- The Evolution of Algorithmic Trading in Cryptocurrency Markets

- Understanding Grid Trading Bot Architecture

- The Mathematical Foundation of Grid Systems

- Technical Implementation and Order Management

- Performance Optimization and Risk Boundaries

- Dollar-Cost Averaging Bot Mechanisms

- Strategic Foundation and Accumulation Logic

- Technical Architecture and Execution Strategies

- Advanced DCA Variations and Optimization

- Arbitrage Bot Engineering

- Theoretical Framework and Market Inefficiency Exploitation

- Multi-Exchange Architecture and Synchronization

- Risk Management and Capital Efficiency

- Comparative Performance Analysis

- Market Regime Performance Characteristics

- Technical Infrastructure Requirements and Costs

- Risk-Adjusted Return Optimization

- Integration Strategies and Portfolio Construction

- Hybrid Bot Architectures

- Real-Time Strategy Selection and Adaptation

- Portfolio Risk Management Across Multiple Bots

- Future Developments and Emerging Technologies

- Machine Learning Integration and Adaptive Algorithms

- Decentralized and Cross-Chain Bot Operations

- Regulatory Adaptation and Compliance Automation

- Conclusion: Selecting and Implementing the Optimal Bot Strategy

The Evolution of Algorithmic Trading in Cryptocurrency Markets

The cryptocurrency trading landscape has undergone a fundamental transformation as automated trading systems have evolved from simple price alerts to sophisticated algorithmic engines capable of executing complex strategies across multiple exchanges simultaneously. While many traders understand that bots can automate their trading, few truly grasp the architectural differences between various bot types and how these differences impact profitability under different market conditions.

This comprehensive analysis examines three distinct categories of trading bots—grid trading systems, dollar-cost averaging (DCA) bots, and arbitrage engines—not from the typical surface-level feature comparison, but through the lens of their underlying mathematical models, architectural requirements, and performance characteristics across varying market regimes. By understanding how these systems process market data, make decisions, and manage risk at a fundamental level, traders can make informed decisions about which approach aligns best with their goals, technical capabilities, and risk tolerance.

The distinction between these bot types goes far beyond their trading strategies. Each category represents a different philosophy about market behavior, requires different technical infrastructure, and performs optimally under specific market conditions. A grid trading bot that excels in ranging markets might hemorrhage capital during strong trends, while a DCA bot that accumulates effectively during downtrends could underperform dramatically in volatile sideways markets. Understanding these nuances determines the difference between consistent profitability and costly failures in automated trading.

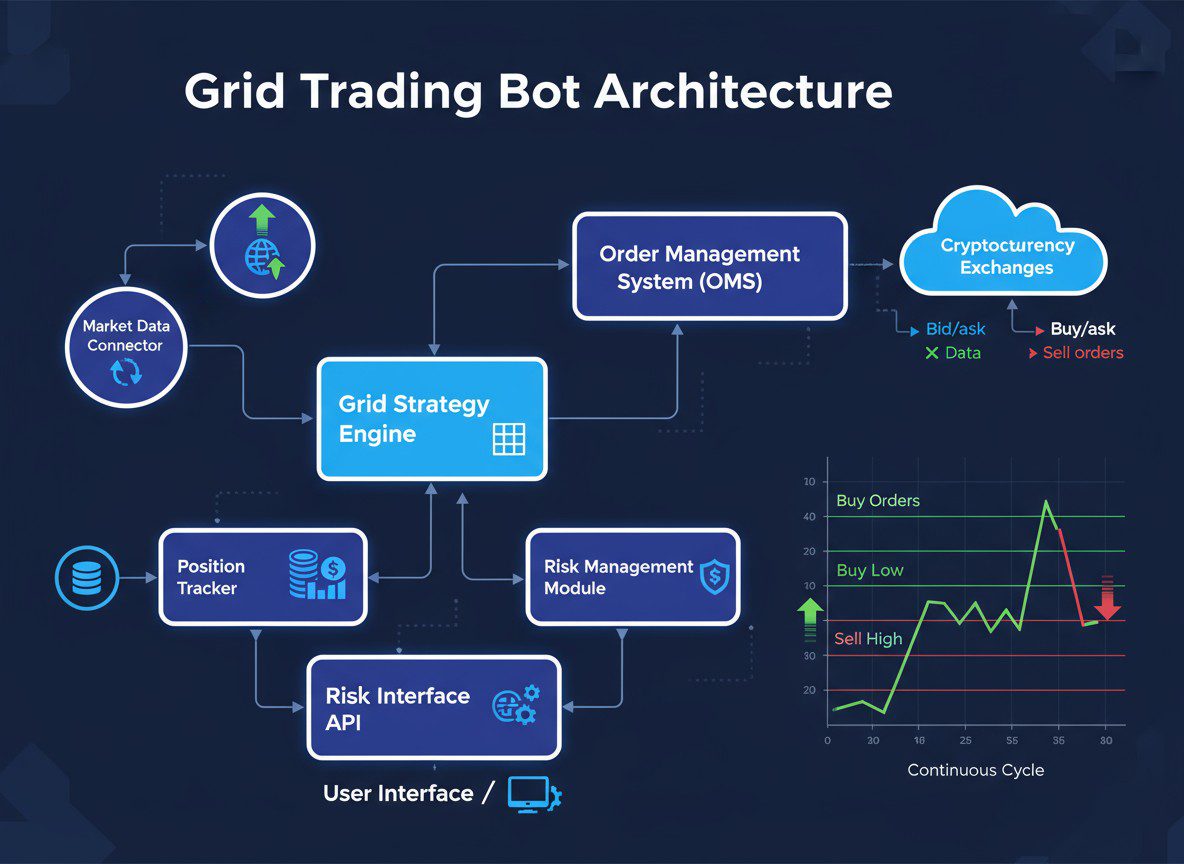

Understanding Grid Trading Bot Architecture

The Mathematical Foundation of Grid Systems

Grid trading bots operate on a deceptively simple principle that conceals sophisticated mathematical relationships. Imagine the market as a playing field divided by horizontal lines at regular price intervals. The bot places buy orders below the current price and sell orders above it, creating a “grid” of pending orders. As price oscillates through these levels, the bot automatically captures profits from each completed buy-sell cycle within the grid.

The mathematical elegance of grid trading emerges from its relationship to mean reversion theory. The system assumes that price will oscillate around a central value, allowing the bot to profit from volatility rather than directional movement. This approach transforms market noise—typically the enemy of traders—into a profit-generating mechanism. The key mathematical parameters that define a grid bot’s behavior include grid spacing (the price distance between orders), grid range (the total price range covered), and order sizing algorithms.

Consider how the profit calculation works in a geometric grid, where spacing increases proportionally rather than linearly. If we define the grid spacing multiplier as r and the base price as P₀, each grid level can be expressed as Pₙ = P₀ × rⁿ. This geometric progression ensures that the bot maintains consistent percentage profits regardless of the absolute price level, adapting naturally to different market capitalizations and volatility profiles.

Technical Implementation and Order Management

The technical architecture of a grid trading bot requires sophisticated order management capabilities that go beyond simple limit order placement. The system must maintain a real-time state machine tracking each grid level’s status—whether it holds an open order, a filled position, or sits empty awaiting reactivation. This state management becomes particularly complex when dealing with partial fills, as commonly occurs in less liquid markets.

Table 1: Grid Bot State Management Matrix

| Grid Level | Current State | Order Type | Order Size | Fill Status | Next Action |

|---|---|---|---|---|---|

| $41,000 | Pending Buy | Limit Buy | 0.05 BTC | Unfilled | Monitor |

| $41,500 | Position Held | None | 0.05 BTC | Completed | Place Sell at $42,000 |

| $42,000 | Pending Sell | Limit Sell | 0.05 BTC | Partial (60%) | Adjust Size |

| $42,500 | Empty | None | 0 | N/A | Wait for Price Return |

| $43,000 | Pending Sell | Limit Sell | 0.05 BTC | Unfilled | Monitor |

Modern grid bots must also handle exchange-specific quirks and limitations. Platforms like Binance impose maximum open order limits, requiring the bot to dynamically manage its order book presence. Some implementations use a sliding window approach, maintaining orders only within a certain distance from current price and adjusting this window as price moves. Others employ virtual orders, tracking positions internally and only submitting real orders when price approaches specific levels.

The challenge intensifies when implementing grid strategies across multiple exchanges. Each exchange has different fee structures, minimum order sizes, and API rate limits. A sophisticated grid bot maintains separate state machines for each exchange while coordinating overall position management to prevent overexposure. This multi-exchange coordination requires careful consideration of network latency, as price discrepancies between exchanges can cause the bot to inadvertently create arbitrage opportunities against itself.

Performance Optimization and Risk Boundaries

Grid trading bots face unique optimization challenges that distinguish them from other automated strategies. The primary optimization problem involves balancing grid density against capital efficiency. Denser grids with smaller spacing capture more profit from small price movements but require more capital and generate higher transaction fees. Wider grids need less capital and incur fewer fees but might miss profitable opportunities during low-volatility periods.

The optimization function can be expressed mathematically as maximizing expected profit while constraining risk exposure. If we define profit per cycle as π, probability of cycle completion as p, number of grid levels as n, and available capital as C, the optimization problem becomes: maximize Σ(πᵢ × pᵢ) subject to Σ(capital_per_levelᵢ) ≤ C and maximum_drawdown ≤ risk_threshold.

Advanced grid bots incorporate dynamic parameter adjustment based on market volatility. Using indicators like Average True Range (ATR) or historical volatility measurements, these systems automatically widen grid spacing during high volatility periods and tighten it during calm markets. This adaptation requires sophisticated backtesting across various volatility regimes to determine optimal adjustment parameters without overfitting to historical data.

Dollar-Cost Averaging Bot Mechanisms

Strategic Foundation and Accumulation Logic

Dollar-cost averaging bots embody a fundamentally different philosophy from grid systems, focusing on systematic accumulation rather than volatility harvesting. The DCA approach acknowledges that timing the market precisely is virtually impossible, instead spreading purchases across time to achieve an average entry price. While this concept seems straightforward, implementing it effectively in cryptocurrency markets requires sophisticated decision-making algorithms that go far beyond simple periodic buying.

The mathematical framework underlying DCA bots revolves around temporal and price-based distribution functions. A basic time-based DCA might follow a uniform distribution, investing equal amounts at regular intervals. However, more sophisticated implementations use weighted distributions that increase investment during price drawdowns. This approach can be modeled using a function that adjusts investment amount based on the deviation from moving averages or historical price percentiles.

Consider an advanced DCA algorithm that incorporates price-weighted accumulation. If the current price P is below the 200-day moving average MA₂₀₀ by percentage δ, the investment amount I could be calculated as: I = I_base × (1 + α × δ), where α is an aggression parameter controlling how much additional capital to deploy during drawdowns. This formula creates a systematic framework for “buying the dip” without relying on subjective judgment about market bottoms.

Technical Architecture and Execution Strategies

The technical implementation of DCA bots involves several architectural components working in concert to execute accumulation strategies reliably. Unlike grid bots that maintain multiple simultaneous orders, DCA systems typically execute single orders at predetermined triggers, requiring different optimization priorities and error handling approaches.

Table 2: DCA Bot Execution Strategy Comparison

| Strategy Type | Trigger Mechanism | Position Sizing | Advantages | Disadvantages |

|---|---|---|---|---|

| Fixed Time | Hourly/Daily/Weekly | Constant | Predictable, Simple | Ignores Price Action |

| Price Threshold | X% Below Average | Variable | Improved Entry | May Not Execute |

| Volatility-Based | High Volatility Periods | Inverse to Volatility | Risk-Adjusted | Complex Calculation |

| Technical Indicator | RSI < 30, MACD Cross | Indicator-Weighted | Market-Aware | Potential Overfitting |

| Hybrid Adaptive | Multiple Conditions | Dynamic Algorithm | Flexible, Robust | Requires Tuning |

The execution engine of a DCA bot must handle various edge cases that can disrupt accumulation strategies. Market orders might experience significant slippage during volatile periods, while limit orders risk non-execution if price moves away rapidly. Sophisticated DCA bots implement adaptive order types, starting with limit orders slightly below market price and converting to market orders if execution doesn’t occur within a specified timeframe.

Integration with portfolio management systems adds another layer of complexity to DCA bot architecture. The system must track cost basis across multiple accumulation periods, calculate weighted average entry prices, and potentially rebalance positions across different assets. This requires maintaining detailed transaction histories and implementing tax-lot accounting methods like FIFO (First-In-First-Out) or specific identification for tax optimization purposes.

Advanced DCA Variations and Optimization

Modern DCA bots have evolved far beyond simple periodic purchasing, incorporating sophisticated variations that adapt to market conditions and portfolio constraints. Value averaging, for instance, adjusts purchase amounts not just based on time but on portfolio value targets. If the portfolio has grown beyond expected value due to price appreciation, the bot might reduce or skip purchases; if the portfolio has declined, it increases accumulation to maintain the target growth trajectory.

The mathematical optimization of DCA strategies involves solving multi-period investment problems under uncertainty. Using stochastic dynamic programming, we can model the optimal investment policy as a function of current wealth, time remaining, and market state. The Bellman equation for this problem takes the form: V(w,t,s) = max[u(c) + βE[V(w’,t+1,s’)|s]], where V is the value function, w is wealth, t is time, s is market state, u is utility function, and β is the discount factor.

Another advanced variation involves correlation-based accumulation across multiple assets. Rather than treating each cryptocurrency independently, these bots analyze correlation matrices to identify optimal accumulation timing. When Bitcoin experiences a significant drawdown, the bot might increase accumulation of positively correlated assets like Ethereum that haven’t yet fully reflected the move, anticipating synchronized recovery patterns.

Arbitrage Bot Engineering

Theoretical Framework and Market Inefficiency Exploitation

Arbitrage bots represent the most technically demanding category of automated trading systems, requiring microsecond-precision execution and sophisticated mathematical modeling to identify and exploit price discrepancies across markets. Unlike grid and DCA bots that operate within single markets, arbitrage systems must continuously monitor multiple venues, calculate profitability after fees and slippage, and execute coordinated trades before opportunities disappear.

The fundamental principle underlying arbitrage relies on the law of one price—identical assets should trade at identical prices across all markets after accounting for transaction costs. In practice, cryptocurrency markets exhibit frequent violations of this principle due to fragmented liquidity, varying regulatory environments, and technical limitations of blockchain networks. These inefficiencies create opportunities for properly equipped arbitrage systems to generate risk-free profits, at least in theory.

The mathematical framework for arbitrage detection involves constructing a graph where nodes represent assets on different exchanges and edges represent possible trades. Using algorithms like the Bellman-Ford algorithm modified for multiplicative weights, the bot can detect negative cycles that indicate arbitrage opportunities. If we represent exchange rates as edge weights wᵢⱼ, an arbitrage opportunity exists when the product of weights along a cycle exceeds 1: Π wᵢⱼ > 1 for any closed path.

Multi-Exchange Architecture and Synchronization

The technical architecture of arbitrage bots demands exceptional engineering to handle the complexities of multi-exchange operations. Each exchange connection requires separate WebSocket streams for real-time price updates, REST API interfaces for order execution, and sophisticated error handling for network failures or exchange outages. The synchronization layer must reconcile different data formats, timestamp discrepancies, and varying levels of market data granularity across exchanges.

Table 3: Exchange Integration Complexity Matrix

| Exchange Feature | Binance | Coinbase Pro | Kraken | FTX* | Integration Challenge |

|---|---|---|---|---|---|

| WebSocket Latency | <10ms | 15-30ms | 20-40ms | <10ms | Synchronization Delay |

| Order Types | 8 types | 4 types | 6 types | 10 types | Standardization Required |

| API Rate Limits | 1200/min | 10/sec | 15/sec | Complex | Throttling Management |

| Fee Structure | Tiered | Maker/Taker | Volume-Based | VIP Levels | Profitability Calculation |

| Fiat Support | Limited | Extensive | Moderate | Limited | Capital Deployment |

*Note: FTX included for historical context despite current status

The execution engine of an arbitrage bot must solve the complex problem of optimal order routing while maintaining inventory balance across exchanges. This involves implementing sophisticated algorithms like the Hungarian method for assignment problems or linear programming solvers for optimal fund allocation. The bot must also maintain real-time position tracking across all venues, accounting for pending orders, in-flight transfers, and settlement delays.

Network latency represents a critical challenge in arbitrage bot implementation. Even milliseconds of delay can mean the difference between profitable execution and losses. Advanced systems implement predictive modeling to anticipate price movements based on order book dynamics, allowing them to initiate trades slightly before arbitrage opportunities fully materialize. This requires maintaining synchronized clocks across all systems using protocols like NTP or GPS time synchronization.

Risk Management and Capital Efficiency

Despite the theoretical risk-free nature of arbitrage, practical implementation involves numerous risks that must be carefully managed. Execution risk arises when one leg of an arbitrage trade fills while another doesn’t, leaving the trader with unwanted directional exposure. Transfer risk occurs when moving funds between exchanges, as blockchain confirmations can take minutes to hours during network congestion.

Capital efficiency optimization in arbitrage bots involves solving complex allocation problems. With limited capital distributed across multiple exchanges, the bot must determine optimal reserve levels for each venue while maintaining sufficient liquidity to capture opportunities. This can be modeled as a stochastic inventory management problem, where the bot must balance the opportunity cost of idle capital against the risk of missing profitable trades due to insufficient funds.

The mathematical formulation of capital allocation involves minimizing the expected opportunity cost: minimize E[Σ(missed_profitᵢ × probabilityᵢ)] subject to Σ(capital_exchangeᵢ) ≤ total_capital and minimum_reserveᵢ ≤ capital_exchangeᵢ ≤ maximum_exposureᵢ. This optimization must be recalculated periodically as market conditions change and opportunities shift between different exchange pairs.

Comparative Performance Analysis

Market Regime Performance Characteristics

Understanding how each bot type performs under different market conditions provides crucial insights for strategy selection and portfolio construction. The performance characteristics of grid, DCA, and arbitrage bots vary dramatically depending on whether markets are trending, ranging, or experiencing high volatility. This section examines quantitative performance metrics across various market regimes, providing a framework for selecting appropriate strategies based on market outlook.

Grid trading bots excel in ranging markets where price oscillates within defined boundaries. During these periods, the bot’s multiple buy-sell cycles generate consistent profits without requiring directional bias. Historical analysis of Bitcoin’s price action shows that approximately 70% of the time, markets exhibit ranging behavior within 20% bands, providing ample opportunities for grid strategies. However, during strong trending periods, grid bots can experience significant drawdowns as sell orders trigger prematurely in uptrends or buy orders accumulate losing positions in downtrends.

Table 4: Performance Metrics by Market Regime (Annualized)

| Market Regime | Grid Trading | DCA Bot | Arbitrage Bot | Optimal Strategy |

|---|---|---|---|---|

| Strong Uptrend (>50% annual) | 15-25% return, High drawdown | 35-45% return | 8-12% return | DCA |

| Moderate Uptrend (20-50%) | 25-35% return | 20-30% return | 10-15% return | Grid |

| Ranging (±20%) | 30-45% return | 5-10% return | 15-20% return | Grid |

| Moderate Downtrend (-20 to -50%) | -10 to -20% | 0-10% return* | 12-18% return | Arbitrage |

| Strong Downtrend (< -50%) | -30 to -40% | -20 to -10%* | 10-15% return | Arbitrage |

*DCA returns calculated including unrealized gains/losses on accumulated positions

DCA bots demonstrate their strength during prolonged downtrends followed by recovery. By accumulating positions at progressively lower prices, these bots achieve superior average entry prices compared to lump-sum investments. The mathematical advantage becomes clear when examining the harmonic mean of purchase prices versus the arithmetic mean of periodic investments. This difference can result in 20-30% better entry prices during volatile bear markets.

Arbitrage bots maintain relatively consistent performance regardless of market direction, as they profit from price discrepancies rather than directional movements. However, arbitrage opportunities tend to increase during high volatility periods when price dislocations become more frequent and pronounced. Analysis of historical arbitrage spreads shows that opportunities yielding more than 1% profit after fees occur 10-15 times more frequently during volatility spikes compared to calm markets.

Technical Infrastructure Requirements and Costs

The technical requirements for implementing each bot type vary significantly, impacting both initial setup costs and ongoing operational expenses. These differences extend beyond simple hosting costs to include data feeds, exchange API access, development complexity, and maintenance overhead. Understanding these requirements helps traders evaluate the true total cost of ownership for automated trading systems.

Grid trading bots represent the middle ground in terms of technical requirements. While they need reliable exchange connectivity and order management capabilities, they don’t require the ultra-low latency infrastructure of arbitrage systems or the sophisticated portfolio tracking of DCA bots. A basic grid bot can run effectively on a cloud VPS costing $20-50 monthly, using standard REST APIs for order placement and WebSocket connections for price updates.

Table 5: Infrastructure Cost Comparison (Monthly USD)

| Component | Grid Bot | DCA Bot | Arbitrage Bot | Notes |

|---|---|---|---|---|

| Server Hosting | $20-50 | $10-30 | $200-500 | Arbitrage needs dedicated/colocation |

| Data Feeds | $0-100 | $0 | $500-2000 | Arbitrage requires premium feeds |

| Exchange APIs | Free | Free | $0-1000 | Some exchanges charge for FIX |

| Development | 100-200 hours | 50-100 hours | 500-1000 hours | Initial development time |

| Monitoring Tools | $10-50 | $10-30 | $100-200 | Logs, alerts, dashboards |

| Backup Systems | Optional | Optional | Required $100+ | Redundancy critical for arbitrage |

| Total Monthly | $30-200 | $20-60 | $900-3800 | Excluding development costs |

Arbitrage bots demand enterprise-grade infrastructure to remain competitive. Colocation services placing servers directly in exchange data centers can cost thousands monthly but provide microsecond latency advantages. These systems also require redundant connections, failover mechanisms, and sophisticated monitoring to ensure continuous operation. The development complexity multiplies when implementing cross-exchange arbitrage, as the system must handle different API protocols, authentication methods, and rate limits simultaneously.

DCA bots, while technically simpler, require robust portfolio tracking and accounting systems. The infrastructure must maintain accurate records for tax reporting, calculate weighted average costs, and integrate with portfolio management tools. Cloud-based solutions using serverless architectures like AWS Lambda can reduce operational costs while maintaining reliability for periodic execution strategies.

Risk-Adjusted Return Optimization

Evaluating bot performance solely on absolute returns neglects the critical dimension of risk-adjusted performance. Each bot type exhibits different risk profiles that must be considered when constructing a balanced automated trading portfolio. Modern portfolio theory provides frameworks for optimizing bot allocation based on expected returns, volatility, and correlation between strategies.

The Sharpe ratio, calculating excess return per unit of volatility, reveals interesting patterns across bot types. Grid bots typically achieve Sharpe ratios between 0.8-1.2 in favorable markets, with relatively smooth equity curves punctuated by occasional drawdowns. DCA bots show lower Sharpe ratios (0.4-0.8) due to the inherent volatility of accumulated positions, but their negative correlation with market drawdowns provides valuable portfolio diversification benefits.

Arbitrage bots often display the highest Sharpe ratios (1.5-3.0) due to their market-neutral nature and consistent return profiles. However, these metrics can be misleading as they don’t capture operational risks like exchange defaults, regulatory changes, or technical failures that could result in total capital loss. The tail risk characteristics of each strategy must be evaluated using metrics like Conditional Value at Risk (CVaR) or maximum drawdown duration.

Integration Strategies and Portfolio Construction

Hybrid Bot Architectures

Rather than viewing grid, DCA, and arbitrage bots as mutually exclusive alternatives, sophisticated traders implement hybrid architectures that combine elements from multiple strategies. These integrated systems leverage the strengths of each approach while mitigating individual weaknesses, creating more robust and adaptive trading solutions.

Consider a hybrid system that uses grid trading as its primary strategy but incorporates DCA logic during trending markets. When the grid bot detects sustained directional movement breaking out of its range, it could transition to DCA mode, accumulating positions during downtrends or taking profits during uptrends. This adaptive behavior requires sophisticated state management and clear transition rules to prevent conflicting actions.

The mathematical framework for hybrid systems involves multi-objective optimization across different performance metrics. If we define performance vectors for each strategy as P_grid, P_dca, and P_arb, the hybrid optimization problem becomes: maximize w₁×P_grid + w₂×P_dca + w₃×P_arb subject to risk constraints and capital limitations, where weights w are dynamically adjusted based on market regime detection algorithms.

Real-Time Strategy Selection and Adaptation

Advanced bot systems implement real-time strategy selection based on market condition analysis. Using machine learning classifiers trained on historical data, these systems identify current market regimes and automatically activate appropriate strategies. The classification problem involves extracting features like volatility, trend strength, volume patterns, and correlation metrics to determine optimal strategy allocation.

Table 6: Market Regime Classification Features

| Feature Category | Specific Metrics | Calculation Method | Strategy Relevance |

|---|---|---|---|

| Volatility | ATR, Historical Vol, GARCH | Rolling window analysis | Grid spacing, DCA timing |

| Trend | ADX, Linear Regression Slope | Multiple timeframes | Strategy selection |

| Volume | OBV, Volume Profile | Exchange aggregation | Arbitrage opportunity |

| Correlation | Asset correlations, Beta | Rolling correlation matrix | Portfolio allocation |

| Microstructure | Spread, Order book depth | Real-time sampling | Execution optimization |

The implementation of adaptive systems requires careful consideration of switching costs and strategy interference. Rapidly switching between strategies can generate excessive transaction costs and create conflicting positions. Successful implementations use hysteresis bands and minimum holding periods to prevent excessive strategy churning while maintaining responsiveness to genuine regime changes.

Portfolio Risk Management Across Multiple Bots

Managing risk across multiple bot strategies requires sophisticated portfolio-level controls that go beyond individual bot risk limits. The correlation between different strategies under various market conditions must be continuously monitored and factored into position sizing decisions. During market stress, correlations often increase, potentially amplifying portfolio-level risk beyond what individual strategy analysis would suggest.

Value at Risk (VaR) calculations for multi-bot portfolios must account for non-normal return distributions and time-varying correlations. Using techniques like filtered historical simulation or Monte Carlo methods with GARCH volatility modeling provides more accurate risk estimates than simple parametric VaR. The portfolio optimization problem can be formulated as minimizing CVaR subject to return targets: minimize CVaR_α(portfolio) subject to E[return] ≥ target and Σ(allocation_i) = 1.

Stress testing multi-bot portfolios involves simulating extreme market scenarios and analyzing system behavior under these conditions. Scenarios might include flash crashes, exchange outages, regulatory changes, or correlation breakdowns. Each bot’s response to these scenarios must be modeled, including potential feedback effects where one bot’s actions impact another’s performance.

Future Developments and Emerging Technologies

Machine Learning Integration and Adaptive Algorithms

The next generation of trading bots increasingly incorporates machine learning algorithms that continuously adapt to changing market conditions. Rather than relying on static parameters, these systems use reinforcement learning to optimize their behavior based on actual trading outcomes. Deep Q-learning networks and policy gradient methods show particular promise for developing strategies that can navigate complex, non-stationary market environments.

Current research focuses on meta-learning approaches that allow bots to quickly adapt to new market regimes without extensive retraining. Using techniques like Model-Agnostic Meta-Learning (MAML), bots can fine-tune their strategies with just a few examples from new market conditions. This capability becomes particularly valuable in cryptocurrency markets where new tokens, exchanges, and trading paradigms emerge constantly.

The integration of natural language processing enables bots to incorporate sentiment analysis and news-based trading signals. Advanced systems use transformer models to analyze social media, news articles, and on-chain communications, extracting alpha-generating signals that purely technical strategies might miss. Platforms like Santiment provide APIs that bots can leverage for sentiment data, though processing and interpreting this information requires sophisticated NLP pipelines.

Decentralized and Cross-Chain Bot Operations

The evolution of decentralized finance (DeFi) creates new opportunities and challenges for automated trading systems. DeFi-native bots must handle the complexities of on-chain execution, including gas optimization, MEV protection, and smart contract interactions. Grid bots implemented as smart contracts on platforms like Ethereum or Solana offer transparency and trustlessness but face limitations in terms of computational complexity and gas costs.

Cross-chain arbitrage represents a rapidly growing opportunity as bridge technologies mature and liquidity fragments across multiple blockchains. Bots that can efficiently identify and execute arbitrage opportunities between Ethereum DeFi protocols and Binance Smart Chain DEXs, for example, can capture significant profits from price discrepancies. However, these systems must handle additional complexities like bridge delays, wrapped token risks, and varying consensus mechanisms.

The emergence of Layer 2 solutions and sidechains adds another dimension to bot strategy development. Different layers often exhibit distinct liquidity profiles and fee structures, creating opportunities for layer-specific strategies. A bot might implement grid trading on high-throughput Layer 2s where transaction costs are minimal while reserving Layer 1 for large arbitrage trades where security is paramount.

Regulatory Adaptation and Compliance Automation

As cryptocurrency markets mature, regulatory requirements increasingly impact bot development and operation. Future trading bots must incorporate compliance modules that automatically adapt to jurisdiction-specific regulations, maintain audit trails, and generate required reports. This includes implementing anti-money laundering (AML) checks, transaction reporting, and tax calculation modules.

The technical architecture for compliance-aware bots involves maintaining detailed transaction logs with cryptographic proofs of execution timing and parameters. Blockchain-based attestation services could provide tamper-proof records of bot behavior, satisfying regulatory requirements while maintaining operational efficiency. Smart contracts implementing regulatory logic could automatically enforce compliance rules, preventing bots from executing trades that would violate applicable regulations.

International regulatory divergence creates both challenges and opportunities for bot operators. Systems that can dynamically route orders to compliant venues based on user jurisdiction and regulatory requirements will gain competitive advantages. This might involve maintaining separate bot instances for different regulatory regimes or implementing sophisticated routing logic that ensures compliance while maximizing execution quality.

Conclusion: Selecting and Implementing the Optimal Bot Strategy

The landscape of automated cryptocurrency trading encompasses diverse approaches, each with distinct advantages, limitations, and optimal use cases. Grid trading bots excel at harvesting volatility in ranging markets, transforming price oscillations into consistent profits through systematic buy-sell cycles. DCA bots provide disciplined accumulation strategies that overcome timing challenges, particularly valuable during bear markets and for long-term portfolio building. Arbitrage bots exploit market inefficiencies across venues, generating relatively consistent returns independent of market direction but requiring sophisticated infrastructure and technical expertise.

The decision between these approaches shouldn’t be viewed as mutually exclusive. Successful automated trading often involves deploying multiple strategies simultaneously, allocating capital based on market conditions, risk tolerance, and technical capabilities. A well-designed portfolio might use grid bots for stable income generation, DCA bots for strategic accumulation of high-conviction assets, and arbitrage bots for market-neutral returns that provide portfolio stability.

The technical journey from concept to profitable implementation requires careful consideration of infrastructure requirements, development complexity, and ongoing maintenance needs. While grid and DCA bots can be implemented with relatively modest resources using platforms like TradingView or 3Commas, competitive arbitrage systems demand enterprise-grade infrastructure and significant technical expertise. Understanding these requirements upfront prevents costly mistakes and ensures realistic expectations about potential returns.

As markets evolve and technology advances, the distinction between different bot types will likely blur. Hybrid systems incorporating machine learning, cross-chain capabilities, and adaptive algorithms represent the future of automated trading. The bots that succeed will be those that can quickly adapt to new market paradigms while maintaining robust risk management and operational reliability. For traders beginning their automation journey, starting with simpler strategies and progressively adding complexity as experience and resources grow provides the most sustainable path to long-term success in algorithmic cryptocurrency trading.