choice carries significant implications for risk management and trading psychology that many traders do not fully appreciate until painful experience teaches them.

The theoretical appeal of mental stops is that they avoid the stop hunting problem we discussed earlier. If your stop is not visible in the order book, market makers cannot see it and therefore cannot specifically target it to trigger your exit. Additionally, mental stops give you flexibility to evaluate context when price reaches your stop level. Perhaps news just broke explaining the move, or perhaps the touch of your stop was an obvious liquidation wick that immediately reversed. With a mental stop, you can exercise judgment rather than being mechanically exited by a brief spike.

However, the practical reality of mental stops reveals severe problems that overwhelm these theoretical benefits for most traders. The fundamental issue is that mental stops rely entirely on your discipline and emotional state exactly at the moment when fear, hope, and loss aversion are most likely to cloud judgment. When price is approaching your mental stop level, a psychological battle begins where every fiber of your being generates reasons why you should give the trade just a little more room or wait to see if this is just a false breakdown.

Let me paint the scenario that virtually every trader who uses mental stops eventually experiences. You enter long at two thousand dollars with a mental stop at one thousand nine hundred dollars. Price declines to one thousand nine hundred twenty dollars and you think “this could be a false breakdown, I will wait to see if it recovers.” Price hits one thousand nine hundred dollars exactly and you think “well, it might bounce right from my stop level, let me see how it reacts here before exiting.” Price continues to one thousand eight hundred seventy dollars and you think “it has already gone past my stop, so exiting now would just lock in a bigger loss than planned, maybe it will recover from here.” Price continues falling and you eventually exit at one thousand seven hundred fifty dollars, taking a twelve point five percent loss on a trade where you planned to risk only five percent.

This scenario is not an exaggeration or strawman argument but rather the precise mechanism by which mental stops fail in practice. The discipline required to manually execute a stop when price reaches your predetermined level is extraordinarily difficult to maintain because every instinct tells you that just waiting a bit longer might save the trade. Traders who succeed with mental stops are typically those with years of experience and ironclad discipline, or those trading in environments like over-the-counter markets where hard stops are not practically available.

Stop Execution Method Comparison

To help you make an informed choice about which approach suits your situation, this detailed comparison examines the tradeoffs between different stop execution methods.

| Stop Method | Execution Reliability | Protection from Stop Hunts | Flexibility for Context | Required Discipline | Best Suited For |

|---|---|---|---|---|---|

| Exchange Hard Stop | 100% guaranteed | Vulnerable to visible stops | None, triggers mechanically | Low – system enforces | Most traders, especially newer ones |

| Mental Stop | Depends entirely on trader | Protected, stops not visible | Maximum, evaluate each situation | Extreme – rarely maintained | Experienced professionals only |

| Stop-Limit Order | Executes if liquidity available | Vulnerable but adds slippage protection | None, triggers mechanically | Low – system enforces | Markets with good liquidity |

| Automated Alert + Manual | Depends on trader response time | Protected from visible stops | High, can evaluate upon alert | Moderate – must act on alerts | Traders who can respond quickly |

| Third-Party Bot Execution | Very high, bot follows rules | Protected if bot logic hidden | Some, based on bot programming | Low – bot enforces | Sophisticated traders with bot access |

This comparison reveals that hard stops placed directly with the exchange are the appropriate choice for the vast majority of traders because they guarantee execution and remove the psychological burden of manual exits. The vulnerability to stop hunting, while real, is a smaller problem than the near-certainty that you will fail to execute mental stops consistently.

For traders determined to use mental stops despite the challenges, several practices can improve success rates. First, establish written rules that are completely unambiguous about when you exit, such as “exit immediately with no discretion if price closes below stop level” or “exit if price trades through stop level by more than one percent.” The specificity removes wiggle room for rationalization. Second, set price alerts at your stop level so you receive notification when discipline is required, rather than having to constantly watch the chart. Third, use a pre-written order that you can execute with a single click when price reaches your stop, removing the friction that creates hesitation.

Some advanced traders use a hybrid approach where they place hard stops for disaster protection but maintain those stops far enough away that they function as true catastrophe stops only. They then use mental stops or alerts closer to price for normal exits. For example, you might enter at two thousand dollars with a mental stop at one thousand nine hundred fifty dollars but also place a hard stop at one thousand eight hundred fifty dollars. If you fail to execute your mental stop due to hesitation or absence, the hard stop at least prevents the loss from becoming catastrophic. This approach requires sufficient capital that the wider hard stop still represents acceptable risk.

Conditional Stop Strategies: When Market Conditions Dictate Stop Placement

As traders gain experience, they begin to recognize that optimal stop-loss placement often depends on specific market conditions that cannot be captured by any single formula or approach. Conditional stop strategies implement different stop logic based on identifiable market regimes, adapting your protection approach to current reality rather than applying the same technique regardless of context.

The foundation of conditional stops requires defining clear criteria that distinguish different market regimes and then establishing appropriate stop strategies for each regime. The most important distinction for stop placement purposes separates trending markets from ranging markets, because these environments require fundamentally different approaches to risk management.

In trending markets where price is making consistent higher highs and higher lows in an uptrend, or lower lows and lower highs in a downtrend, your stop-loss strategy should emphasize trailing stops that lock in profits as the trend develops. The market structure is providing you clear information about direction, so your primary concern shifts from limiting losses to capturing as much of the trend as possible. You might use wider initial stops to give the trend room to breathe, then implement aggressive trailing to ratchet gains higher as confidence in the trend increases.

Ranging markets where price oscillates between defined support and resistance levels without clear directional bias require the opposite approach. Your stops need to be tighter because ranges are mean-reverting environments where moves away from the center tend to snap back quickly. You cannot afford to give trades much room in ranges because the entire profit potential from support to resistance might be only five or eight percent, making it impossible to use stops that allow five percent losses. Instead, you might use stops at one times ATR or even tighter, accepting more frequent stops as the price of trading in a less favorable environment.

Let me show you exactly how this works with a detailed example. Suppose you are analyzing Ethereum and you identify that it has been ranging between two thousand two hundred and two thousand six hundred dollars for the past three weeks, with multiple tests of both boundaries. The total range is four hundred dollars or roughly eighteen percent of the midpoint. You decide to buy at support near two thousand two hundred fifty dollars, targeting the middle or upper end of the range.

In this ranging environment, you recognize that if support breaks, price is likely to fall sharply as it transitions to a new lower range. Therefore, you place a tight stop just fifty dollars below the support at two thousand two hundred dollars, risking about two point two percent. This tight stop makes sense because the range environment means price either bounces from support or breaks through decisively, with little middle ground. You are not trying to hold through substantial adversity but rather making a mean-reversion bet that pays off quickly or fails cleanly.

Now contrast this with a trending scenario. Ethereum has been in a strong uptrend for six weeks, making consistent higher lows and higher highs. You enter at two thousand four hundred dollars as price pulls back to support at the rising twenty-one day moving average. In this trending environment, you use a much wider stop at two thousand two hundred dollars, risking eight percent, because you know trends often experience false breakdowns and volatility that would trigger tighter stops. You are betting on trend continuation and need to give it room to work. You also implement a trailing stop starting at eight percent trailing distance, tightening to five percent after reaching twenty percent profit, because you want to ride the trend as far as it goes.

Market Regime Stop Strategy Matrix

To systematically implement conditional stops based on market regime, use this decision matrix that specifies appropriate stop characteristics for each identifiable market condition.

| Market Regime | Key Indicators | Initial Stop Distance | Trailing Strategy | Stop Adjustment Logic | Risk Level |

|---|---|---|---|---|---|

| Strong Uptrend | Higher highs, higher lows, price above 50/200 MA | 2.5-4x ATR (6-10%) | Aggressive trail, 3-5% | Widen stops, focus on staying in | Moderate, trend protects |

| Weak Uptrend | Irregular highs, shallow pullbacks | 2-3x ATR (4-7%) | Moderate trail, 5-7% | Normal stops, prepare for reversal | Moderate-High, could break |

| Tight Range | Clear support/resistance, low ATR | 1-1.5x ATR (2-4%) | No trail, take profit at resistance | Very tight, range mean-reverts | High, frequent stops |

| Wide Range | Volatile swings within boundaries | 2-2.5x ATR (5-7%) | Trail to breakeven after 30% of range | Respect structure absolutely | Moderate, structure defines risk |

| Breakdown/Downtrend | Lower lows, breaking support | Avoid longs or use very tight 1x ATR | Tight trail if countertrend trading | Exit immediately on failure | Very High, fighting trend |

| Consolidation | Sideways, indecisive, low volume | 1.5-2x ATR (3-5%) | Trail to breakeven quickly | Wait for breakout, keep stops tight | High, no clear direction |

| High Volatility Spike | ATR doubles, flash moves | Wider stops or reduce size | Trail wide initially, tighten as volatility normalizes | Account for chaos, expect whipsaws | Very High, unpredictable |

This matrix provides specific guidance for every identifiable market condition rather than forcing a one-size-fits-all approach. The key insight is that your stop strategy should match the behavior you expect from the market, and that behavior changes dramatically across different regimes.

Implementing regime-based conditional stops requires developing the skill to accurately identify which regime currently exists. This comes through chart analysis and experience, but some objective criteria can help. For trends, you might require that price is above its fifty-day and two-hundred-day moving averages with both averages rising, plus a series of at least three higher lows. For ranges, you might look for multiple tests of similar highs and lows with no sustained breakouts over several weeks. For high volatility regimes, you can simply measure when current ATR exceeds one point five times the six-month average ATR.

Many professional traders use automated systems built on platforms like TradingView with Pine Script, or external tools like Python with trading libraries, to systematically classify market regimes and automatically adjust stop parameters accordingly. This removes human bias and ensures consistent application of regime-appropriate stops. However, even manual traders who review market regime once per day and adjust their stop approach accordingly will see substantial improvement over using identical stops in all conditions.

The Psychology of Stops: Why Following Your Rules Is Harder Than Setting Them

We have now covered the technical aspects of advanced stop-loss strategies, from volatility adjustment to structure-based placement to trailing mechanisms to conditional approaches. However, the harsh reality of trading is that most traders fail not because they lack knowledge of proper stop placement but because they cannot consistently execute the stops they set. The psychological dimension of stop-loss discipline represents perhaps the greatest challenge in trading, and addressing it requires honest examination of the mental traps that prevent execution.

The fundamental psychological problem stems from loss aversion, a well-documented cognitive bias where the pain of losses feels roughly twice as intense as the pleasure of equivalent gains. When you are facing a stop-loss that will lock in a loss, your mind generates powerful resistance to accepting that pain. Every mechanism of rationalization activates to suggest why you should wait just a little longer, move your stop a bit further, or ignore your stop entirely this one time.

This loss aversion combines with several other psychological biases to create a perfect storm that prevents stop execution. Confirmation bias causes you to selectively focus on any information that supports your original trade thesis while ignoring contradictory evidence. When price is approaching your stop, you suddenly notice every bullish indicator you can find while completely discounting the bearish price action that is literally triggering your stop. Recency bias makes recent market behavior seem more important than longer-term patterns, so if the last few trades where you held through stop levels eventually recovered, you convince yourself the same will happen again.

Perhaps most insidious is the sunk cost fallacy, where the fact that you have already invested money, time, and emotional energy into a trade makes you reluctant to exit even when the evidence clearly shows the trade has failed. You think “I have already lost three percent, and if I exit now that loss becomes real, so I might as well hold and maybe it will come back.” This thinking ignores the reality that the money is already lost whether you exit or not, and that holding a losing position prevents you from deploying that capital into better opportunities.

Let me describe a scenario that will resonate with anyone who has struggled with stop discipline. You spend two hours analyzing Ethereum, identifying a perfect setup with confirmation from multiple timeframes, clear support levels, and strong momentum. You enter at two thousand five hundred dollars with a stop at two thousand four hundred dollars based on careful structure analysis. You feel confident and excited about the trade.

Within an hour, price drops to two thousand four hundred fifty dollars, approaching your stop. Your confidence evaporates and anxiety floods in. You start rationalizing: “The market is just being choppy, this might be a false breakdown. I spent so much time on this analysis, it cannot be wrong already. Maybe I should give it more room, the support might be a bit lower than I thought. Other traders are probably stopping out right now and I should hold through their weakness.” Price hits your stop at two thousand four hundred dollars, and instead of exiting, you watch and hope. Price continues to two thousand three hundred dollars and finally, in disgust and fear, you exit at two thousand two hundred fifty dollars, taking a ten percent loss instead of the four percent loss your stop was designed to limit.

Psychological Barriers to Stop Execution and Solutions

To address these psychological challenges systematically, we need to identify specific mental traps and implement concrete solutions that work with human psychology rather than expecting superhuman discipline.

| Psychological Barrier | How It Manifests | Impact on Trading | Practical Solution | Implementation |

|---|---|---|---|---|

| Loss Aversion | Overwhelming resistance to taking losses | Stops get ignored or moved | Pre-commit to losses as business expense | Journal expected losses, normalize them |

| Confirmation Bias | Seeing only bullish signals when holding long | Rationalizing failed trades | Checklist: evaluate bearish case explicitly | Review opposing evidence before decisions |

| Sunk Cost Fallacy | “Already lost money, might as well hold” | Holding bad trades far too long | Focus on forward opportunity, not past loss | Ask: “Would I enter this trade right now?” |

| Recency Bias | Last few experiences overshadow overall data | Inconsistent risk management | Track long-term statistics, not recent trades | Monthly review of all trades, not daily |

| Hope and Prayer | Waiting for miracle recovery | Catastrophic losses | Use hard stops that execute automatically | Remove human decision from execution |

| Analysis Paralysis | Unable to act at critical moment | Delayed exits worsen losses | Time-based rules: must decide within 5 minutes | Use preset orders ready to execute |

| Pride and Ego | Admitting wrong feels like failure | Refusing to exit losing trades | Reframe stops as professional risk management | Celebrate good process, not just winning trades |

These solutions share a common theme: they create external structures and processes that compensate for predictable psychological weaknesses rather than relying on willpower to overcome those weaknesses in the moment of stress. The trader who depends on discipline alone will eventually fail because discipline is a finite resource that depletes under stress. The trader who builds systems that execute automatically or that force structured decision-making will succeed because they have removed emotion from the execution process.

One of the most powerful psychological techniques involves pre-commitment through visualization and mental rehearsal. Before you enter any trade, spend a moment visualizing what it will feel like when price approaches your stop. Imagine the anxiety and the rationalizations that will arise. Then visualize yourself executing the stop cleanly and professionally, feeling the sense of relief and pride that comes from following your process. This mental rehearsal creates a reference point that helps you recognize the emotional state when it actually arrives and gives you a pre-established response pattern.

Another effective technique involves maintaining a trading journal where you record not just the technical aspects of each trade but also the emotional experience and decision quality. Tools like Edgewonk, TraderSync, or even simple Notion templates allow you to track patterns in when you follow your stops versus when you override them. When you review this journal and see clear evidence that every time you ignored a stop, the resulting loss was larger than planned, this empirical evidence helps overcome the psychological resistance on future trades.

Some traders find accountability helpful, sharing their trades and stop levels with a trading partner or mentor who can provide external perspective when emotions are running high. Others use commitment devices like publicly posting their trades and stops on social media, creating social pressure to follow through. The specific mechanism matters less than finding something that works for your psychology to ensure consistent execution of your stop-loss strategy regardless of how you feel in the moment.

Building Your Personal Stop-Loss System: Integration and Implementation

After exploring the various sophisticated stop-loss approaches, the final step involves integrating these concepts into a coherent personal system that you can implement consistently in your actual trading. The goal is not to use every technique simultaneously but rather to select the approaches most appropriate for your trading style, timeframe, and psychological makeup, then codify them into clear rules that guide your decisions.

The foundation of your personal system begins with defining your primary trading style and timeframe, because this determines which stop-loss approaches are most relevant. A scalper trading five-minute charts will use very different stops than a swing trader holding positions for days or weeks. The scalper needs tight ATR-based stops with minimal breathing room, quick trailing mechanisms, and willingness to accept frequent small stops as a cost of capturing many small profits. The swing trader needs structure-based stops that respect support and resistance, moderate trailing that captures trends without being shaken out by daily noise, and patience to let trades develop over days.

Once you have clarity on your trading style, establish specific rules for each component of your stop-loss system. These rules should be written down in a trading plan document and should be specific enough that they remove discretion in the moment. Vague rules like “place stops at reasonable levels” guarantee inconsistency. Specific rules like “for swing trades, place stops two to three times ATR below entry or one to two percent below nearest support level, whichever is closer” provide clear guidance.

Your complete stop-loss system should address at least these components: initial stop placement rules including how you will choose between ATR-based and structure-based approaches, trailing stop activation and tightening criteria, conditions under which you will manually adjust stops before they trigger, maximum loss per trade as a percentage of capital, and circumstances where you will exit without waiting for stops such as during major news events or when market regime changes dramatically.

Let me show you what a complete integrated system might look like for a swing trader who holds positions from two days to two weeks. The initial stop placement rule states: calculate two point five times ATR from entry and identify nearest significant support level, then place stop at whichever is closer but never less than two percent below entry to ensure acceptable risk-reward. This combines volatility adjustment with structure awareness while enforcing a minimum buffer.

The trailing stop rule states: once a position reaches eight percent profit, move stop to breakeven. At fifteen percent profit, activate a five percent trailing stop. At thirty percent profit, tighten trail to three percent. This progressive trailing locks in gains as confidence builds without choking off early profit potential. The manual adjustment rule states: if price approaches within one percent of your stop but then forms a clear bullish reversal pattern such as a hammer or engulfing candle, you may give the trade one more day before executing the stop. This allows some flexibility for false breakdowns while preventing indefinite rationalization.

Complete Stop-Loss System Template

To help you build your own system, here is a comprehensive template structure that covers all essential components and decision points.

| System Component | Your Specific Rules | Example Rules (Swing Trading Style) | Rationale |

|---|---|---|---|

| Initial Stop Calculation | (Your chosen method) | 2-3x ATR or below support, minimum 3% | Adapts to volatility and structure |

| Stop Placement Location | (ATR, structure, or hybrid) | Hybrid: calculate both, use closer | Balances mathematics and market reality |

| Minimum Risk-Reward | (Your threshold) | Minimum 1:2 risk-reward or pass | Ensures worthwhile profit potential |

| Trailing Stop Activation | (Profit level to start trail) | Activate trail at 10% profit | Protects only after confidence established |

| Trailing Stop Distance | (Percentage or ATR multiple) | Start 6% trail, tighten to 4% at 20% profit | Progressive tightening locks gains |

| Stop Adjustment Rules | (When you can move stops) | Never move stop further from entry, can move toward entry only | Prevents rationalization of increased risk |

| Manual Override Criteria | (When you exit without stop hit) | Exit on major news, regime change, or loss of confidence | Allows discretion for exceptional circumstances |

| Hard vs Mental Stop | (Which you will use) | Hard stops on exchange for all trades | Guarantees execution, prevents rationalization |

| Maximum Consecutive Stops | (Risk of ruin protection) | After 4 stops in row, reduce size 50% and review system | Prevents death by thousand cuts |

| Journal Requirements | (What you track) | Record planned stop, actual exit, reason if different | Creates accountability and learning |

This template provides structure while allowing customization to your specific approach. The key is filling in each component with specific, measurable rules that remove ambiguity about what you will do in various situations. The more specific your rules, the less room exists for emotional decision-making to override your plan.

Implementation of your system requires testing and refinement through actual trading experience. Start by applying your system on smaller position sizes while you verify that the rules work as intended and that you can follow them consistently. After twenty to thirty trades, review your journal to identify patterns. Are your initial stops being triggered more than forty percent of the time, suggesting they are too tight? Are trailing stops locking in profits effectively or stopping you out of winners too early? This empirical feedback allows you to refine your system based on actual results rather than theoretical assumptions.

Many traders find it helpful to create visual aids or checklists that they review before entering each trade. A simple checklist might include: calculate ATR and multiply by 2.5x for stop distance, identify nearest support level and calculate stop distance, verify chosen stop allows minimum 1:2.5 risk-reward, confirm stop is appropriate for current market volatility regime, set hard stop order on exchange, record all details in trading journal. This systematic checklist ensures you follow your complete process on every trade rather than taking shortcuts when busy or distracted.

For traders managing multiple positions simultaneously, risk management becomes more complex because you need to consider your total exposure across all trades, not just individual position risk. Your system should include rules about maximum total risk across all open positions. A common framework limits total risk to five to eight percent of account value across all positions combined, preventing over-concentration even when individual trades seem reasonably sized. Tracking tools like Delta or simple spreadsheets help you monitor aggregate exposure and ensure you are not inadvertently taking excessive risk through multiple correlated positions.

Conclusion: Stop-Loss Strategy as Professional Risk Management

The journey from basic percentage-based stops to sophisticated adaptive stop-loss strategies represents one of the most important developmental progressions that separates amateur traders from professionals. While beginners obsess over entry signals and profit targets, experienced traders focus intensely on stop-loss placement because they recognize that capital preservation is the foundation upon which all trading success is built. You can have mediocre entries and imperfect profit-taking, but if your stop-loss strategy is sound and consistently executed, you will survive and eventually thrive. Conversely, even brilliant entries combined with poor stop discipline leads inevitably to account destruction.

The advanced techniques we have explored in this article, from volatility-adjusted ATR-based stops to structure-aware placement to sophisticated trailing mechanisms to regime-dependent conditional stops, all serve the same ultimate purpose: protecting your capital while giving your trades enough room to succeed. These are not exotic techniques reserved for hedge funds but rather practical tools that any serious trader can implement with available platforms and modest effort. The difference between a five percent stop placed arbitrarily and a carefully calculated ATR-based stop positioned below meaningful support with a trailing mechanism activated might be the difference between a losing year and a profitable one.

The psychological dimension of stop-loss discipline cannot be overstated. Technical knowledge of proper stop placement means nothing if you consistently fail to execute your stops when triggered. The solutions lie not in developing superhuman willpower but rather in building external systems that compensate for predictable psychological weaknesses. Using hard stops placed with the exchange removes the temptation to override your plan. Maintaining detailed journals creates accountability and reveals patterns in your decision-making. Pre-commitment through written rules and mental rehearsal prepares you for the emotional experience of losing trades. These practical tools address the reality that we are humans with emotions and biases rather than perfectly rational calculating machines.

As you move forward implementing what you have learned, remember that developing a truly effective stop-loss system is an iterative process that requires experience and refinement. Your first attempts at ATR-based stops might need adjustment after you see how they perform in actual trading. Your trailing stop distances might need tweaking based on the markets you trade and your holding periods. This refinement is normal and expected. The goal is not perfect execution from the start but rather continuous improvement through systematic tracking, honest review, and willingness to adapt your approach based on evidence.

The cryptocurrency market will continue providing opportunities for those who survive its volatility, and survival depends fundamentally on disciplined risk management of which stop-loss strategy is the critical component. The traders who master advanced stop-loss techniques, implement them systematically, and execute them with discipline will be positioned to compound wealth across multiple market cycles. Those who continue using naive percentage stops or, worse, who avoid stops entirely due to psychological resistance will join the statistics of failed traders who entered crypto markets with hope and exited with depleted accounts.

Your assignment moving forward is to take the concepts from this article and build your personal stop-loss system using the template provided, test it rigorously on smaller position sizes, track every trade in a detailed journal, and refine based on actual results. This process of systematization and continuous improvement represents the path from random trading to professional trading, from hoping for luck to creating edge through superior risk management.

Additional resources for deepening your stop-loss knowledge include technical analysis education from BabyPips which covers stops in forex but applies equally to crypto, systematic trading research at QuantConnect for those interested in automated stop systems, and trading psychology materials from Trading Psychology which address the execution challenges we discussed. The time invested in mastering stop-loss strategy provides perhaps the highest return on investment in your trading education because it protects every future trade you will ever make.